- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

AST SpaceMobile (ASTS) Is Up 34.0% After Accelerating Satellite Launches With FCC Approval and EllioSat Deal

Reviewed by Sasha Jovanovic

- AST SpaceMobile recently announced major milestones in its space-based cellular broadband network, including final assembly of the BlueBird 6 satellite and plans to launch up to 60 satellites by the end of 2026, following FCC approval for initial launches and the completion of its acquisition of EllioSat.

- These updates highlight AST SpaceMobile's push to enable direct cellular connectivity for unmodified smartphones worldwide, supported by partnerships with over 50 global mobile operators and significant U.S. government contracts.

- We’ll examine how the accelerated satellite launch timeline strengthens AST SpaceMobile’s investment narrative in the rapidly evolving space-based communications sector.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is AST SpaceMobile's Investment Narrative?

Owning AST SpaceMobile stock has always been about faith in the company’s ability to launch its global satellite network, win large-scale commercial traction, and manage an ambitious path to profitability. Following its recent satellite assembly news and accelerated launch timeline, key short-term catalysts such as regulatory approvals, launch execution, and broadening partnerships feel more immediate and real. The fresh shelf registration filing is unlikely to dramatically shift these priorities, as the offering size remains modest compared to previous large capital raises. While the share price has continued its strong run, risks tied to recurring losses, high cash burn, and shareholder dilution are front of mind, combining with execution risks as launch cadence intensifies. Investors should be mindful that the rapid pace of share offerings, while funding growth, also tests confidence in the company’s path to profitability and sustainable value creation. Despite recent momentum, frequent share offerings could impact shareholder value if not managed carefully.

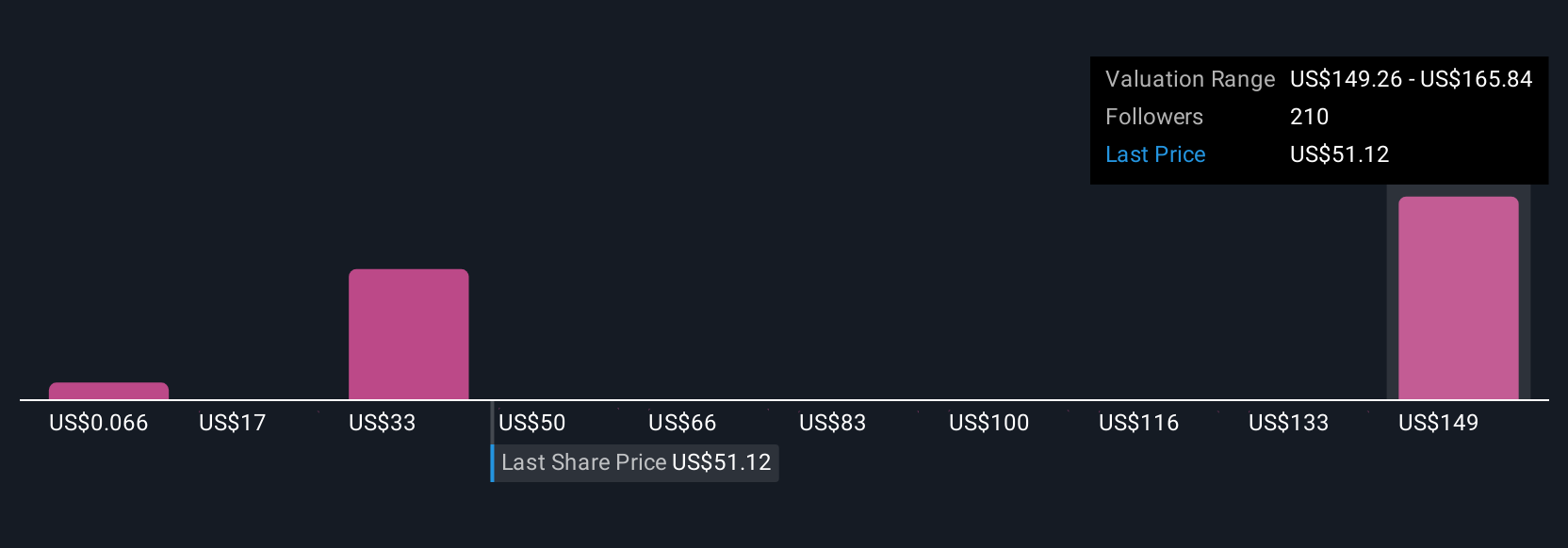

AST SpaceMobile's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 59 other fair value estimates on AST SpaceMobile - why the stock might be worth over 2x more than the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

No Opportunity In AST SpaceMobile?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success