- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Will AST SpaceMobile's (ASTS) New German Operations Hub Signal a Stronger Path to European Growth?

Reviewed by Sasha Jovanovic

- Vodafone Group Plc and AST SpaceMobile recently announced that Germany has been chosen as the location for their main Satellite Operations Centre, which will manage satellite connectivity for mobile network operators across Europe with plans to launch commercial service in 2026.

- This initiative aims to provide ubiquitous European mobile broadband, including support for public protection and disaster relief agencies, reflecting rising demand for robust satellite-powered connectivity solutions in underserved regions.

- We'll explore how the establishment of the European Satellite Operations Centre could strengthen AST SpaceMobile's long-term growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is AST SpaceMobile's Investment Narrative?

For anyone following AST SpaceMobile, the central question is whether its vision of direct-to-device satellite broadband connectivity for underserved regions will translate into sustainable business results. The recent announcement of a European Satellite Operations Centre in partnership with Vodafone is a significant step that could accelerate commercial service launch plans and strengthen credibility with mobile network operators. This progress may influence short-term catalysts, such as commercial contracts and regulatory milestones, but also raises immediate questions around execution, especially given the company’s persistent losses and continuing capital raises, including the latest US$23.91 million equity offering. Recent price volatility indicates that the market is weighing these growth ambitions against high cash burn and execution risks. With the centre not yet operational, most short-term risks, like funding needs and the path to profitability, still loom large despite this promising partnership.

In contrast, execution risk surrounding the rollout remains a key issue for investors to watch.

Exploring Other Perspectives

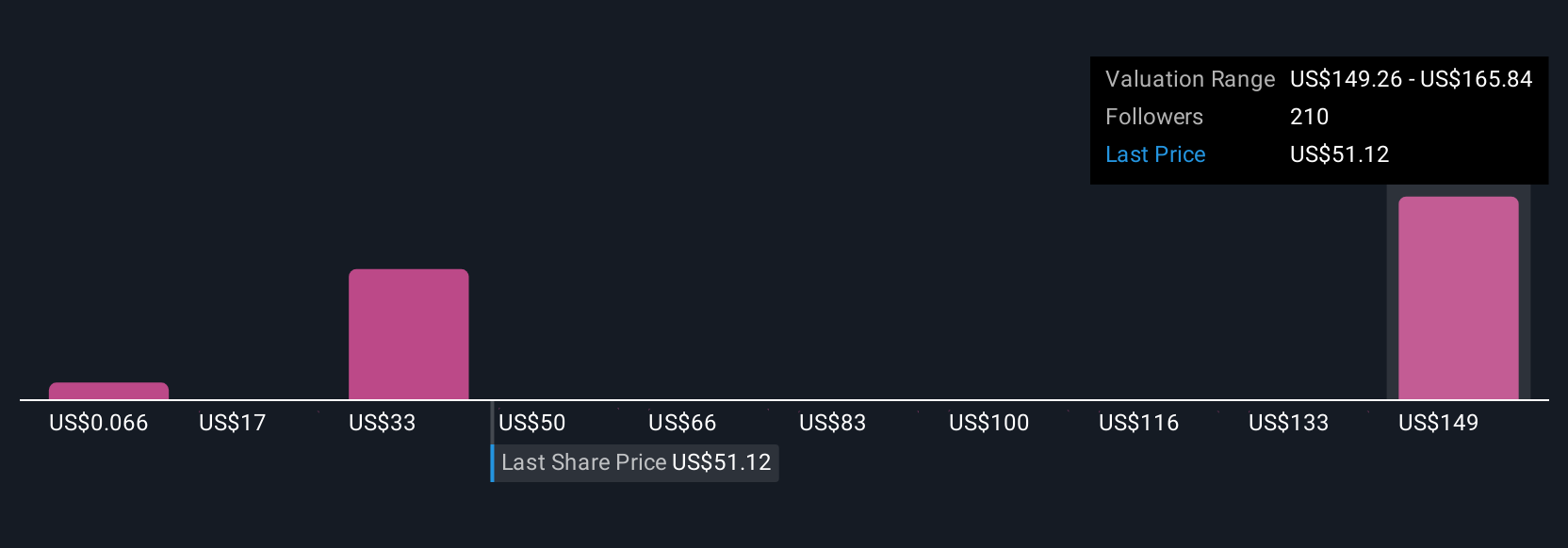

Explore 61 other fair value estimates on AST SpaceMobile - why the stock might be worth less than half the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives