What TE Connectivity (TEL)'s Strong Q3 Earnings and Buyback Activity Means For Shareholders

Reviewed by Simply Wall St

- TE Connectivity recently reported third quarter results, showing year-over-year sales growth to US$4.53 billion and net income rising to US$638 million, alongside updated share repurchase activity totaling over US$17.42 billion since 2007.

- The company's strong outlook for continued revenue and earnings growth, combined with recent buyback progress, highlights management's confidence in ongoing operational momentum.

- We'll examine how TE Connectivity's robust earnings performance and optimistic guidance may influence its long-term investment narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TE Connectivity Investment Narrative Recap

To back TE Connectivity as a shareholder, you need confidence in sustained demand across AI, energy, and Asian transportation, supported by strong quarterly growth and upbeat guidance. The recent share buyback and positive outlook amplify management’s conviction, but for now, these developments don’t materially change the near-term catalyst: continued traction in AI and electrification segments. The biggest risk remains any slowdown or unexpected shift in demand from the company’s most influential regional and sector exposures.

The company’s latest quarterly report, with sales rising to US$4.53 billion and net income up to US$638 million, is particularly relevant given its emphasis on accelerating revenue from AI-driven infrastructure and energy. This performance bolsters recent guidance for a significant year-over-year earnings jump, putting focus on whether momentum in these growth areas can offset concentration risks.

By contrast, investors should also monitor the increasing concentration of revenue in fast-growing but potentially volatile markets, as any abrupt slowdown could...

Read the full narrative on TE Connectivity (it's free!)

TE Connectivity's outlook anticipates $20.3 billion in revenue and $3.1 billion in earnings by 2028. This projection is based on a 7.0% annual revenue growth rate and a $1.6 billion increase in earnings from the current $1.5 billion.

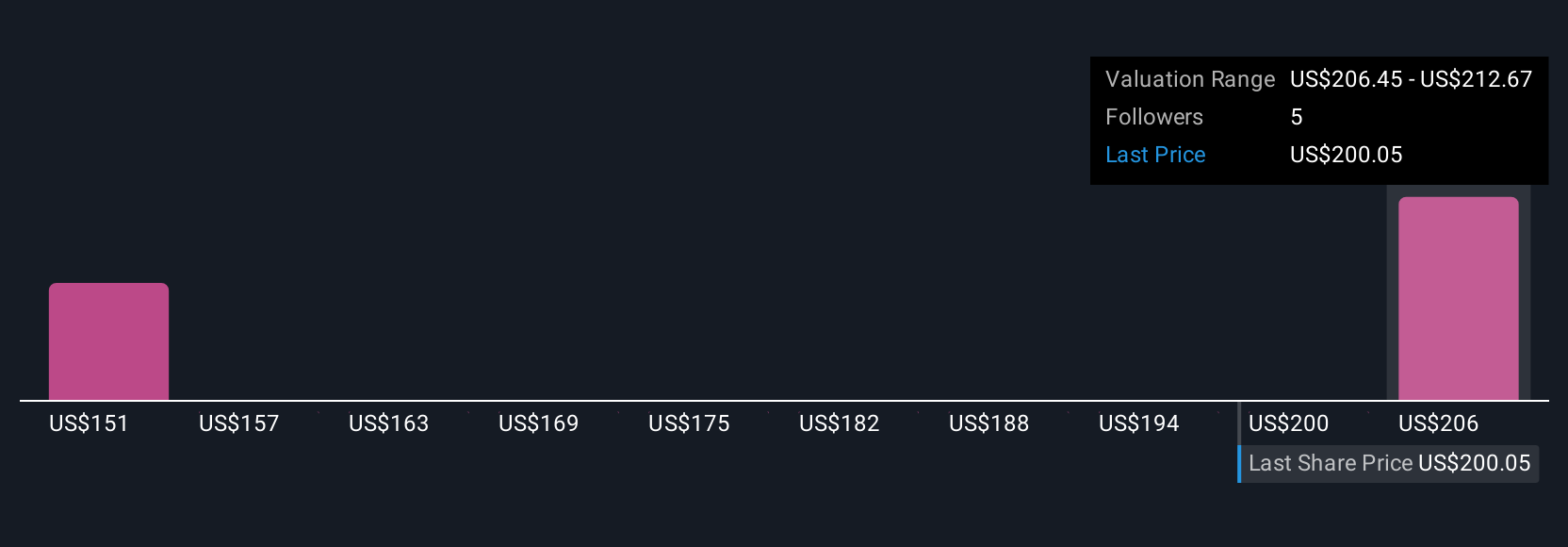

Uncover how TE Connectivity's forecasts yield a $216.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$150.38 to US$216, with 2 investor perspectives represented. As investor outlooks diverge, close attention to ongoing AI and electrification demand trends could prove crucial for broader expectations around TE Connectivity’s performance.

Explore 2 other fair value estimates on TE Connectivity - why the stock might be worth 26% less than the current price!

Build Your Own TE Connectivity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TE Connectivity research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free TE Connectivity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TE Connectivity's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives