Did Teledyne's (TDY) Upbeat Guidance and $2B Buyback Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- In late July 2025, Teledyne Technologies reported increased quarterly sales and net income, raised its full-year earnings forecast, and unveiled a new US$2 billion share repurchase program, alongside the launch of an advanced DDR4-3200 memory module from Teledyne HiRel Semiconductors.

- This combination of robust financial results, management’s raised guidance, and expanded capital allocation signals ongoing confidence in Teledyne’s business outlook and operational progress.

- Now, we'll examine how Teledyne's upbeat earnings guidance and buyback program update shape its investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

Teledyne Technologies Investment Narrative Recap

Shareholders of Teledyne Technologies need to believe in the company’s ability to deliver consistent earnings growth through innovation and disciplined capital allocation, particularly as defense spending and demand for embedded electronics remain key drivers. The recent quarterly results and raised earnings outlook reinforce the near-term catalyst of solid order momentum; however, pressure on free cash flow and margin trends in newly acquired businesses remain the most important risks. The impact of the latest announcements on these risks and catalysts appears supportive, but not materially transformative.

The most relevant announcement is Teledyne’s decision to launch a new US$2 billion share repurchase program. This move comes alongside improved full-year earnings guidance, reflecting management’s confidence in sustainable earnings quality and balance sheet strength. For investors tracking catalysts, continued buybacks may signal a focus on shareholder returns and capital discipline.

On the flip side, investors should be mindful of Teledyne’s recent decline in free cash flow and whether margin pressures in acquired segments will persist…

Read the full narrative on Teledyne Technologies (it's free!)

Teledyne Technologies' outlook anticipates $6.9 billion in revenue and $1.1 billion in earnings by 2028. This scenario is based on a projected 5.3% annual revenue growth and an earnings increase of $241 million from current earnings of $859 million.

Uncover how Teledyne Technologies' forecasts yield a $608.90 fair value, a 10% upside to its current price.

Exploring Other Perspectives

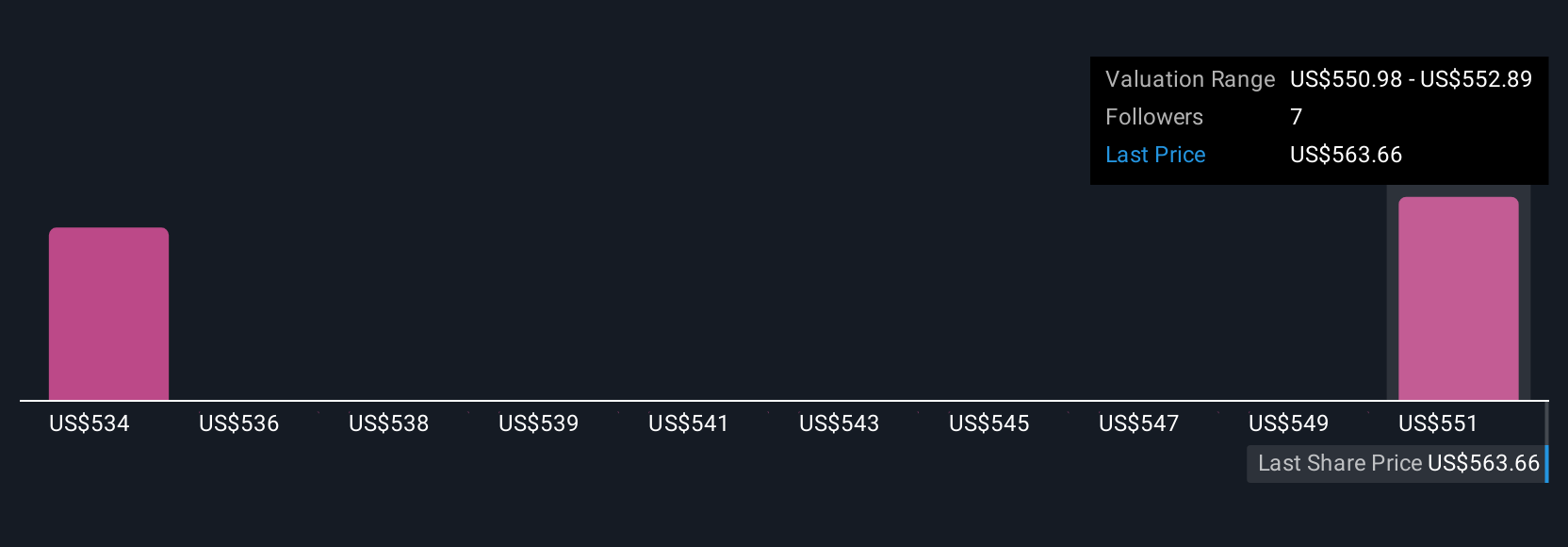

Simply Wall St Community members provided just 2 fair value estimates for TDY, ranging from US$580.70 to US$608.90 per share. With margin trends in acquired segments presenting ongoing uncertainty, these diverse views remind you to explore several contrasting outlooks before making decisions.

Explore 2 other fair value estimates on Teledyne Technologies - why the stock might be worth just $580.70!

Build Your Own Teledyne Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teledyne Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teledyne Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teledyne Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives