- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Will Pure Storage's (PSTG) New Revenue Chief Reshape Its Enterprise Sales Ambitions?

Reviewed by Sasha Jovanovic

- Pure Storage announced the appointment of Patrick Finn as Chief Revenue Officer, who brings decades of sales leadership experience from technology companies including Cloudflare, Iron Mountain, and Cisco.

- Finn's hire comes as the company aims to advance its global sales and channel strategy amid a backdrop of increasing enterprise cloud adoption and evolving storage market demands.

- We'll explore how this executive transition, especially Finn's background in cloud and enterprise sales, could influence Pure Storage's long-term business outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Pure Storage Investment Narrative Recap

Owning Pure Storage means believing in a future where the shift to cloud-native solutions and growing enterprise data needs are long-term value drivers. The recent appointment of Patrick Finn as Chief Revenue Officer introduces leadership strength, but does not materially affect the most immediate catalyst, momentum in subscription-based revenue, or the persistent risk tied to accurately forecasting product versus recurring sales mix, which continues to impact revenue predictability.

Of the company’s recent activities, its expanded guidance for fiscal 2026 revenue, now projecting US$3.60 billion to US$3.63 billion, stands out. This updated outlook reinforces growth expectations amid market shifts, and aligns with Finn’s responsibility to drive global sales execution, directly connecting leadership transitions with near-term performance catalysts.

Yet, despite Pure Storage’s high growth ambitions, investors should weigh the challenge of managing its as-a-service and product revenue balance…

Read the full narrative on Pure Storage (it's free!)

Pure Storage's narrative projects $5.1 billion in revenue and $571.5 million in earnings by 2028. This requires 15.2% yearly revenue growth and a $432.3 million increase in earnings from $139.2 million today.

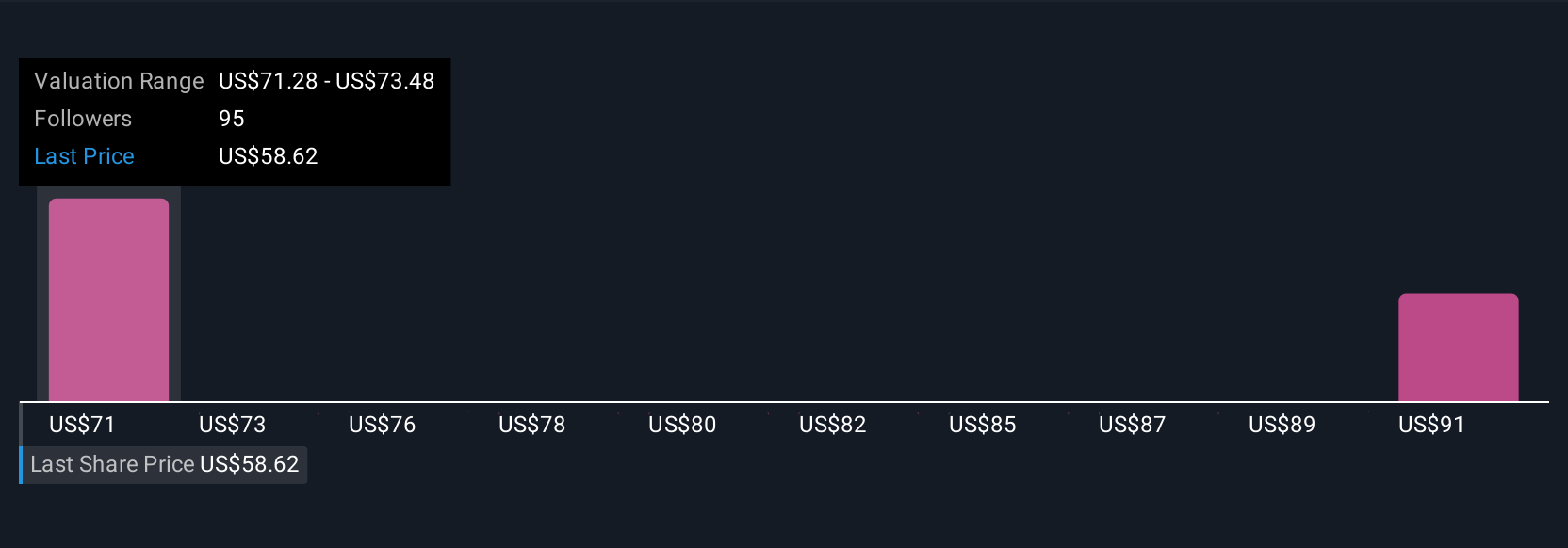

Uncover how Pure Storage's forecasts yield a $89.39 fair value, a 6% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community estimates fair value for Pure Storage between US$89.34 and US$101.26, based on four independent analyses. While opinions differ, many focus on the upside from enterprise data cloud adoption and recurring revenue growth as key performance indicators.

Explore 4 other fair value estimates on Pure Storage - why the stock might be worth just $89.34!

Build Your Own Pure Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pure Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pure Storage's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives