Evaluating Vishay Intertechnology’s Valuation After Its Breakthrough Planar Transformer Launch in Aerospace and Defense

Reviewed by Simply Wall St

Vishay Intertechnology (NYSE:VSH) has launched the SGTPL-28 series planar transformers, described as the industry's first components tailored for 28 V input forward converters in aerospace and defense settings. This move could open doors to new market opportunities and strengthen competitive positioning.

See our latest analysis for Vishay Intertechnology.

After unveiling several innovative new components for aerospace and industrial applications, Vishay Intertechnology has seen momentum build in its stock price, with a 1-month share price return of nearly 14%. Despite some ups and downs, the company’s total shareholder return of 1.4% over the past year lags broader benchmarks. However, its 5-year total return of more than 15% reflects the longer-term upside as it taps specialty tech markets.

Curious to find other industry leaders pushing the boundaries in defense and aerospace? Explore new opportunities with our See the full list for free.

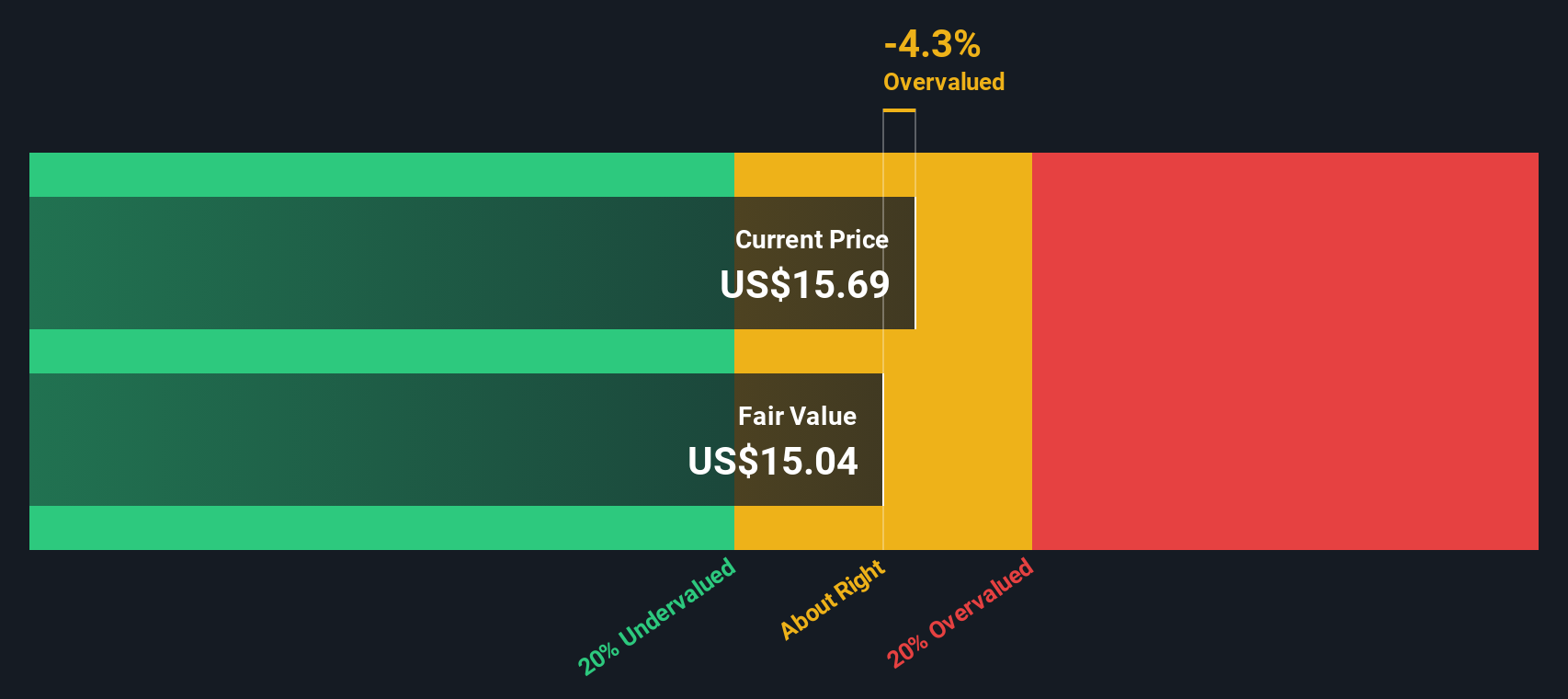

With shares trading just below analysts' price targets even after a run-up, the key question is whether Vishay Intertechnology is still undervalued after recent product wins, or if the market is already pricing in further growth.

Most Popular Narrative: 23% Overvalued

With Vishay Intertechnology's current share price closing at $17.28, the most widely followed valuation narrative places fair value at $14.00, suggesting the stock is trading well above its justified level. The narrative points to a compelling alignment of catalysts and fundamental trends, but also prompts a much more cautious interpretation of where value lies today.

With major multi-year investments in capacity expansion nearing completion, including readiness across nearly all product lines and the ramp of high-growth, higher-profit products, Vishay is well positioned to capture share as demand accelerates in areas like AI, smart grid infrastructure, data centers, and automotive electrification. This supports higher future revenues and improved operating leverage. Accelerating global trends in electric and hybrid vehicle adoption, alongside increasing electronic content per car, are driving sustained design wins and growing backlog from Tier 1 automotive customers. This points to durable revenue growth in higher-margin, specialized segments.

Think Vishay’s future hinges on technology megatrends and industry tailwinds? There’s one key variable behind the experts’ valuation. Can you guess what it is? Their fair value is rooted in bold growth assumptions that may surprise you. Discover which financial leap fuels this perspective and why it challenges the market’s optimism.

Result: Fair Value of $14.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and heavy ongoing capex could strain cash flow. This could make Vishay’s optimistic outlook more vulnerable to disappointment.

Find out about the key risks to this Vishay Intertechnology narrative.

Another View: Our Model Suggests Less Downside

While the most popular valuation approach points to Vishay as overvalued, our SWS DCF model tells a slightly different story. According to this model, the fair value estimate lands at $14.80. This puts the current price only moderately above what fundamentals suggest. Could the gap shrink if expectations shift?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vishay Intertechnology Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own Vishay Intertechnology narrative in just minutes: Do it your way.

A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip by. Take action now and find stocks primed for growth, value, and innovation with these hand-picked ideas from Simply Wall Street’s screeners:

- Snap up potential blue-chip bargains before the market catches on by searching for hidden value with these 848 undervalued stocks based on cash flows.

- Secure reliable returns for your portfolio by targeting steady income streams. Start with these 21 dividend stocks with yields > 3% boasting attractive yields.

- Tap into the next big leap in computing power and innovation by analyzing these 28 quantum computing stocks driving game-changing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives