Is Vishay Precision Group, Inc. (NYSE:VPG) Potentially Undervalued?

While Vishay Precision Group, Inc. (NYSE:VPG) might not be the most widely known stock at the moment, it received a lot of attention from a substantial price movement on the NYSE over the last few months, increasing to US$45.38 at one point, and dropping to the lows of US$33.49. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether Vishay Precision Group's current trading price of US$33.49 reflective of the actual value of the small-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Vishay Precision Group’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Check out our latest analysis for Vishay Precision Group

What's The Opportunity In Vishay Precision Group?

According to my price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average, the stock price seems to be justfied. In this instance, I’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. I find that Vishay Precision Group’s ratio of 12.42x is trading slightly below its industry peers’ ratio of 16.19x, which means if you buy Vishay Precision Group today, you’d be paying a decent price for it. And if you believe Vishay Precision Group should be trading in this range, then there isn’t much room for the share price to grow beyond the levels of other industry peers over the long-term. So, is there another chance to buy low in the future? Given that Vishay Precision Group’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us an opportunity to buy later on. This is based on its high beta, which is a good indicator for share price volatility.

What does the future of Vishay Precision Group look like?

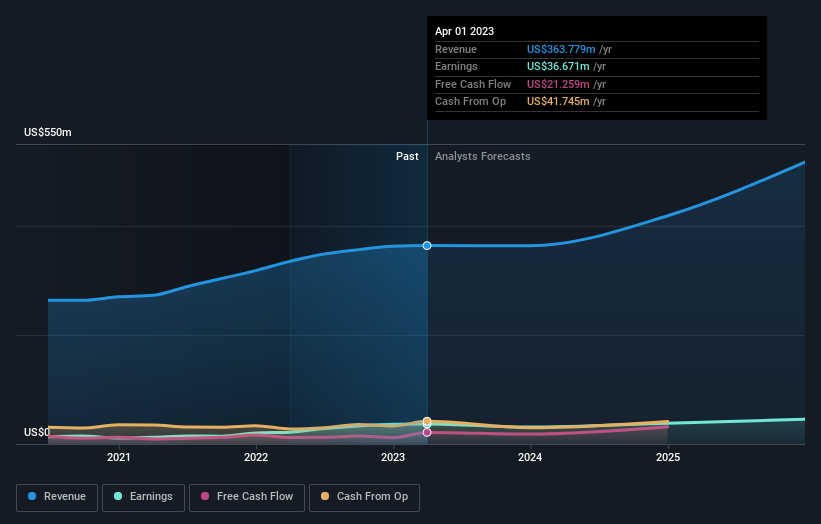

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Though in the case of Vishay Precision Group, it is expected to deliver a relatively unexciting earnings growth of 8.9%, which doesn’t help build up its investment thesis. Growth doesn’t appear to be a main reason for a buy decision for the company, at least in the near term.

What This Means For You

Are you a shareholder? VPG’s future growth appears to have been factored into the current share price, with shares trading around industry price multiples. However, there are also other important factors which we haven’t considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at VPG? Will you have enough confidence to invest in the company should the price drop below the industry PE ratio?

Are you a potential investor? If you’ve been keeping tabs on VPG, now may not be the most advantageous time to buy, given it is trading around industry price multiples. However, the positive growth outlook may mean it’s worth diving deeper into other factors in order to take advantage of the next price drop.

Since timing is quite important when it comes to individual stock picking, it's worth taking a look at what those latest analysts forecasts are. Luckily, you can check out what analysts are forecasting by clicking here.

If you are no longer interested in Vishay Precision Group, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VPG

Vishay Precision Group

Engages in the precision measurement and sensing technologies business in the United States, Europe, Israel, Asia, and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion