- United States

- /

- Communications

- /

- NYSE:MSI

Could Motorola Solutions’ (MSI) New AI Transparency Labels Shape Trust in Public Safety Technology?

Reviewed by Simply Wall St

- In the past week, Motorola Solutions introduced 'AI nutrition labels' for its safety and security technologies, providing detailed transparency about AI usage, data ownership, human controls, and the specific application of AI in each product.

- This pioneering approach in the safety and enterprise security sector aims to build greater customer trust and understanding of AI's role within Motorola's ecosystem.

- We'll explore how this new transparency initiative could reinforce Motorola Solutions’ leadership in AI-driven public safety technologies.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Motorola Solutions Investment Narrative Recap

To be a shareholder of Motorola Solutions, you need to believe in the company's leading role in public safety technology and its focus on AI-driven growth, especially in software and services. The introduction of AI nutrition labels aims to strengthen customer trust and market reputation, but as of now, this move does not materially alter the most immediate catalysts, like software adoption, or address key risks such as potential margin pressure from rising tariffs and a shrinking order backlog.

Among recent announcements, the $750 million delayed-draw term loan to fund the Silvus Technologies acquisition is particularly relevant. This type of acquisition-related financing underscores how Motorola is positioning itself to expand its capabilities in wireless and communication technologies, directly tied to its long-term growth strategy centered on software, cloud, and AI solutions.

However, in contrast, investors should be aware that margin pressures from tariff-related costs could impact earnings if not successfully managed...

Read the full narrative on Motorola Solutions (it's free!)

Motorola Solutions' outlook anticipates $13.0 billion in revenue and $2.7 billion in earnings by 2028. This reflects a 5.9% annual revenue growth rate and a $0.7 billion increase in earnings from the current $2.0 billion.

Uncover how Motorola Solutions' forecasts yield a $493.31 fair value, a 14% upside to its current price.

Exploring Other Perspectives

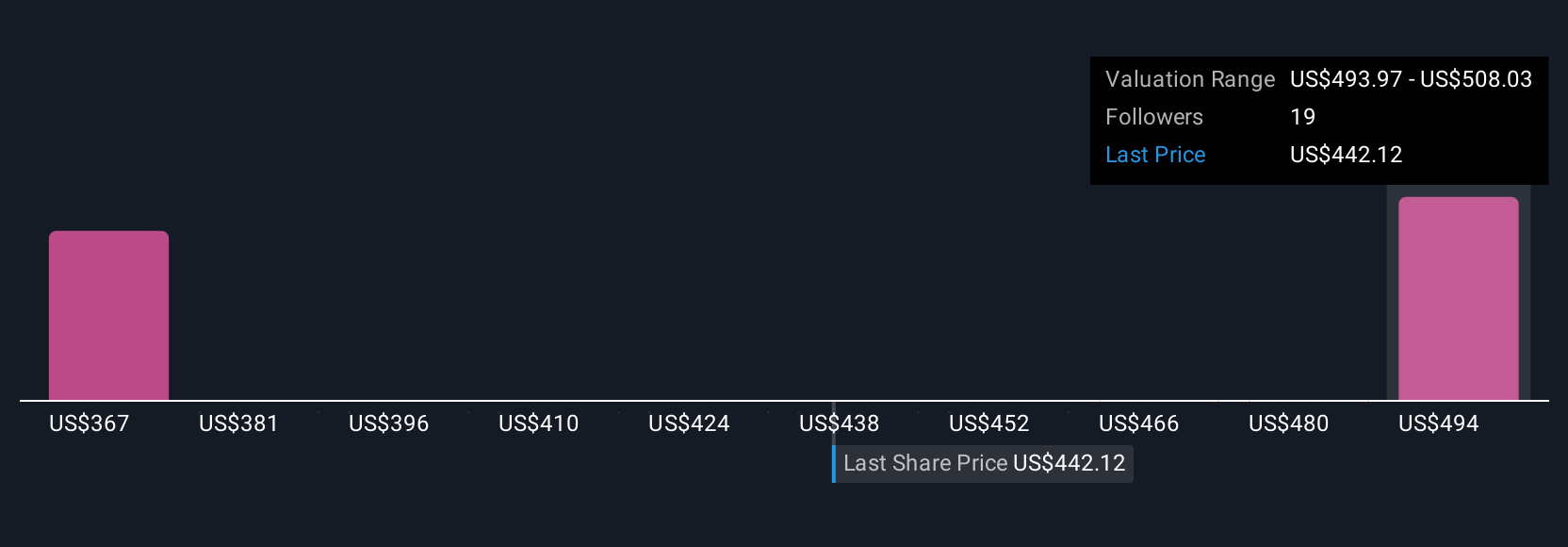

Five fair value estimates from the Simply Wall St Community for Motorola Solutions range from US$393.85 to US$508.03 per share. While many see opportunity in the company's AI and software focus, differences in outlook reflect ongoing concerns about rising costs and future revenue streams, see how other investors weigh these factors in their analysis.

Explore 5 other fair value estimates on Motorola Solutions - why the stock might be worth as much as 17% more than the current price!

Build Your Own Motorola Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Motorola Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Motorola Solutions' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives