- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (PSTG): Valuation Check After Expanding Its Share Buyback to $900 Million

Reviewed by Simply Wall St

Why Pure Storage’s Expanded Buyback Matters Now

Pure Storage (PSTG) just completed a 2.5% share repurchase and simultaneously boosted its buyback authorization to $900 million, a clear signal that management sees value in the current share price.

See our latest analysis for Pure Storage.

The bigger backdrop is that the share price has slipped in recent weeks, with a 30 day share price return of minus 18.17 percent and a 90 day share price return of minus 23.68 percent. Even though the 3 year total shareholder return of 151.63 percent shows long term momentum remains firmly positive, this expanded buyback looks like management leaning into temporary weakness rather than backing away at a share price of 67.06 dollars.

If Pure Storage’s pullback has you scanning the rest of the sector, it could be a good moment to explore other high growth tech and AI names via high growth tech and AI stocks.

With the share price down double digits while revenue and earnings keep climbing, and with analyst targets and intrinsic value models still pointing higher, is Pure Storage now trading below its true potential, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 29.5% Undervalued

Against Pure Storage’s last close of 67.06 dollars, the most followed narrative argues for a materially higher fair value anchored in AI driven growth.

The adoption of Pure's Enterprise Data Cloud architecture and software defined solutions is accelerating among large enterprises, driven by the need to manage rapidly growing and increasingly valuable data assets in the evolving AI economy; this positions Pure to capture rising long term revenue from digital transformation and AI/ML driven workloads.

Want to see why this vision supports a meaningfully higher price tag? The story refers to revenue momentum, expanding margins, and a bold profit multiple. Curious what assumptions make that math work? Step inside the full narrative to review the forecasts behind this fair value estimate.

Result: Fair Value of $95.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still hinges on deeper hyperscaler traction and a smooth shift to higher margin cloud services, both of which remain uncertain.

Find out about the key risks to this Pure Storage narrative.

Another Lens on Valuation

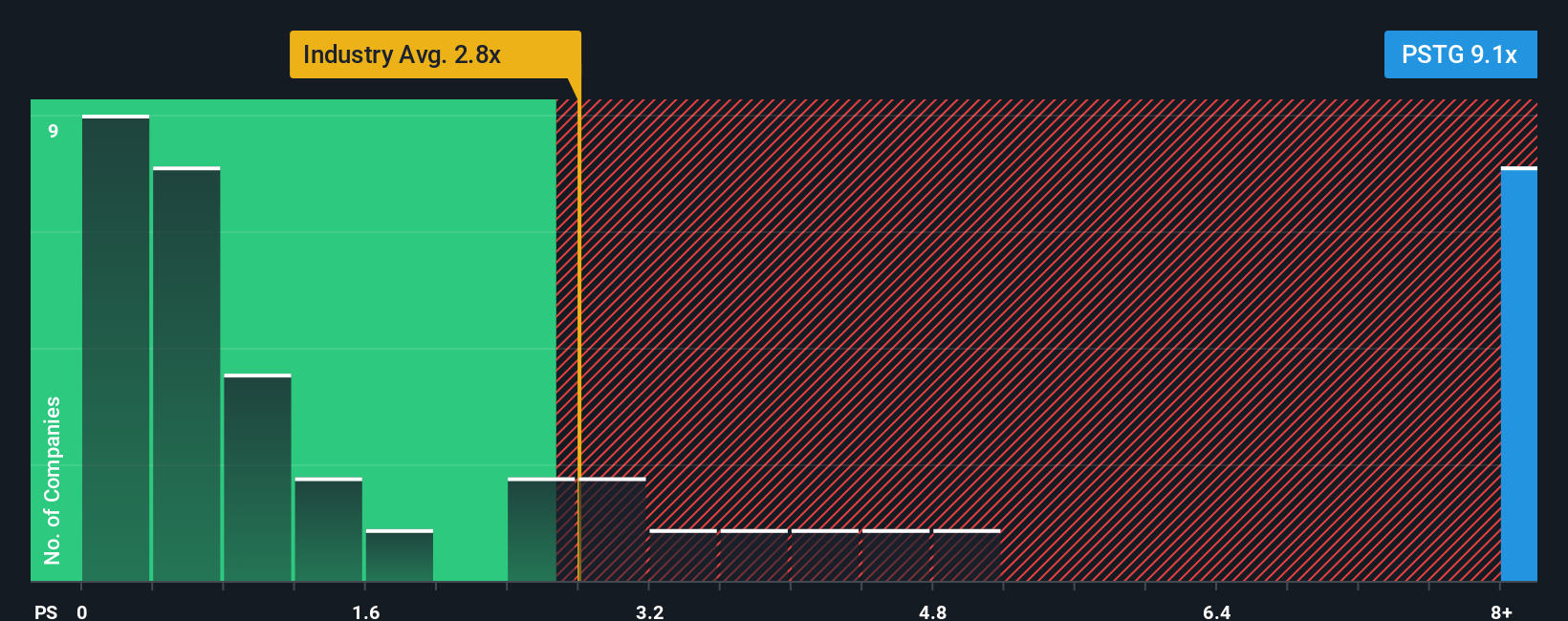

While the popular narrative sees Pure Storage as roughly 29.5 percent undervalued, the market is sending a very different signal when you look at sales based pricing. The stock trades on a 6.4 times price to sales ratio versus 2.2 times for peers and 1.5 times for the wider US tech sector, a sharp premium that bakes in a lot of future success.

Yet our fair ratio analysis suggests the market could eventually justify something closer to 11.7 times sales if Pure keeps compounding revenue and margins. That would turn today’s rich looking multiple into a possible opportunity rather than a warning sign. The question is whether this represents a rerating in progress or enthusiasm getting ahead of execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pure Storage Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your Pure Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now to broaden your opportunity set, and use the Simply Wall St screener to uncover focused stock ideas before the crowd catches on and prices them in.

- Capitalize on mispriced quality by scanning these 917 undervalued stocks based on cash flows that pair solid fundamentals with attractive upside potential.

- Target cutting edge innovation with these 24 AI penny stocks shaping the next wave of automation, data intelligence, and productivity gains.

- Strengthen your income stream through these 13 dividend stocks with yields > 3% that combine meaningful yields with the backing of established businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion