- United States

- /

- Communications

- /

- NYSE:UI

Does Ubiquiti’s (UI) Surging Dividend and Earnings Reveal a Turning Point for Investors?

Reviewed by Sasha Jovanovic

- Ubiquiti Inc.'s Board of Directors declared a US$0.80 per share cash dividend payable November 24, 2025, and reported first quarter 2025 earnings with sales of US$733.77 million and net income of US$207.88 million, both up strongly from a year ago.

- The combination of a higher dividend payout and very large year-over-year growth in both sales and earnings highlights the company's upbeat financial momentum.

- We will explore how Ubiquiti's markedly increased dividend and financial results impact its investment narrative and broader appeal to shareholders.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Ubiquiti's Investment Narrative?

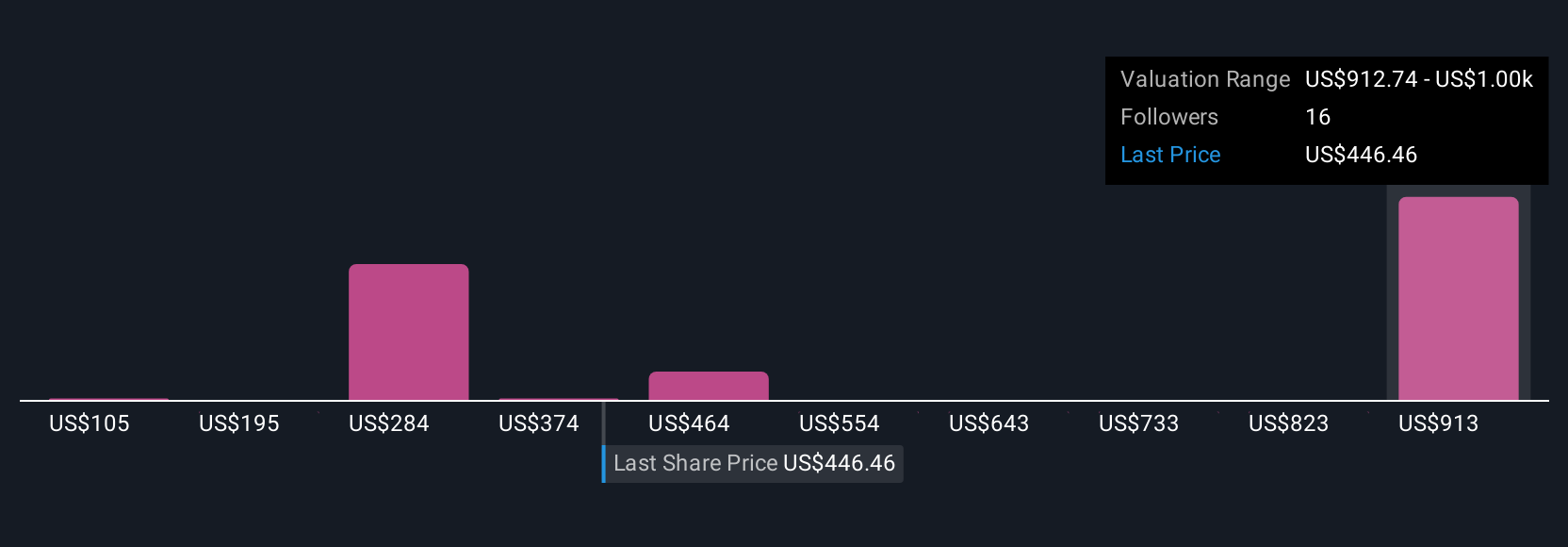

For investors considering Ubiquiti, the story hinges on confidence in the company's ability to sustain its recent momentum in both growth and shareholder returns. The just-announced US$0.80 dividend and strong quarterly earnings reinforce a positive short-term outlook, with the company continuing to post standout performance, particularly in revenue and profit expansion. While the higher payout and robust results likely enhance Ubiquiti's investment appeal and could support the share price in the near term, the premium valuation remains a key consideration, with the price-to-earnings ratio still well above industry averages. The earnings upgrade and dividend hike may shift immediate catalysts toward continued financial outperformance but also bring renewed focus to ongoing risks, such as whether recent rapid growth levels can be maintained. Given these developments, the risk profile, especially related to valuation, may evolve as market participants factor in the new data.

Yet, sustaining such rapid growth often comes with heightened valuation risk that shouldn’t be overlooked. Ubiquiti's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 14 other fair value estimates on Ubiquiti - why the stock might be worth less than half the current price!

Build Your Own Ubiquiti Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ubiquiti research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ubiquiti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ubiquiti's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers in North America, Europe, the Middle East, Africa, Asia Pacific, South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives