What Teledyne Technologies (TDY)'s New Middle East Headquarters Means for Regional Growth and Innovation

Reviewed by Sasha Jovanovic

- Teledyne Technologies recently secured a Regional Headquarters license in Saudi Arabia and announced it plans to open a Middle East headquarters in Riyadh by mid-2026, establishing a central hub for operations and innovation in the region.

- This move positions Teledyne to strengthen relationships with Gulf government and defense agencies, and accelerate the localization of advanced technologies like AI, autonomy, and sensing through its expanded FLIR Defense footprint.

- We'll examine how establishing a Riyadh headquarters could further support Teledyne's regional collaboration and growth opportunities across defense and technology markets.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Teledyne Technologies Investment Narrative Recap

To be a Teledyne Technologies shareholder, you need conviction in the company’s ability to expand its international footprint and sustain demand for its advanced sensing and defense solutions, despite facing risks like supply chain volatility and margin pressures in acquired businesses. The recent announcement of a new Middle East headquarters in Riyadh could help accelerate long-term order growth in defense markets, but its near-term impact on Teledyne’s main revenue drivers and primary risk factors, such as cost inflation and trade uncertainties, appears limited at this stage.

Among Teledyne’s recent developments, the Middle East expansion stands out for its relevance to international defense demand, a key catalyst for the business. This move complements strong order trends in unmanned and sensing technologies, but persistent risks tied to global supply chains and input costs remain central to any growth outlook.

However, investors should be conscious of the prospect that persistent cost inflation or new geopolitical tensions could pressure margins if...

Read the full narrative on Teledyne Technologies (it's free!)

Teledyne Technologies is projected to reach $6.9 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a 5.2% annual revenue growth rate and a $241 million increase in earnings from the current $859 million.

Uncover how Teledyne Technologies' forecasts yield a $621.73 fair value, a 21% upside to its current price.

Exploring Other Perspectives

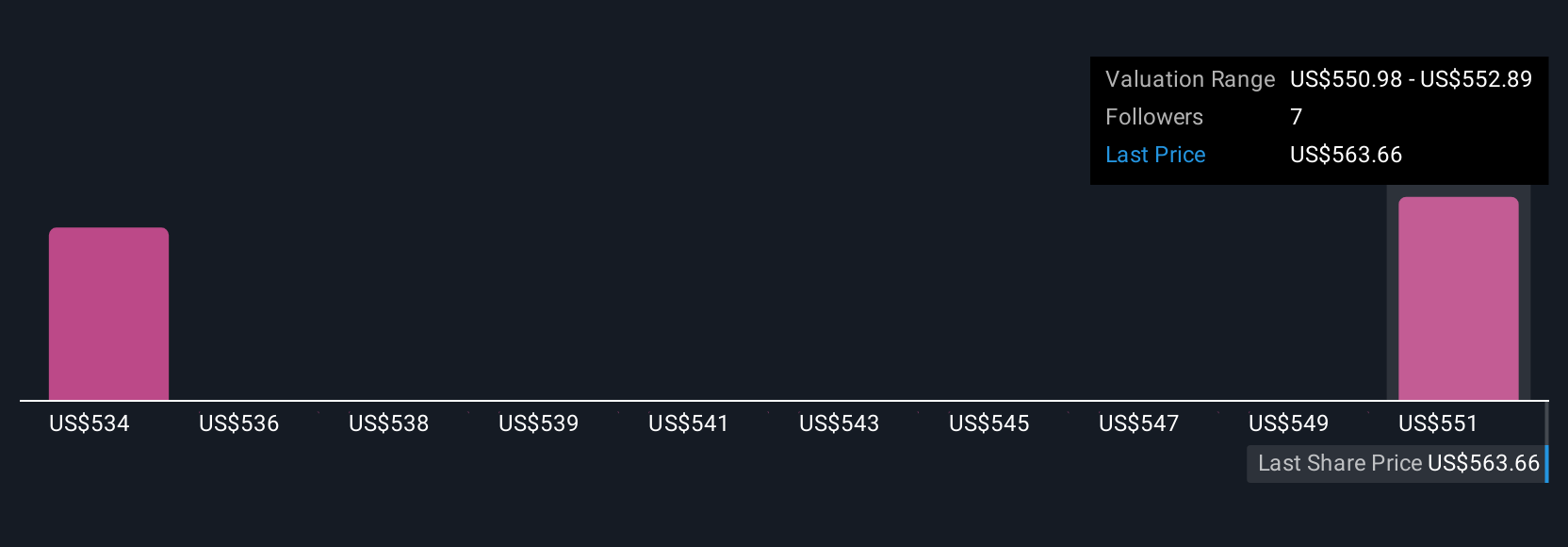

Simply Wall St Community participants set fair value estimates for Teledyne between US$584.06 and US$621.73, with only 2 perspectives informing this range. While some see deep value potential, sustained global defense demand and innovation in unmanned systems may prove crucial drivers of future returns. Consider these diverse views as you assess the company’s path forward.

Explore 2 other fair value estimates on Teledyne Technologies - why the stock might be worth as much as 21% more than the current price!

Build Your Own Teledyne Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teledyne Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teledyne Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teledyne Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives