- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Why Pure Storage (PSTG) Is Up 8.9% After Launching Cloud Platform and Integrating with Azure

Reviewed by Sasha Jovanovic

- In late September 2025, Pure Storage announced significant enhancements to its platform, including the launch of Pure Storage Cloud, expanded AI-powered management tools, and integration with Microsoft Azure for easier migration and unified data management across hybrid and public cloud environments.

- This marks a material step forward in enabling enterprises to boost cyber resilience and empower AI applications through seamless, policy-driven access to data wherever it resides.

- We'll explore how Pure Storage's expansion into Azure Native cloud services could reshape its investment narrative and long-term growth outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Pure Storage Investment Narrative Recap

For Pure Storage shareholders, conviction hinges on the company's shift from traditional storage to software-driven, cloud-native services capable of capitalizing on strong AI and cloud infrastructure demand. The recent launch of Pure Storage Cloud and deep Azure integration may accelerate enterprise cloud migration, enhancing near-term revenue catalysts, yet lingering uncertainty remains over Pure's ability to consistently forecast and grow recurring revenues in step with elevated R&D investment, this remains the principal risk even after the news. Among recent announcements, the unveiling of Pure Storage Cloud as an Azure Native service directly aligns with the company’s cloud-first ambitions. This integration can help enterprises manage large-scale AI workloads more efficiently, supporting the growing demand for unified data infrastructure, an immediate catalyst to watch in the context of rising hyperscaler partnerships and subscription revenue momentum. However, investors should be aware that even with recent progress, the risk around the predictability of recurring revenue remains...

Read the full narrative on Pure Storage (it's free!)

Pure Storage's narrative projects $5.1 billion in revenue and $571.5 million in earnings by 2028. This requires 15.2% yearly revenue growth and a $432.3 million increase in earnings from $139.2 million today.

Uncover how Pure Storage's forecasts yield a $80.22 fair value, a 11% downside to its current price.

Exploring Other Perspectives

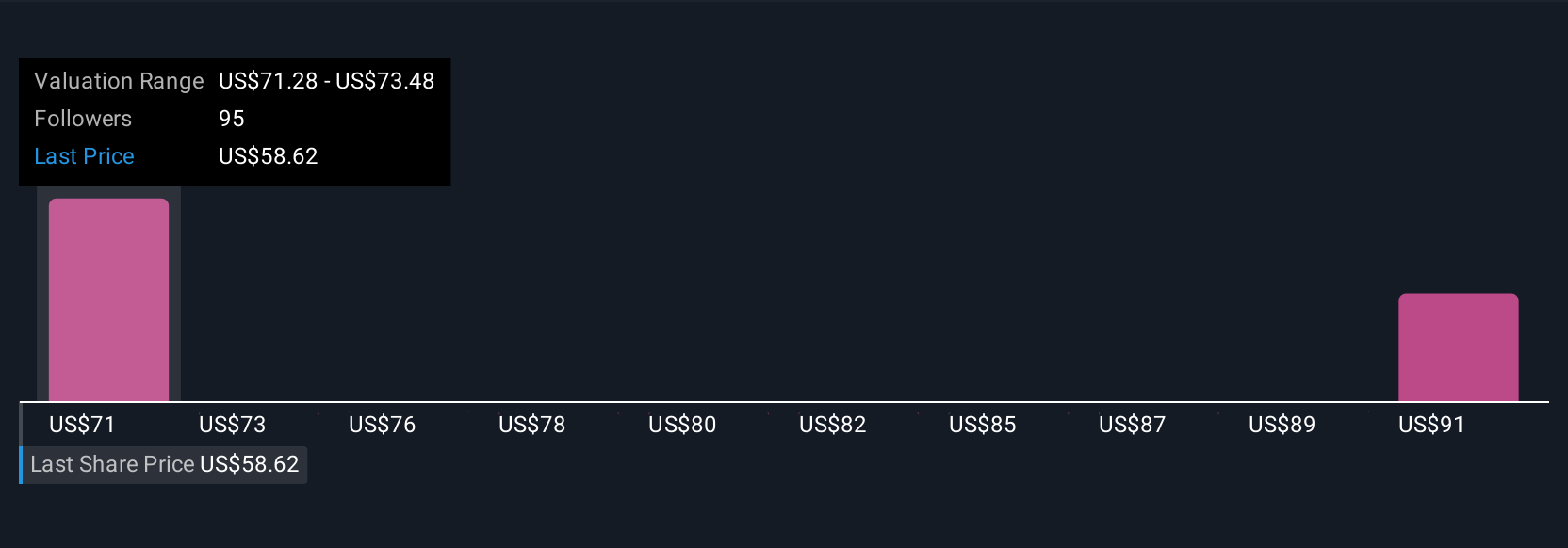

Four fair value estimates from the Simply Wall St Community place Pure Storage between US$80.22 and US$102.82, highlighting considerable differences in individual outlooks. With recurring revenue growth still facing forecasting challenges, you can examine how these varying perspectives reflect broader uncertainty about the company’s future performance.

Explore 4 other fair value estimates on Pure Storage - why the stock might be worth as much as 14% more than the current price!

Build Your Own Pure Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pure Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pure Storage's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion