Is Teledyne a Smart Opportunity After 11.6% Drop and Fresh Aerospace Wins in 2025?

Reviewed by Bailey Pemberton

- Wondering if Teledyne Technologies is fairly valued or a hidden gem? You are not alone, especially if you follow stocks with strong long-term potential and quality fundamentals.

- Teledyne’s stock has shown resilience, edging up 10.4% year-to-date despite a recent dip of 11.6% over the past month that has caught some investors’ attention.

- Recent headlines highlight Teledyne’s continued investment in sensor and instrumentation technology, as well as high-profile contract wins that strengthen its position in the aerospace and defense market. These developments have added fresh optimism, helping to put recent price volatility in context.

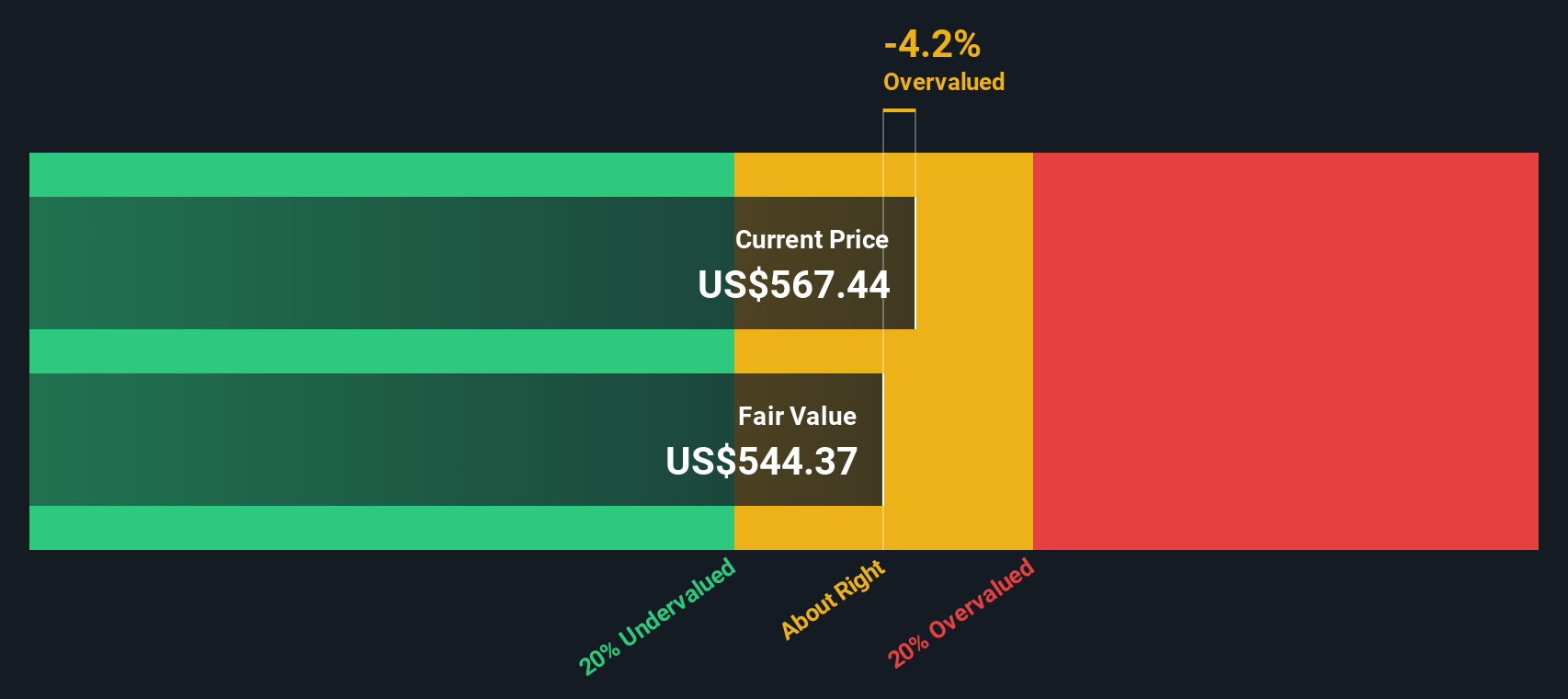

- When it comes to valuation, Teledyne scores a 3 out of 6 on our value checks, which means it passes half the tests for being undervalued. In a moment, we will review exactly how these valuation methods stack up, and we will wrap up with a more holistic approach to finding value that even seasoned investors might not have considered.

Find out why Teledyne Technologies's 6.1% return over the last year is lagging behind its peers.

Approach 1: Teledyne Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by forecasting future cash flows and discounting them back to today's dollars. This method helps investors focus on what truly matters: the cash a business will generate, adjusted for today’s value.

For Teledyne Technologies, the most recent twelve months have produced free cash flow of $1.04 billion. Analyst expectations extend out about five years, projecting annual free cash flow growth, with forecasts reaching $1.19 billion by 2026 and around $1.34 billion by 2027. After that, additional estimates are extrapolated by Simply Wall St and show free cash flow potentially rising as high as $2.05 billion by 2035, based on a gradual slowdown in growth rates as the company matures.

Discounting all these future cash flows back to today delivers an estimated intrinsic value of $584.36 per share. Compared to the current share price, this means Teledyne appears to be trading at a 13.5% discount, implying it is undervalued according to the DCF model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Teledyne Technologies is undervalued by 13.5%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

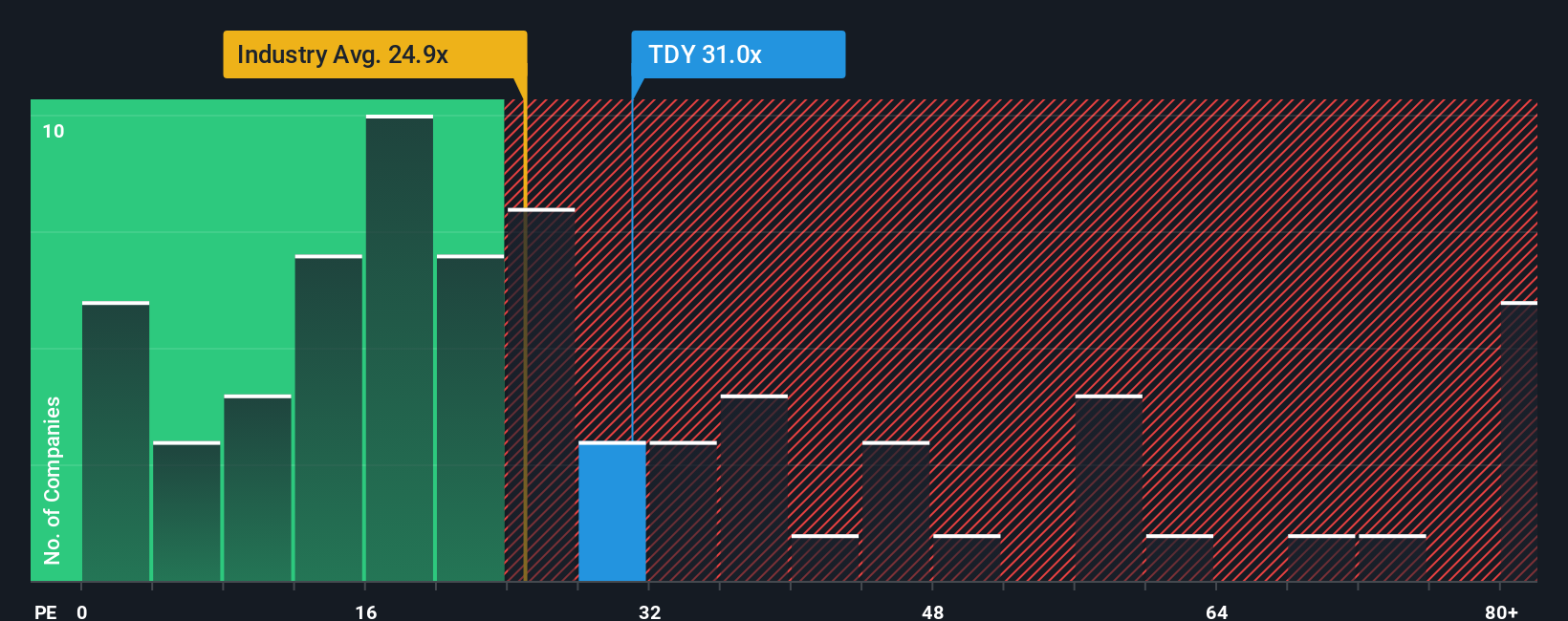

Approach 2: Teledyne Technologies Price vs Earnings

When analyzing profitable companies like Teledyne Technologies, the Price-to-Earnings (PE) ratio is a widely used metric because it connects a company’s share price to its earnings, giving investors a sense of how much they are paying for profit today. It is especially relevant for steady, earnings-generating firms in mature sectors.

Growth outlook and company-specific risks both heavily influence what qualifies as a “fair” PE ratio in the market. In general, higher earnings growth or lower risk often justifies a higher PE, while companies with stagnating profits or higher perceived risk will trade at a discount.

Currently, Teledyne trades at a PE ratio of 29x. By comparison, its electronic industry peers average a lower 23.9x and the peer set’s average is significantly higher at 46x. Beyond these benchmarks, Simply Wall St provides a proprietary “Fair Ratio,” designed to reflect just what Teledyne deserves based on growth outlook, profitability, market cap, and risk factors. For Teledyne, that Fair Ratio is 26x.

The Fair Ratio is more insightful than peer or industry comparisons alone, as it blends objective metrics, including expected growth and risk profile, into a single, actionable number tailored to the company’s unique situation. This customized approach is especially useful for companies that may not mirror the average risk or performance of their sector.

With Teledyne’s current PE of 29x sitting just above the 26x Fair Ratio, the stock appears a bit more expensive than what its fundamentals would suggest, but not excessively so. The difference between actual and fair is 3x, which indicates a modest premium.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

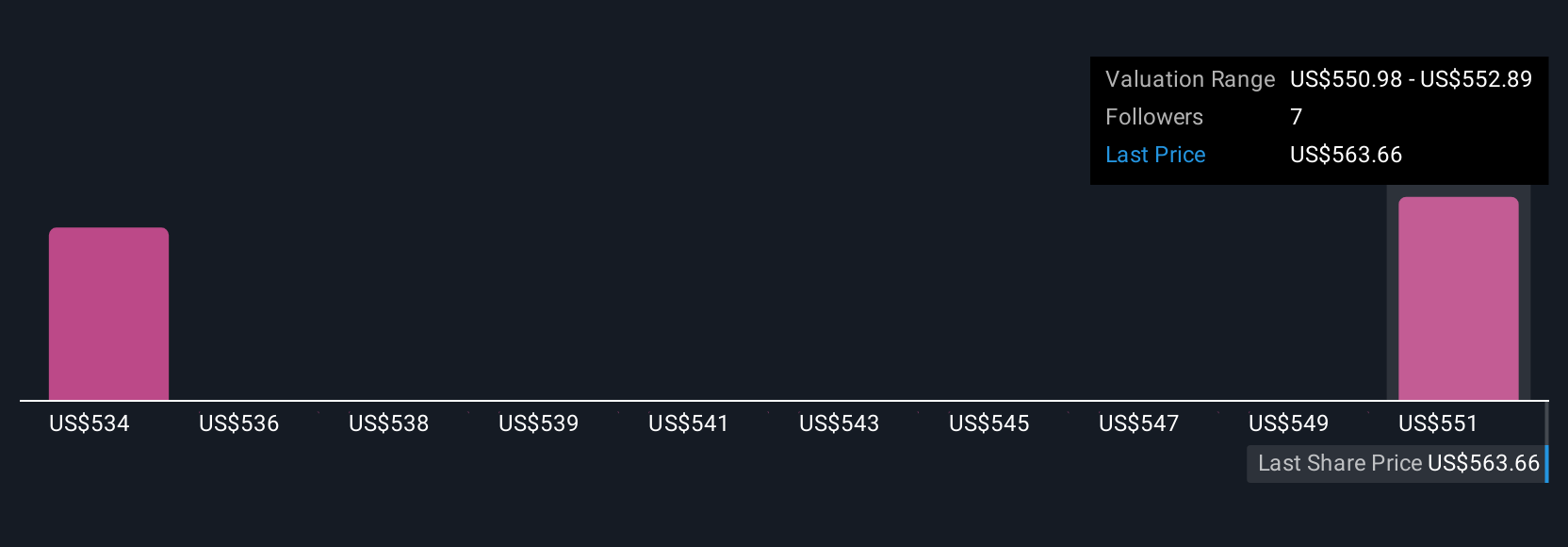

Upgrade Your Decision Making: Choose your Teledyne Technologies Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, structured way for investors to explain their personal perspective or story on a company, linking together their assumptions for future revenue, earnings, and margins to reach an estimated fair value. Instead of relying solely on standard financial ratios or analysts’ models, Narratives help you create and clearly see your own investment thesis by tying the company’s story to its actual numbers and the price you think it is worth.

This approach is not just for professionals. On Simply Wall St’s Community page, millions of investors can easily build, share, and update Narratives. Narratives compare the fair value you calculate against the real share price, helping you decide if it is time to buy more, take profits, or wait on the sidelines. When news or earnings come in, Narratives adjust dynamically, so your story for Teledyne Technologies is always up to date.

For example, one investor may build a bullish Narrative for Teledyne based on robust defense demand and margin expansion and estimate fair value near the highest analyst target ($621). Another could focus on slowing organic sales and macro risks, projecting value toward the lower end. Both perspectives are instantly visualized, helping you see where you agree or differ with the crowd.

Do you think there's more to the story for Teledyne Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives