- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (PSTG): Evaluating Valuation After Recent Resilience in Share Price

Reviewed by Simply Wall St

See our latest analysis for Pure Storage.

While Pure Storage’s share price has pulled back about 8.6% over the past month, the stock’s latest 1-day gain adds to what has been a strong stretch. Momentum remains very much intact, with total shareholder returns reaching an impressive 75% over the past year and more than 170% for three years.

Curious to see what other high-potential tech names are making waves lately? Now’s a great time to check out the See the full list for free..

But with shares not far from analyst price targets and strong gains already in the rearview, investors are left to wonder: Is Pure Storage undervalued at these levels, or is future growth already fully reflected?

Most Popular Narrative: 5% Undervalued

Pure Storage’s most-followed valuation narrative places its fair value above the most recent close, suggesting some upside remains even after strong recent gains. This opens the door for a deeper look at how the market is weighing the company’s rapidly evolving fundamentals.

The adoption of Pure's Enterprise Data Cloud architecture and software-defined solutions is accelerating among large enterprises, driven by the need to manage rapidly growing and increasingly valuable data assets in the evolving AI economy. This positions Pure to capture rising long-term revenue from digital transformation and AI/ML-driven workloads. Strategic wins and expanding co-engineering relationships with hyperscalers (e.g., Meta) are creating new high-margin royalty and software revenue streams, and ongoing early-stage engagements with additional hyperscalers signal potential for material upside to revenue and gross margin as cloud infrastructure investments scale.

Want to know what’s fueling this premium? The narrative’s valuation hinges on bolder growth targets and margin jumps as AI-driven demand accelerates. Ready to dig into the numbers and discover which bullish financial forecasts shape the fair value calculation? Find out what could give Pure Storage its edge.

Result: Fair Value of $89.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty around hyperscale contract wins and the challenge of transitioning to scalable cloud-native services could threaten Pure Storage’s bullish narrative.

Find out about the key risks to this Pure Storage narrative.

Another View: What Do the Multiples Say?

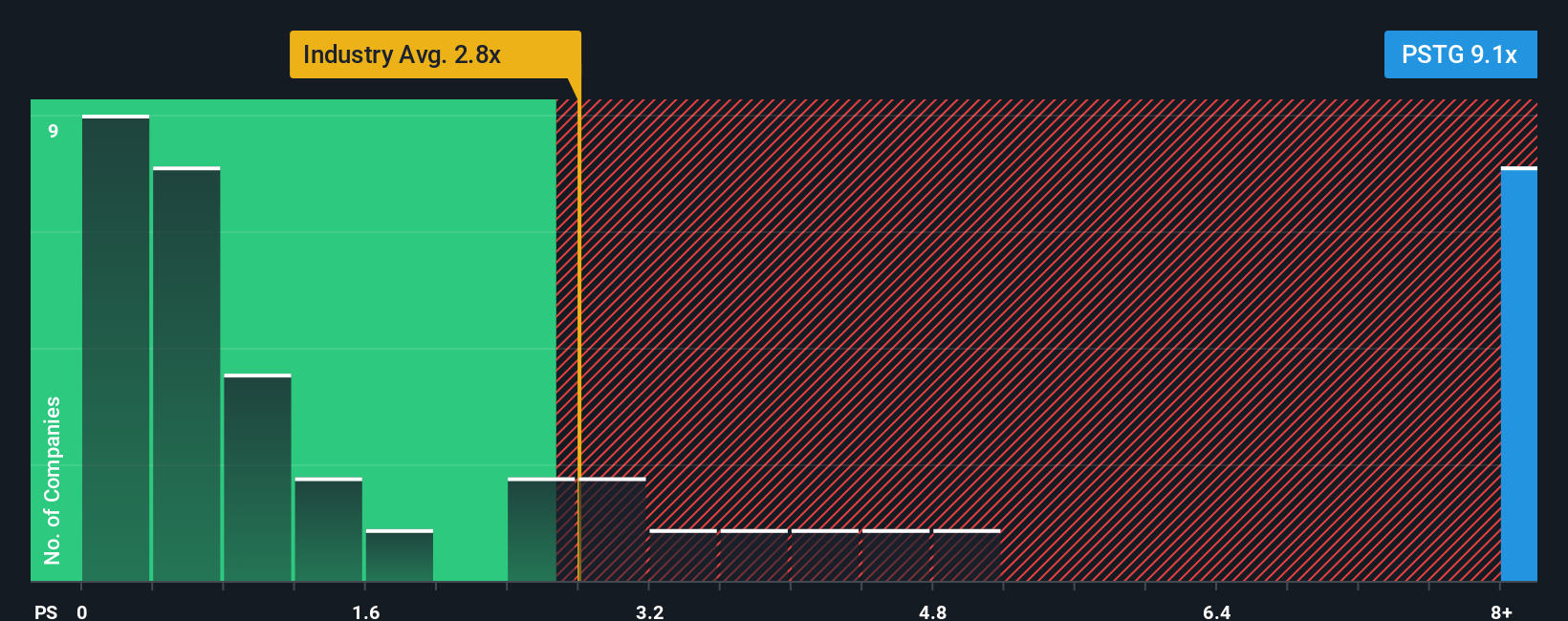

Looking beyond fair value estimates, Pure Storage trades at an 8.3x price-to-sales ratio, which is much higher than both the US Tech industry average of 1.9x and its closest peers at 2.4x. However, our fair ratio model points to a value closer to 13.4x, suggesting the stock isn’t as expensive as it first seems. This could also indicate that the broader market may eventually catch up. Does this premium reflect justified optimism, or does it add a risk if momentum slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pure Storage Narrative

If you have your own take or want to dig deeper into the numbers, you can build your own Pure Storage narrative in just a few minutes. Do it your way

A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay ahead and uncover hidden gems, don’t miss these unique stock ideas handpicked for smart investors ready to make bold moves.

- Catch rising trends in artificial intelligence companies by checking out these 25 AI penny stocks that are setting the pace for tomorrow’s innovations.

- Boost your portfolio’s yield by tapping into these 16 dividend stocks with yields > 3% with payouts above 3% for income-focused strategies.

- Seize rare opportunities in undervalued businesses by reviewing these 879 undervalued stocks based on cash flows. Your next potential winner could be waiting.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives