- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (NYSE:PSTG) Projects US$3.5 Billion Revenue For Fiscal 2026 Amid CFO Departure

Reviewed by Simply Wall St

Pure Storage (NYSE:PSTG) recently announced its first-quarter results, revealing a substantial improvement with reduced net losses and increased revenue, setting positive guidance for the future. This financial upswing coincided with a remarkable monthly stock price increase of 22%. The company also faced leadership shifts as CFO Kevan Krysler announced his departure, while collaborations with industry leaders like SK hynix and Nutanix highlighted its strategic partnerships. These developments possibly contributed to the stock's performance, amplified by the tech sector's rally following Nvidia's robust earnings, even as broader markets remained mixed.

Buy, Hold or Sell Pure Storage? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments at Pure Storage, including its strategic partnerships and leadership changes, could significantly influence its market trajectory. Collaborations with SK hynix and Nutanix may bolster operational capabilities and extend market reach, potentially enhancing revenue growth trajectories. Despite immediate fluctuations, Pure Storage's long-term total shareholder returns have shown exceptional growth over the past five years with a 219.47% increase, offering a stark contrast to its 1-year underperformance relative to the US Tech industry, which returned 4%.

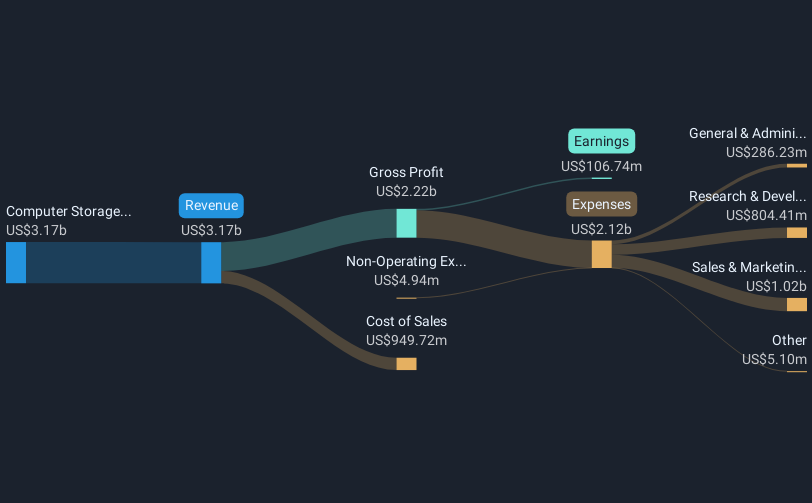

The financial upswing reported in Pure Storage's first-quarter results and positive future guidance are key indicators impacting revenue and earnings forecasts. With revenue at approximately $3.17 billion and earnings of $106.74 million, the potential design win with a top hyperscaler and initiatives like the expansion of the E family and launch of the 150-terabyte DirectFlash module could position the company for heightened revenue and margin growth amid growing AI demands. Analyst price targets, with a consensus fair value of US$69.16, indicate a 29% upside from the current share price of US$47.58, suggesting investor optimism about the company's future prospects, albeit with recognition of broader market challenges and competitive pressures.

Gain insights into Pure Storage's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives