- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Investors push AST SpaceMobile (NASDAQ:ASTS) 6.6% lower this week, company's increasing losses might be to blame

AST SpaceMobile, Inc. (NASDAQ:ASTS) shareholders might be concerned after seeing the share price drop 23% in the last quarter. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. Indeed, the share price is up a whopping 406% in that time. So we wouldn't blame sellers for taking some profits. While winners often keep winning, it can pay to be cautious after a strong rise.

While the stock has fallen 6.6% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for AST SpaceMobile

AST SpaceMobile isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

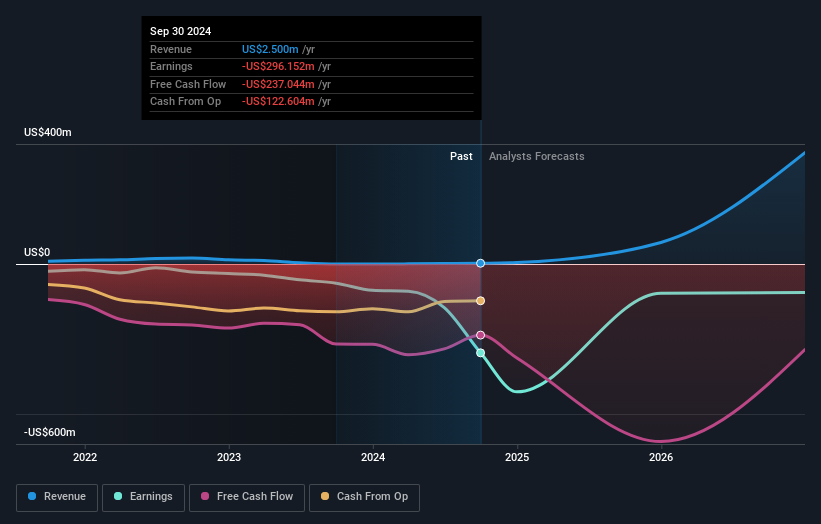

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling AST SpaceMobile stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that AST SpaceMobile shareholders have received a total shareholder return of 406% over the last year. That gain is better than the annual TSR over five years, which is 20%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand AST SpaceMobile better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with AST SpaceMobile (including 1 which makes us a bit uncomfortable) .

AST SpaceMobile is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ASTS

AST SpaceMobile

Develops and provides access to a space-based cellular broadband network for smartphones in the United States.

Exceptional growth potential moderate.