- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

AST SpaceMobile (ASTS) Is Up 10.1% After Securing $575 Million for US Satellite Internet Launch

Reviewed by Simply Wall St

- AST SpaceMobile has advanced toward a U.S. commercial launch of its direct-to-device satellite internet network after raising US$575 million in convertible notes, while SpaceX has committed US$17 billion and secured US$2 billion in debt to enter the same market.

- This development spotlights both AST SpaceMobile's significant war chest, now totaling US$1.5 billion, and an intensifying rivalry as two ambitious players target the emerging direct-to-device market.

- We'll explore how AST SpaceMobile's funding strength and SpaceX's competitive entry shape the company's evolving investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is AST SpaceMobile's Investment Narrative?

For anyone considering AST SpaceMobile, the big conviction is about the scale of the direct-to-device opportunity and whether the huge capital being deployed can translate into meaningful, profitable revenue before competitors catch up. The recent US$575 million convertible note raise gives AST SpaceMobile the liquidity to push ahead aggressively with its network buildout, addressing the key catalyst that has always been front-and-center: a successful US commercial launch in the coming quarters. With SpaceX pledging billions to chase the same market, the competitive risk has sharpened, even if AST SpaceMobile hints at a potential head start. In the short term, the expanded funding base also reduces the company’s liquidity risk, but the pressure to execute, hit launch timelines and begin signing customers, is now even higher. The business remains highly unprofitable and capital hungry, and the stock’s sharp price swings point to ongoing uncertainty about whether progress will soon translate to concrete commercial traction or just more dilution as the spending continues. Overall, the rivalry with SpaceX and the hefty new cash pile are likely to impact risk and reward calculus, making execution and speed more important than ever.

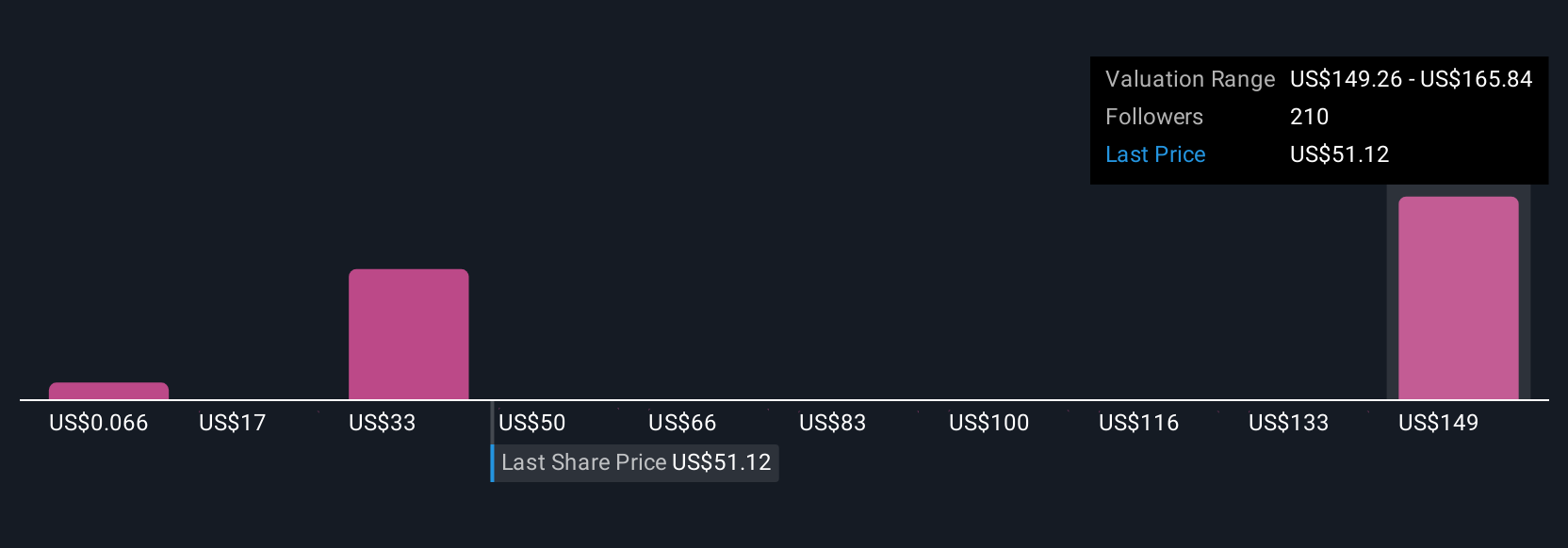

But with insider selling and ongoing losses, there’s more risk than just competition for investors to weigh. AST SpaceMobile's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 56 other fair value estimates on AST SpaceMobile - why the stock might be worth less than half the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success