- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CCOI

Cogent Communications (CCOI): Assessing Valuation Following Strategic Moves, Improved Margins, and Dividend News

Reviewed by Simply Wall St

Cogent Communications Holdings (CCOI) released its third quarter results, surprising investors with a narrower loss than expected and progress on operational efficiency. The update also featured new services, asset moves, and a forthcoming dividend.

See our latest analysis for Cogent Communications Holdings.

Despite Cogent’s progress with cost control and its rollout of new services, shares have struggled, dropping 43% over the past week alone and leaving the one-year total shareholder return at nearly -70%. Momentum clearly remains pressured as investors weigh near-term challenges against prospects for longer-term transformation while management pursues asset sales, new revenue streams, and operational improvements.

If recent volatility has you curious about other opportunities, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a significant discount to analyst price targets, investors now face a key question: Is Cogent Communications offering a rare value opportunity, or has the recent turmoil already captured all the downside and future upside?

Most Popular Narrative: 47% Undervalued

With the most widely followed narrative estimating fair value at $44.55, Cogent Communications' latest closing price of $23.49 appears significantly below potential. The stage is set for a deeper investigation into what could drive such an optimistic valuation gap.

The integration and monetization of Sprint Wireline assets is entering its final phase. With low or negative margin legacy contracts nearly phased out, this transition back to exclusively selling high-margin on-net services underpins the company's guidance of a return to sequential revenue growth and ongoing adjusted EBITDA margin expansion of 200 basis points annually, supporting improved long-term earnings.

Want to know what powers this bold valuation? The narrative leans on a unique mix of margin recovery, structural asset shifts, and the pursuit of robust recurring growth. Find out which future financial leaps could justify such a dramatic price move.

Result: Fair Value of $44.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent price declines for bandwidth services and delays in monetizing key data center assets could present challenges for Cogent's path to sustainable growth and improved margins.

Find out about the key risks to this Cogent Communications Holdings narrative.

Another View: Market Valuation vs. Potential

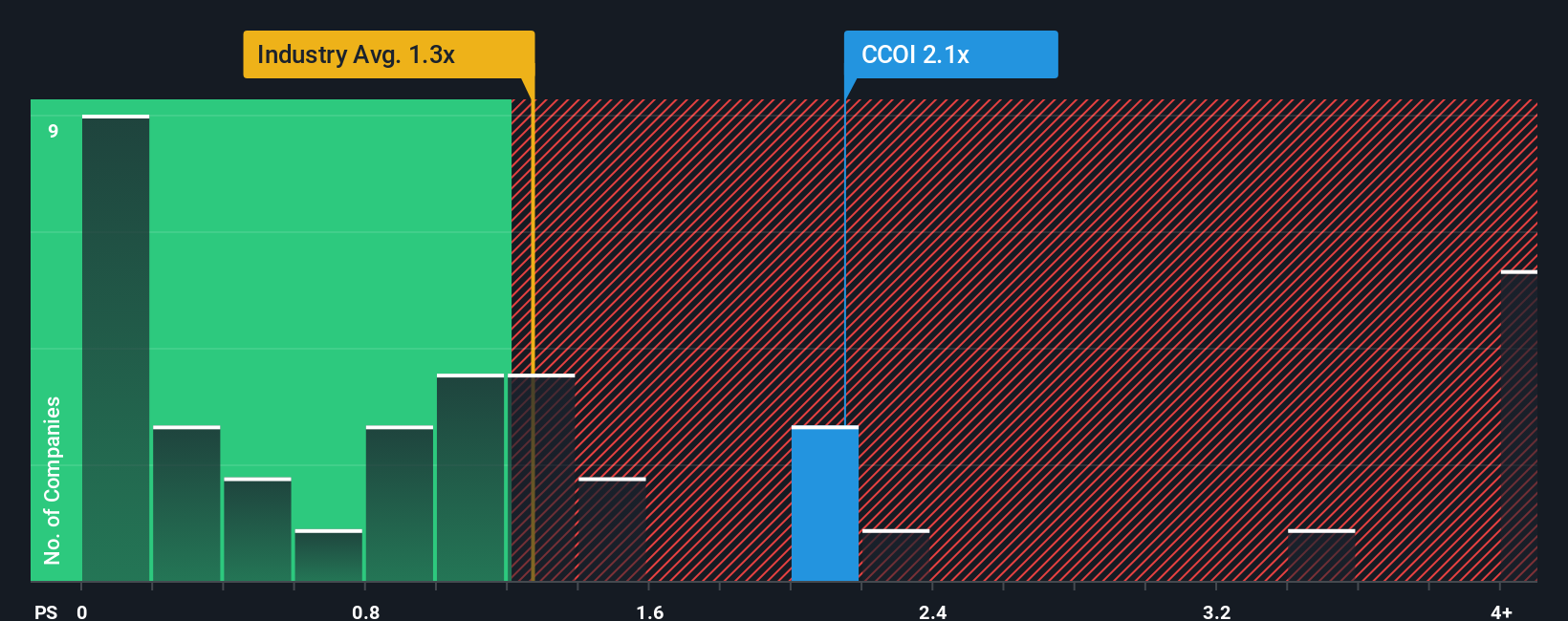

While our earlier look at fair value points to Cogent as deeply undervalued, a quick check on its price-to-sales ratio tells a more cautious story. With Cogent’s ratio of 1.2x sitting roughly in line with its industry average and just above its fair ratio, there may be less hidden upside than the first method suggests. Does this mean the bigger opportunity is already priced in, or is the market overlooking a potential turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cogent Communications Holdings Narrative

If this view doesn't quite match your own research, or you see a different story in the numbers, take a few minutes to craft your own perspective. It's quick and straightforward. Do it your way

A great starting point for your Cogent Communications Holdings research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

Smart investing means looking beyond the obvious. Don't let opportunity slip away. Find standout stocks in sectors others overlook and stay ahead of market trends with powerful tools designed to give you the edge.

- Unlock growth by checking out these 870 undervalued stocks based on cash flows that are primed for a rebound and still trading at compelling discounts.

- Boost your portfolio's yield and earnings by targeting reliable income opportunities through these 16 dividend stocks with yields > 3% with higher-than-average payouts.

- Catch the next wave of innovation and growth in healthcare by studying these 32 healthcare AI stocks, where AI-driven breakthroughs are transforming patient outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCOI

Cogent Communications Holdings

Through its subsidiaries, provides high-speed Internet access, private network, and data center colocation space services in North America, South America, Europe, Oceania, and Africa.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives