Revisiting TE Connectivity (TEL) Valuation After Its Recent Share Price Climb

Reviewed by Simply Wall St

TE Connectivity (TEL) has quietly delivered a strong run over the past year, and with shares hovering near 229 dollars, investors are starting to revisit whether the current price still reflects future growth potential.

See our latest analysis for TE Connectivity.

That steady climb in the share price to about 229.98 dollars, backed by a robust year to date share price return and a strong multi year total shareholder return, suggests momentum is still building as investors reassess TE Connectivity’s growth and profitability profile.

If TE Connectivity’s run has you rethinking your watchlist, this could be a good moment to discover other aerospace and defense stocks that might be catching similar tailwinds.

With solid double digit earnings growth and a share price still trading at a discount to analyst targets, investors now face a key question: is TE Connectivity a buy at current levels, or is future growth already priced in?

Most Popular Narrative: 15% Undervalued

With TE Connectivity last closing at 229.98 dollars against a narrative fair value near 270.47 dollars, the story hinges on sustained growth, rising margins, and resilient earnings power.

Broad based order growth, especially in Industrial and Energy markets, coupled with positive early signs of recovery in factory automation, creates a durable foundation for double digit EPS growth and high free cash flow conversion (>100%), further strengthening the company's capacity to invest in secular tailwinds or execute value accretive acquisitions.

Curious how double digit earnings, rising profitability, and shrinking share count all feed into that higher fair value, and what earnings multiple they are betting on, the full narrative unpacks the precise forecasts behind this upside case.

Result: Fair Value of $270.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in key end markets or missteps in integrating new capacity and acquisitions could pressure margins and derail those upbeat long term earnings assumptions.

Find out about the key risks to this TE Connectivity narrative.

Another Lens on Valuation

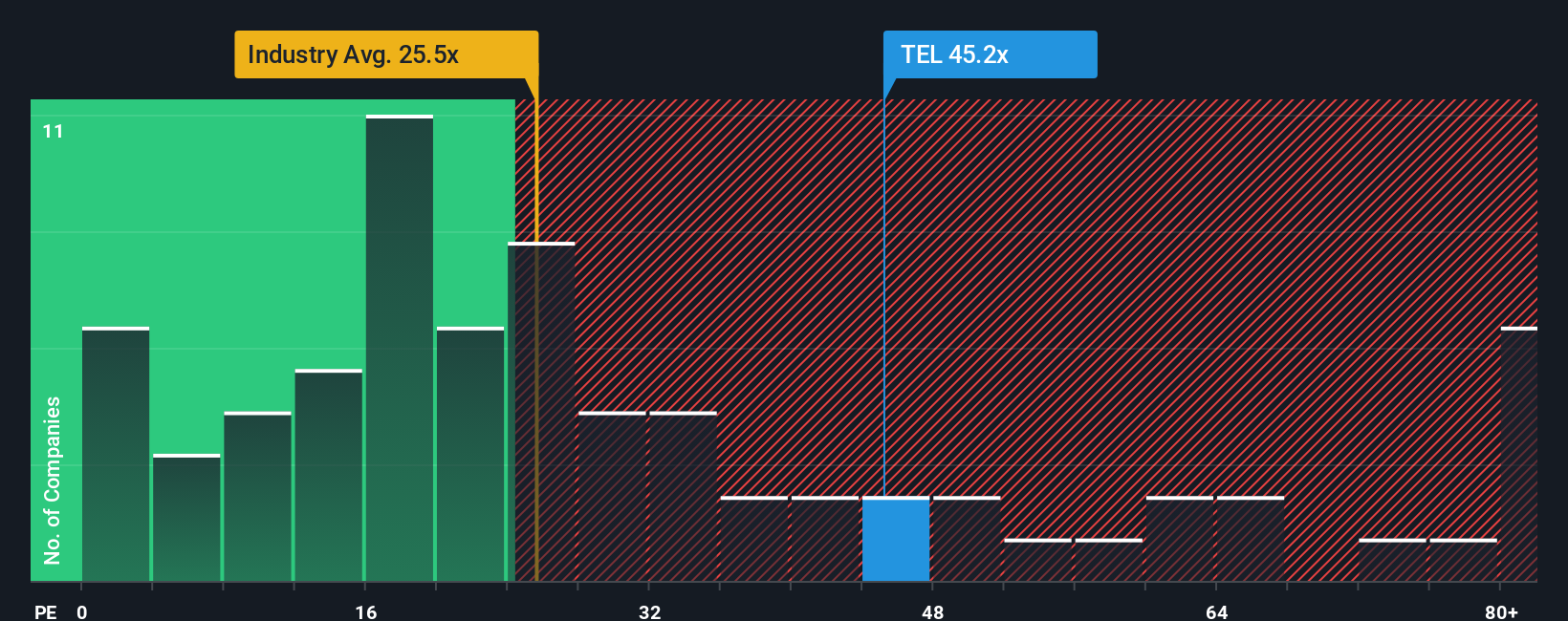

While the narrative fair value points to upside, the market is already paying a rich price relative to earnings. TE Connectivity trades on a 36.7x P E versus 24.5x for the US Electronic industry and a 30x fair ratio, which suggests limited margin for error if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TE Connectivity Narrative

If you prefer to stress test the assumptions yourself and shape your own view from the ground up, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your TE Connectivity research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next opportunity?

Before you move on, lock in your edge by scanning fresh ideas on Simply Wall St's screener, where data backed picks can sharpen your next move.

- Capitalize on potential mispricing by targeting undervalued cash flow winners through these 913 undervalued stocks based on cash flows, so you are not leaving obvious value on the table.

- Ride the next wave of innovation by zeroing in on frontier names with these 24 AI penny stocks, positioning your portfolio ahead of fast moving themes.

- Strengthen your income stream by focusing on reliable yield opportunities via these 13 dividend stocks with yields > 3%, before the market fully recognizes their payout power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion