Will Vishay's (VSH) Space-Grade Transformer Launch Reshape Its Advanced Electronics Growth Story?

Reviewed by Sasha Jovanovic

- In October 2025, Vishay Intertechnology announced the launch of its SGTPL-28 series of 150 W low profile, space-grade planar transformers optimized for 28 V input forward converters in demanding applications such as avionics, military, and space.

- This innovation expands Vishay's presence in specialized high-reliability markets by offering devices that meet stringent military and space standards and can be easily customized to meet specific design requirements.

- We'll explore how Vishay's entrance into advanced avionics and space-grade components could shift its earnings growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Vishay Intertechnology Investment Narrative Recap

To be a shareholder in Vishay Intertechnology, you have to believe in the company's ability to translate heavy investments in advanced, high-reliability components like space-grade transformers into revenue and margin growth, while overcoming recent profitability challenges. The SGTPL-28 launch may support Vishay’s push into specialty markets, but it is unlikely to materially offset near-term margin pressures or reverse persistent negative free cash flow until there is clear evidence of sustained high-margin orders. Of the company's recent product launches, the 150 W space-grade planar transformers are most relevant, as they reinforce Vishay’s expansion into defense and space applications, a segment with distinct margins and demand patterns. However, the impact on the most immediate catalysts, such as broad-based volume recovery and factory utilization rates, is likely to be limited, since the announced product targets niche, highly specialized applications. By contrast, investors should be aware that ongoing negative cash flow from capacity expansions still leaves open the risk that...

Read the full narrative on Vishay Intertechnology (it's free!)

Vishay Intertechnology's outlook anticipates $3.5 billion in revenue and $587.0 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 6.6% and a $674.7 million increase in earnings from the current earnings of -$87.7 million.

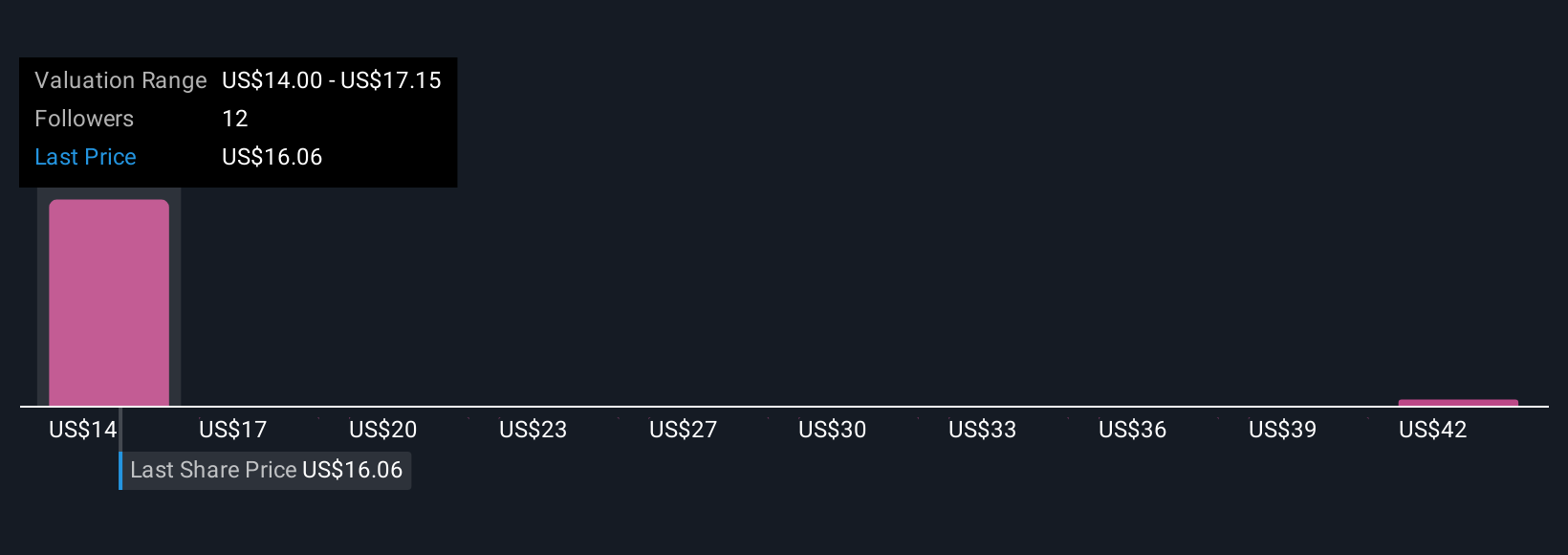

Uncover how Vishay Intertechnology's forecasts yield a $14.00 fair value, a 18% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$14.00 to US$45.54 across three models. While optimism about margin recovery exists, persistent cash flow strain could temper expectations until broader demand improves.

Explore 3 other fair value estimates on Vishay Intertechnology - why the stock might be worth 18% less than the current price!

Build Your Own Vishay Intertechnology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vishay Intertechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vishay Intertechnology's overall financial health at a glance.

No Opportunity In Vishay Intertechnology?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives