Is Teledyne Technologies Fairly Priced After Imaging Segment Expansion in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Teledyne Technologies stock right now? You're definitely not alone. After all, the company has caught plenty of attention from investors watching it climb 16.2% year-to-date, despite a recent cooling-off with the stock giving up 5.4% in the past week and 7.8% over the past month. Looking at the big picture, Teledyne’s long-term performance still impresses, up 13.4% over the last year and an even stronger 72.1% over five years.

What has been fueling these shifts? Investors have wrestled with reports of Teledyne expanding its high-performance digital imaging segment, as well as ongoing developments in aerospace and defense technology. While recent headlines have not dramatically moved the stock, they do provide relevant context for those watching the company’s growth potential and risk profile.

When it comes to valuation, Teledyne’s score is a 2 out of 6, indicating the company is undervalued by two key measures but may be considered pricey by others. Let’s break down exactly why those two checks matter, how analysts judge a stock’s true worth, and whether there is an even smarter way to size up Teledyne’s real value.

Teledyne Technologies scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Teledyne Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that projects a company’s future cash flows and discounts them back to today’s value. This helps estimate what Teledyne Technologies is truly worth, separate from short-term market swings.

Currently, Teledyne’s Free Cash Flow stands at $1.04 billion. Analyst projections, combined with extrapolations, suggest steady growth and estimate that annual free cash flow could reach $2.03 billion by 2035. While cash flows are forecasted directly by analysts for the next five years, projections beyond that use systematic growth rates to keep estimates grounded and realistic.

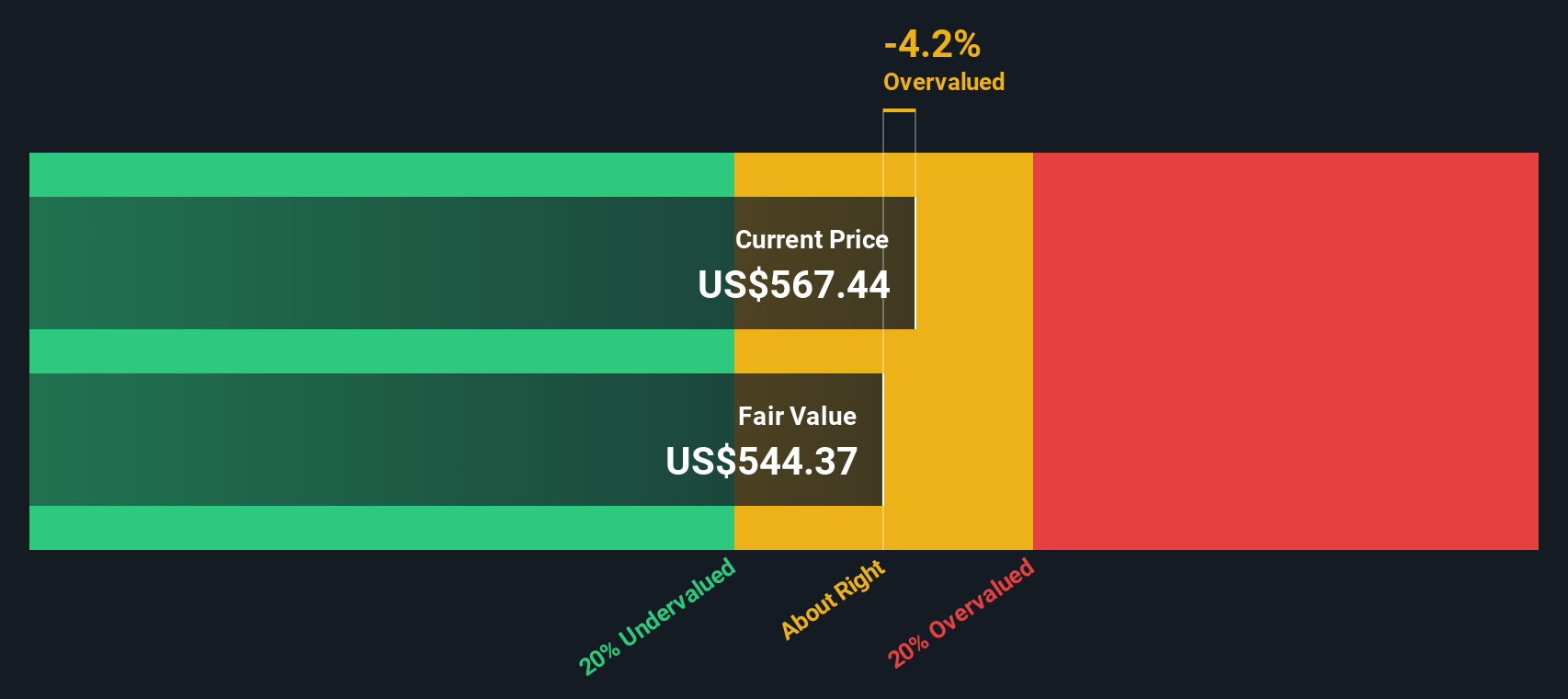

The output of this DCF model assigns an intrinsic value of $584.61 per share for Teledyne Technologies. Compared to the company’s current share price, this means the stock is trading at a 9.0% discount to its underlying value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Teledyne Technologies's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Teledyne Technologies Price vs Earnings

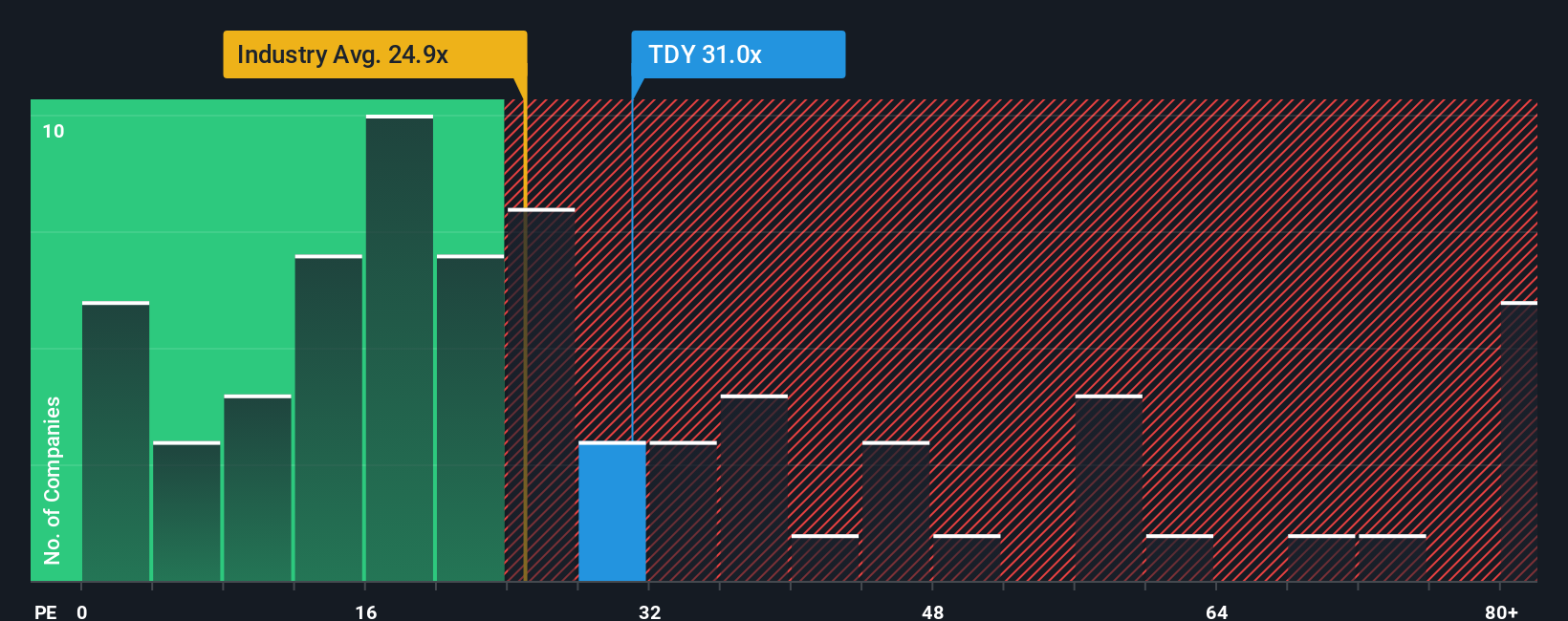

The price-to-earnings (PE) ratio is a popular tool for valuing profitable companies like Teledyne Technologies because it connects the current stock price to the company’s earnings power. Investors often look to the PE ratio to gauge how much they are paying for each dollar of earnings, making it a key measure for assessing whether a stock is attractively priced relative to its profits.

However, what counts as a "normal" or "fair" PE ratio relies on factors such as future growth expectations and business risks. Companies with stronger growth prospects or stable earnings can justify higher PE ratios while those facing uncertainty or slower expansion tend to see lower ones.

At the moment, Teledyne is trading at a PE ratio of 30.5x. This is above the electronic industry average of 25.5x but well below the average for its closest peers at 54.1x. While industry and peer comparisons provide helpful context, these numbers only tell part of the story.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Teledyne is 28.0x, calculated using a proprietary algorithm that accounts for the company’s expected earnings growth, profit margins, risk levels, industry group, and market capitalization. Unlike traditional comparisons, this approach moves beyond surface-level averages to factor in what makes Teledyne unique.

Comparing Teledyne’s current PE of 30.5x to its Fair Ratio of 28.0x suggests the stock is trading just a touch above where it "deserves" to be. The difference, though, is minor and indicates that Teledyne’s valuation is broadly in line with its underlying fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Teledyne Technologies Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives.

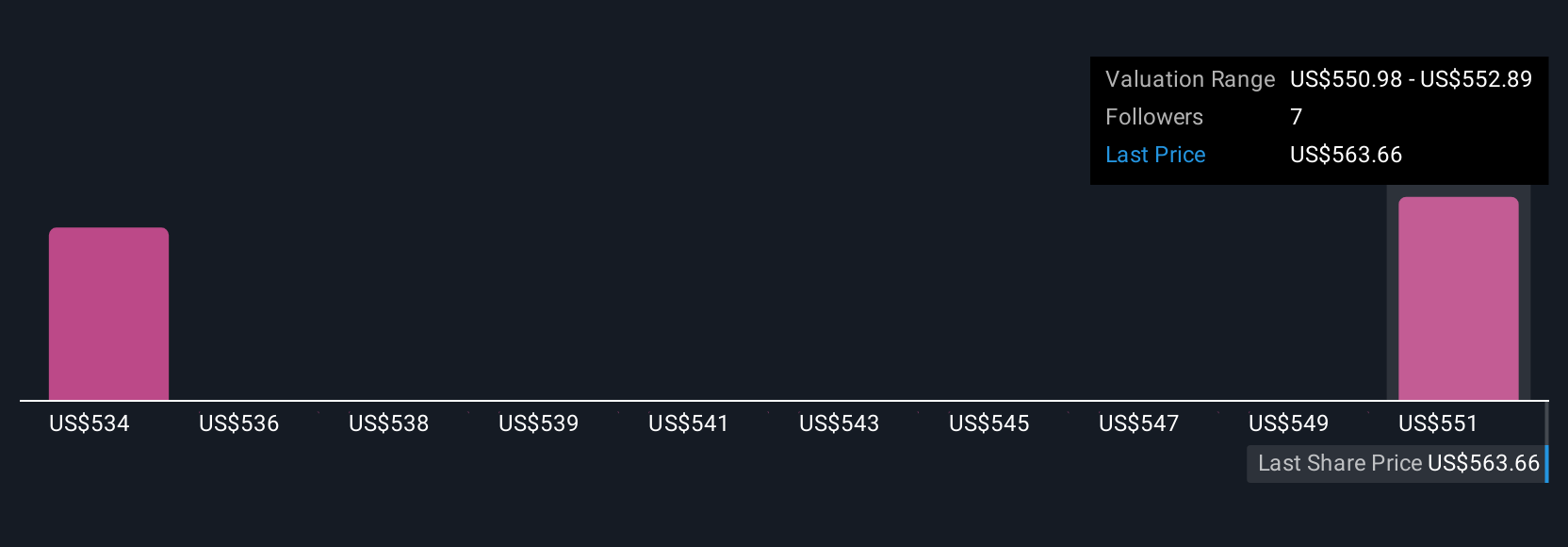

A Narrative is a simple yet powerful approach where you tell the story behind your view of a company like Teledyne Technologies, combining your assumptions about its future growth, earnings, and margins with a clear financial forecast and fair value estimate.

By crafting a Narrative, you connect the company’s business outlook, such as new products, market trends, management execution, and risks, to a projected valuation. This makes your investment decisions evidence-based rather than just reacting to short-term news or headline numbers.

Narratives are easily created and shared on Simply Wall St’s Community page, where millions of investors outline their perspectives, each linked to a fair value estimate. This lets you compare your own view to others and track how your story changes as new information comes in, like news or earnings releases.

The real power comes from comparing your Narrative’s fair value to Teledyne’s actual share price, helping you spot opportunities to buy, hold, or sell with confidence.

For example, one investor might see Teledyne’s focus on defense and high-margin products fueling robust future growth and assigns a fair value above $620. Another, worried about supply chain risks and cyclical trends, estimates a much lower fair value, demonstrating just how dynamic and personalized Narratives can be.

Do you think there's more to the story for Teledyne Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives