Teledyne's (TDY) Upward Earnings Guidance and Board Changes Might Change the Case for Investing

Reviewed by Sasha Jovanovic

- Teledyne Technologies has raised its full-year 2025 earnings guidance, now projecting GAAP diluted earnings per share between US$17.83 and US$18.05, and issued new quarterly targets while appointing two new members to its Board of Directors.

- The absence of share repurchases during the buyback period contrasts with the company's improved earnings outlook, offering insight into capital allocation decisions amidst operational optimism.

- We'll examine how Teledyne's upward earnings revision could influence its investment narrative around margin expansion and future growth expectations.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Teledyne Technologies Investment Narrative Recap

Teledyne Technologies’ investment story is anchored in its ability to deliver consistent earnings growth through disciplined capital management and expanding high-margin segments like defense and instrumentation. The recent upward revision to full-year 2025 earnings guidance strengthens confidence around margin improvement, but the absence of share repurchases during a period of better outlook has little immediate impact on the key short-term catalyst: realization of high-value defense orders and successful integration of acquired businesses. The main near-term risk remains pressure on net margins if cash flow challenges persist; this latest update does not materially alter that concern. Among the latest developments, the expansion of Teledyne’s board is particularly relevant for investors focused on management execution as a catalyst. Adding experienced external leadership and the company’s new CEO could support governance and capital allocation, which are important as the business balances growth investments and operational efficiency. Yet, in contrast, ongoing challenges around margin compression due to integration of recent acquisitions are risks every investor should keep…

Read the full narrative on Teledyne Technologies (it's free!)

Teledyne Technologies' outlook anticipates $6.9 billion in revenue and $1.1 billion in earnings by 2028. This scenario assumes a 5.2% annual revenue growth rate and an increase in earnings of $241 million from current earnings of $859 million.

Uncover how Teledyne Technologies' forecasts yield a $620.82 fair value, a 18% upside to its current price.

Exploring Other Perspectives

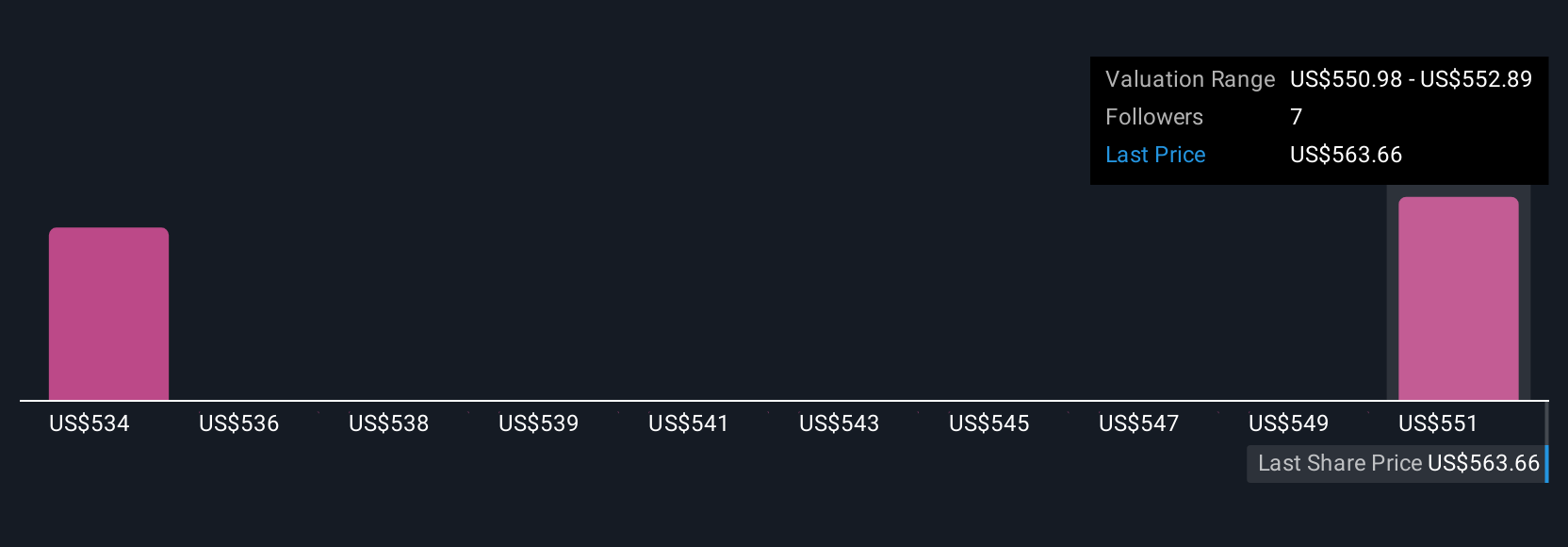

Simply Wall St Community members have set fair value estimates for Teledyne Technologies between US$582.87 and US$620.82, across two distinct analyses. While some foresee continued order strength as a catalyst, your peers’ outlooks highlight the need to weigh both integration and margin risks when considering future performance.

Explore 2 other fair value estimates on Teledyne Technologies - why the stock might be worth as much as 18% more than the current price!

Build Your Own Teledyne Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teledyne Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teledyne Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teledyne Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives