- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Is AST SpaceMobile's Market Surge Justified After Recent Satellite Partnership News?

Reviewed by Bailey Pemberton

- Wondering if AST SpaceMobile's rapid rise means it is undervalued, overhyped, or still holds untapped potential? You're not alone. Many investors are trying to figure out if the current price is justified or if there is more upside ahead.

- AST SpaceMobile’s stock has seen remarkable gains recently, rising 6.9% in the past week, jumping 56.2% over the last month, and boasting a staggering 254.3% gain year-to-date.

- Much of this excitement is being fueled by news around successful satellite tests and partnerships with major telecom players. These developments have reassured the market about the company's ambitious plans. Headlines about new breakthroughs and collaborations have played a significant role in pushing the share price higher and attracting the attention of potential investors.

- When it comes to value, AST SpaceMobile currently scores a 2 out of 6 on our valuation checks. This suggests there are reasons for both optimism and caution. We will break down what that means using traditional valuation tools, and later in the article, introduce a smarter way to think about fair value for this fast-moving stock.

AST SpaceMobile scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AST SpaceMobile Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. In other words, a DCF aims to answer what all future expected cash the business generates is worth in present terms.

For AST SpaceMobile, current Free Cash Flow (FCF) stands at -$483.4 Million, reflecting the company's significant reinvestment as it builds out its satellite network. Analyst forecasts suggest negative FCF will continue in the near term, with 2026 FCF expected to be -$734.2 Million and 2027 still negative at -$448.2 Million. Projections indicate a dramatic turnaround beginning in 2028 with a positive FCF of $241.5 Million, and by 2029, analysts expect FCF to increase to $766.6 Million. Extrapolations beyond the analyst-covered period estimate FCF could rise above $4.3 Billion by 2035, according to Simply Wall St’s model.

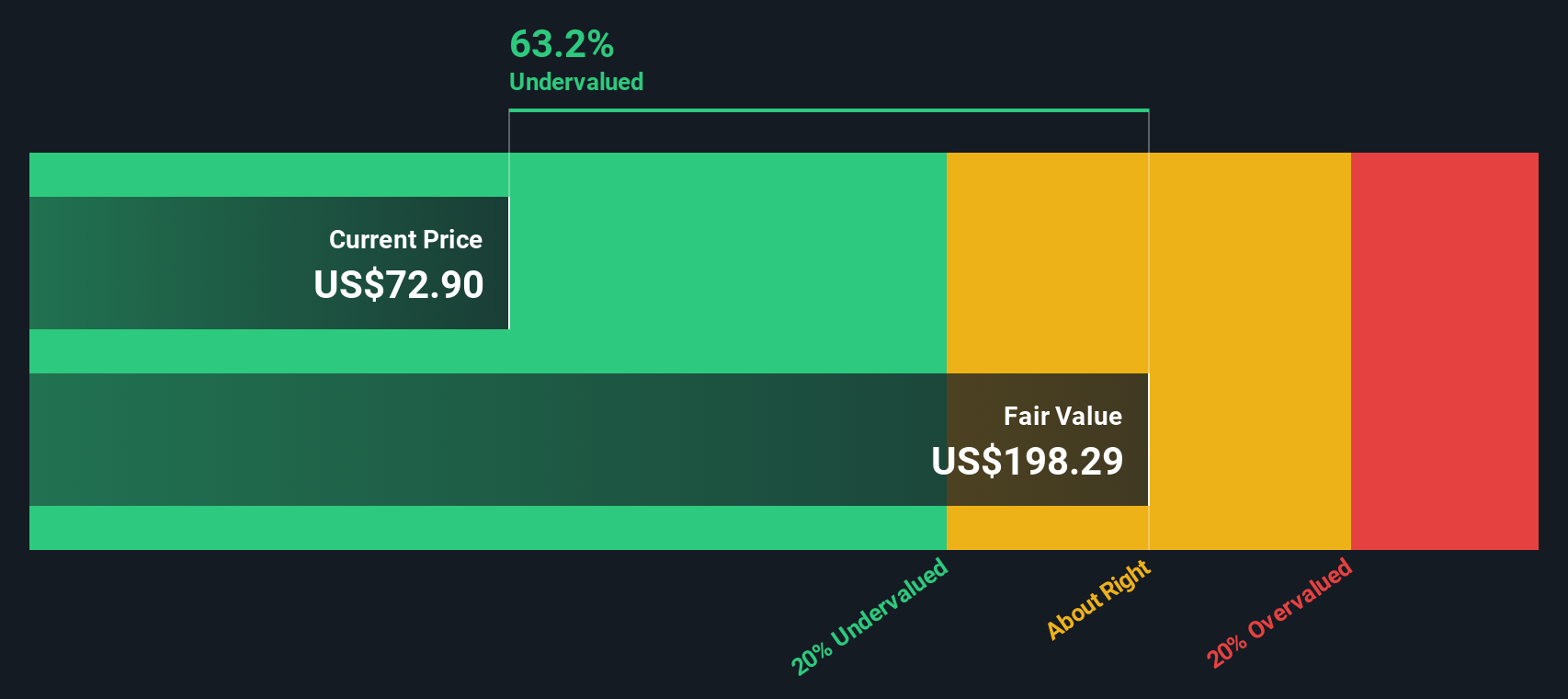

Based on these discounted projections, the DCF intrinsic value for AST SpaceMobile is $198.19 per share. Compared to the current share price, this suggests the stock is trading at a 61.3% discount and is significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AST SpaceMobile is undervalued by 61.3%. Track this in your watchlist or portfolio, or discover 847 more undervalued stocks based on cash flows.

Approach 2: AST SpaceMobile Price vs Book

The Price-to-Book (PB) ratio is a commonly used valuation tool, especially for companies in asset-heavy industries or those without consistent profits. It compares a company's market value to its balance sheet assets. While earnings-based metrics like Price-to-Earnings are preferable for profitable firms, for early-stage companies like AST SpaceMobile, where profits are yet to materialize, PB provides a practical alternative for gauging valuation.

The appropriate PB ratio often depends on expectations for growth and the perceived risks of the business. Investors may be willing to pay a higher multiple for rapid innovation and future profitability. However, higher risk or uncertain asset values usually bring the PB multiple down toward or even below industry norms.

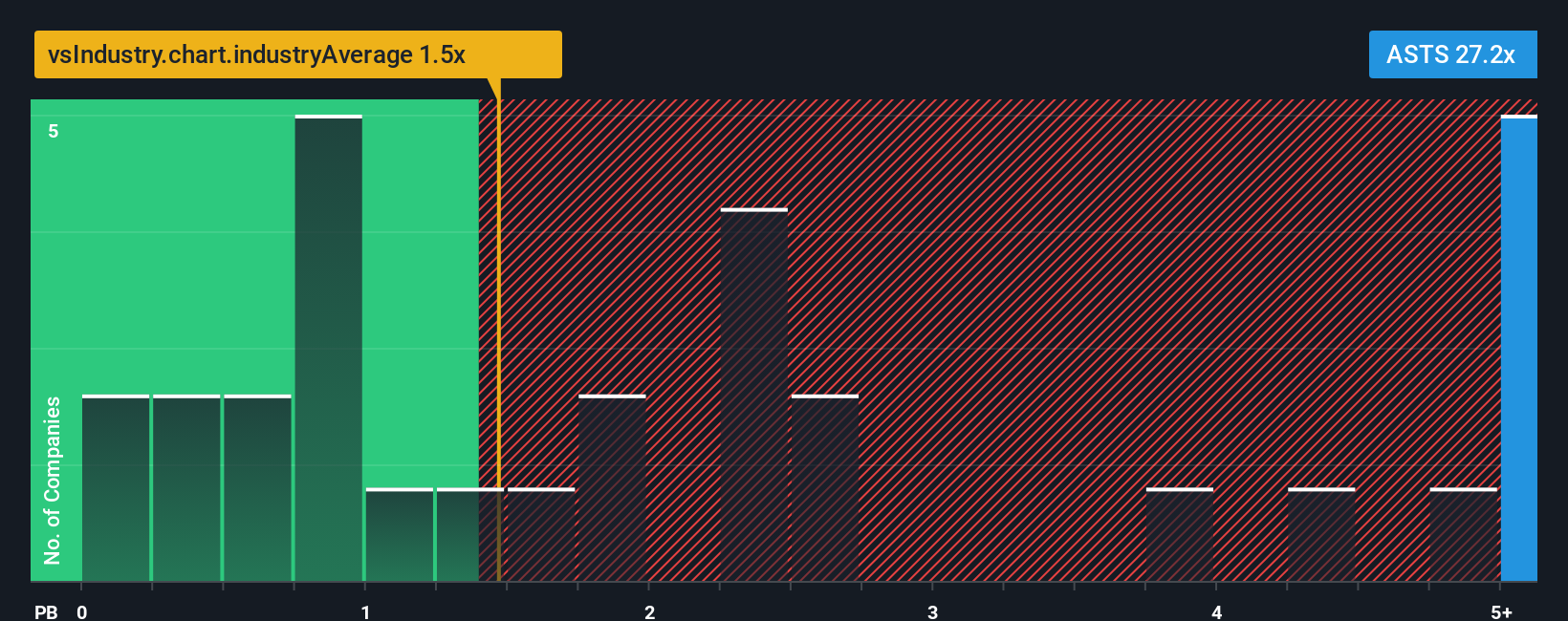

AST SpaceMobile currently trades at a PB ratio of 24.3x. This is substantially above the Telecom industry average of 1.4x and also much higher than the peer average of 5.4x. At first glance, this elevated PB multiple could imply the stock is overvalued compared to standard benchmarks.

However, Simply Wall St’s proprietary "Fair Ratio" model customizes the expected PB ratio for each company by incorporating growth prospects, profit margins, market cap, and business risks, rather than just using industry averages or peer values. This tailored approach provides a more nuanced and fair representation of what the multiple should be for AST SpaceMobile’s unique situation.

Comparing the current PB multiple to the Fair Ratio, the difference is substantial. This indicates AST SpaceMobile’s shares are trading well above what the underlying fundamentals and risk profile justify at this stage.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AST SpaceMobile Narrative

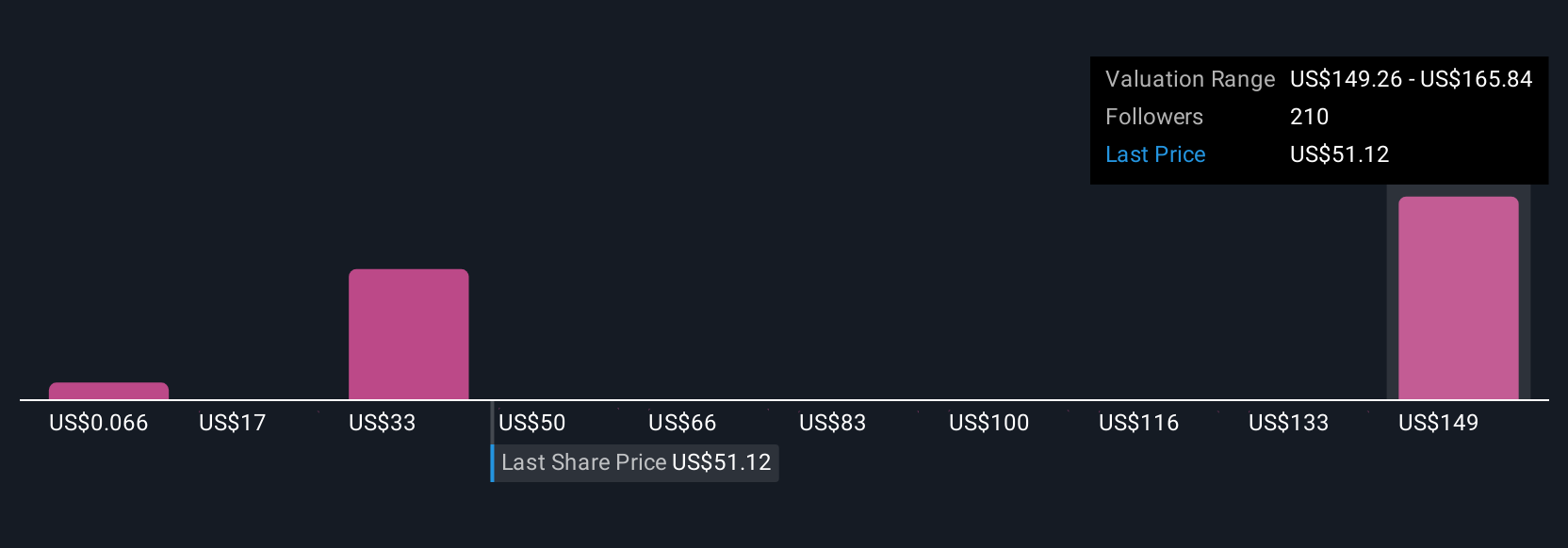

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is essentially your own story or perspective on a company, explaining how you see its potential by setting your expectations for future revenue, profit margins, and ultimately, fair value. Narratives bridge the gap between a company's big-picture story and the specific financial forecasts behind it. This gives you a clear view of where your estimates and assumptions might lead.

On Simply Wall St's Community page, Narratives have become an easy and accessible tool for millions of investors. Using Narratives, you can quickly connect your beliefs about what’s next for AST SpaceMobile to real financial models. This makes it simpler to decide whether the current price offers a buying or selling opportunity. As new information like earnings reports or major news is released, Narratives are refreshed dynamically to ensure your analysis stays up to date.

For example, one investor might believe AST SpaceMobile will achieve rapid commercialization, leading to a high fair value. Another might expect slower adoption and set a more cautious outlook. With Narratives, you can compare these perspectives and choose the one that matches your conviction.

Do you think there's more to the story for AST SpaceMobile? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives