Is Vishay Intertechnology Attractively Priced After Recent 19.5% Rally And Dividend Outlook?

Reviewed by Bailey Pemberton

- If you have been wondering whether Vishay Intertechnology is a bargain or a value trap at around $14.84, you are not alone. Investors have been watching this one closely for signs of a turnaround.

- The stock has slipped 6.3% over the past week, but that comes after a punchy 19.5% gain over the last month, even though it still sits in negative territory year to date and over the past 1, 3 and 5 years.

- Recent headlines have centered on Vishay's positioning in key semiconductor and passive component markets, particularly in areas like automotive and industrial applications where demand cycles can shift quickly. These developments help explain why sentiment has swung between caution and optimism as investors try to gauge how durable any recovery in orders and pricing might be.

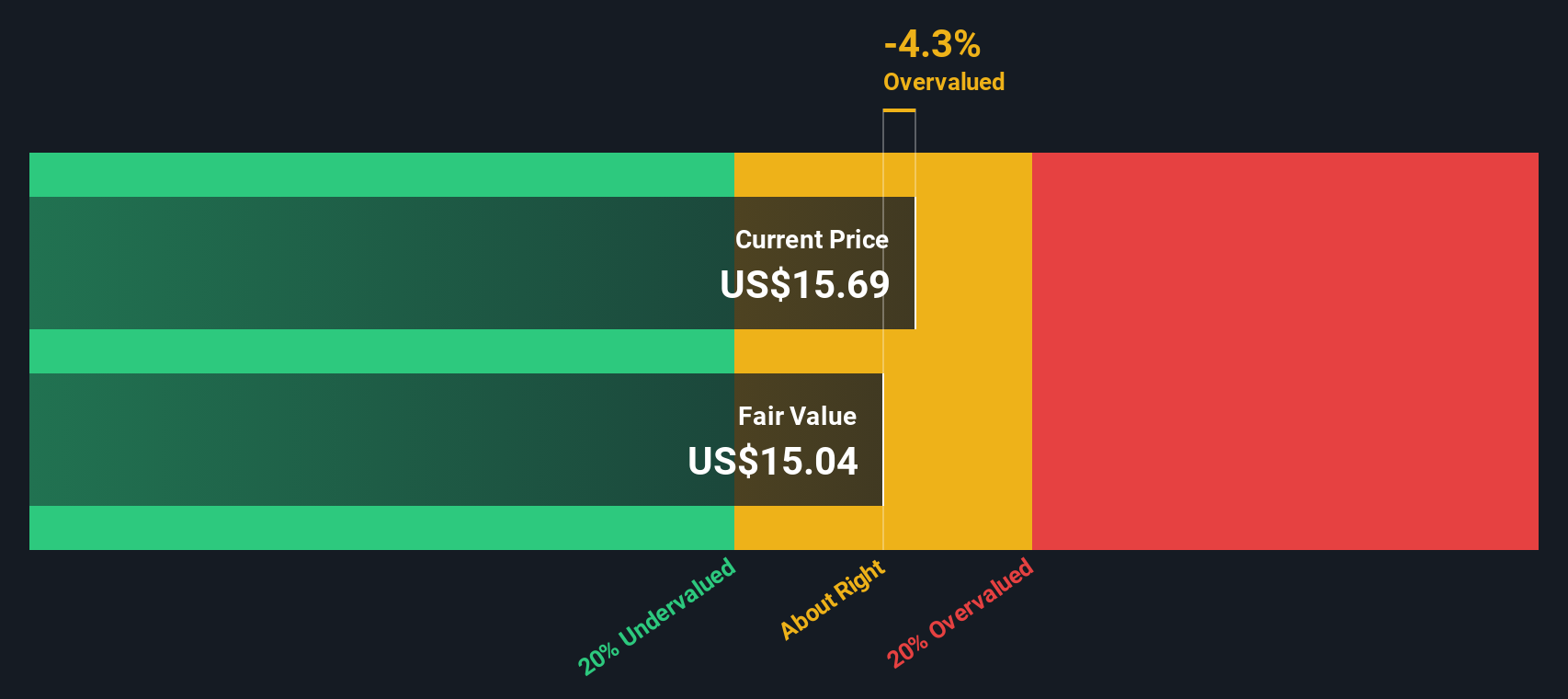

- On our numbers, Vishay scores a 3 out of 6 on valuation checks, suggesting some metrics flag undervaluation while others are more cautious. We will walk through the main valuation approaches next, and then circle back to a more nuanced way of thinking about what the stock might really be worth.

Find out why Vishay Intertechnology's -10.4% return over the last year is lagging behind its peers.

Approach 1: Vishay Intertechnology Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividends, assuming a long term growth rate, and discounting those payments back to today.

For Vishay Intertechnology, the starting dividend per share is $0.40, with an implied long term dividend growth rate of 3.26%, capped down from a higher historical estimate to keep the forecast conservative. The company currently earns a return on equity of about 11.3%, yet only pays out roughly 13.4% of earnings as dividends. This suggests there is ample room to sustain or even gradually increase the payout over time.

Using these inputs, the DDM valuation arrives at an intrinsic value of roughly $6.88 per share. Compared with the current share price around $14.84, this implies the stock is about 115.6% overvalued on a dividend led view. In other words, investors are paying well above what the model suggests those future dividends are worth today.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Vishay Intertechnology may be overvalued by 115.6%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

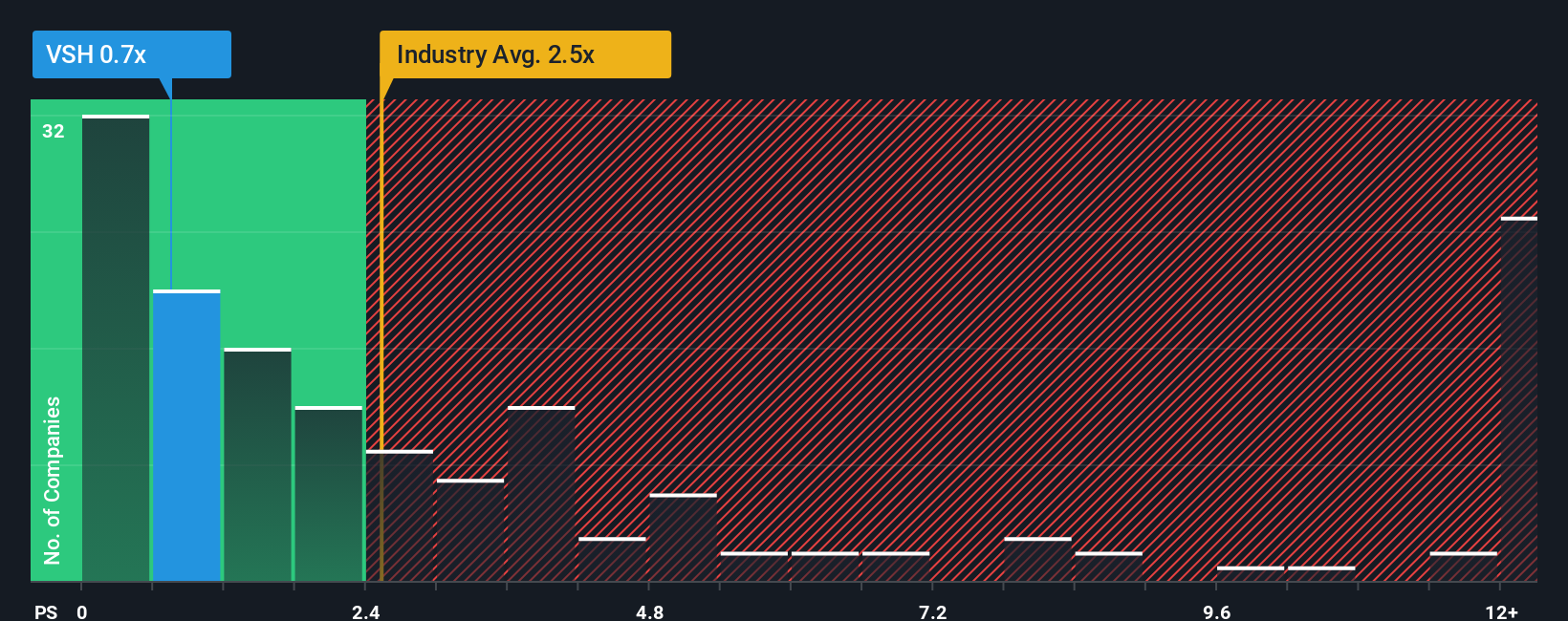

Approach 2: Vishay Intertechnology Price vs Sales

For companies like Vishay that are established operators in their industry, valuation multiples can offer a quick sense check on where the market is pricing the business. The preferred metric here is the Price to Sales ratio, which is particularly useful when earnings are volatile or temporarily depressed, but revenues remain a more stable indicator of the company’s scale and market position.

In general, higher growth and lower risk justify a higher multiple, while slower growth or elevated risk call for a discount. Vishay currently trades on a Price to Sales ratio of about 0.67x, well below the Electronic industry average of around 2.45x and also below the peer group average of roughly 2.48x. On the surface, that makes the stock look very inexpensive compared with its sector.

Simply Wall St’s “Fair Ratio” refines this picture by estimating the multiple Vishay should trade on, given its growth profile, profitability, size, industry and risk factors. For Vishay, that Fair Ratio is 0.92x, which is more tailored than a simple peer or industry comparison because it adjusts for company specific fundamentals. Since the current 0.67x is meaningfully below the 0.92x Fair Ratio, the multiple approach points to the shares being undervalued.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making, Choose your Vishay Intertechnology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you describe your story about Vishay Intertechnology, translate that story into forecasts for revenue, earnings and margins, and then convert those forecasts into a Fair Value you can compare to today’s share price to decide whether to buy, hold or sell. A Narrative links the company’s real world drivers, like capacity expansions, automotive design wins and margin risks, to a quantified outlook and a valuation that updates automatically as new news, earnings and guidance arrive, so your view is always current rather than static. Because different investors can plug in different assumptions, one Narrative for Vishay might see its fair value well above the current price on the back of accelerating AI, smart grid and EV demand, while another far more cautious Narrative could put fair value comfortably below the market due to execution risks, competitive pressure and cash flow strain.

Do you think there's more to the story for Vishay Intertechnology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion