TE Connectivity (TEL) Declares Regular US$0.71 Dividend for December 2025

Reviewed by Simply Wall St

TE Connectivity (TEL) recently affirmed a regular quarterly dividend, distributing $0.71 per share, which may have been a factor in its share price rising by nearly 27% last quarter. The company's strategic actions, such as a significant buyback tranche and positive earnings announcements, likely added weight to this rise in its stock price. Furthermore, with the broader market setting record highs amid expectations for Federal Reserve interest rate cuts, TE Connectivity's performance aligns with these overall trends. The dividend declaration and robust financial results underscored the company's appeal to investors during this period.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent dividend affirmation and stock buyback initiatives from TE Connectivity have not only bolstered investor confidence but might also have provided additional momentum to its stock price in the short term. Over the past five years, the company's total return, which includes both share price appreciation and dividends, was 124.14%. This indicates substantial long-term performance, considering its 58.1% earnings decline in the past year. Furthermore, TE Connectivity outperformed the US Electronic industry, which saw a 43.5% return over the past year, highlighting its secondary market strength. The alignment of TE Connectivity's performance with broader market highs has underscored its competitive positioning in the electronic components space.

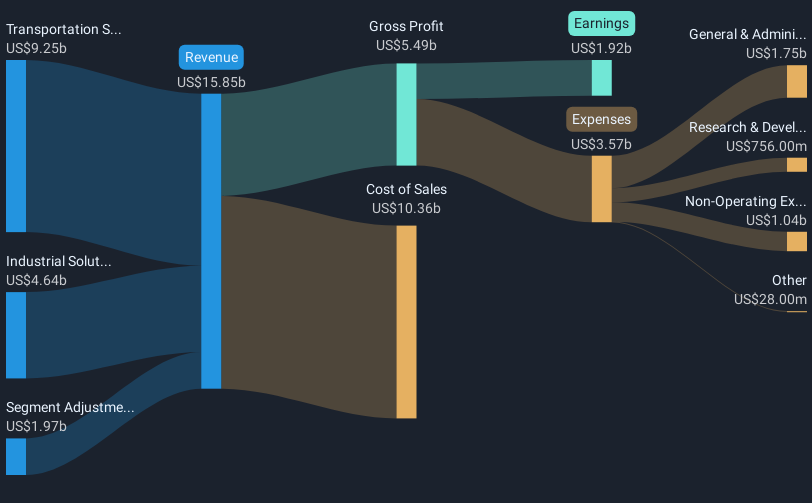

The positive market sentiment reflected in TE Connectivity's share price movement is consistent with the analysts' consensus price target of $218.31, which represents a modest 3.8% premium to its current price of $210.35. The company's increased revenue from $16.58 billion, driven by AI data centers and Asia's electrification, suggests that these sectors may continue to influence upward revisions in revenue and earnings forecasts. Analysts predict that continued margin improvements and restructuring efforts could fuel earnings growth, possibly reaching $3.1 billion by 2028. The recent news is consistent with these analyst projections, though the effective realization of these figures will depend on consistent execution in its key growth segments.

Learn about TE Connectivity's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion