- United States

- /

- Communications

- /

- NYSE:MSI

Assessing Motorola Solutions After Public Safety Expansion and a 28% Gap to Fair Value

Reviewed by Bailey Pemberton

Thinking about what’s next for Motorola Solutions stock? You’re not alone. With shares recently closing at $438.98, investors are trying to determine whether it’s time to double down or take some gains off the table. Over the past year, the stock has drifted lower, down 4.1%, and it has shed 4.4% year-to-date. Even the shorter-term moves have been a bit uninspiring, with a 3.8% slip in the last month and a 1.4% dip over the past week. However, not everything is as quiet as it seems. Zoom out a little and you’ll see a long-term rally most investors would envy, with shares up an impressive 81.5% over three years and a staggering 195.4% in five.

Behind these numbers, Motorola Solutions has been active on several fronts. Recent headlines point to the company expanding its public safety ecosystem, forging partnerships to broaden its software offerings, and investing in next-generation communication systems for critical services. These are shaping how investors view risk and opportunity around Motorola today, even if some of these strategic moves take time to play out in the company’s share price.

On valuation, Motorola currently picks up a score of 1 out of 6 checks for being undervalued, a sign that the market may be pricing in much of its growth and quality already. But traditional metrics never tell the whole story. Up next, we’ll dive into the details of how Motorola stacks up using several common valuation approaches and tease out a smarter way to think about what it’s really worth.

Motorola Solutions scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Motorola Solutions Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to present-day dollars to reflect their current worth. This method focuses on the company’s ability to generate cash into the future and weighs that against today’s investment.

For Motorola Solutions, the DCF model begins with the company’s latest reported Free Cash Flow of $2.35 billion. Analyst projections suggest this annual cash flow will rise, reaching $3.25 billion by 2029. While analysts provide estimates for up to five years out, projections beyond that, covering up to 2035, are extrapolated. This two-stage DCF approach attempts to balance near-term forecasts with anticipated long-term trends in the business.

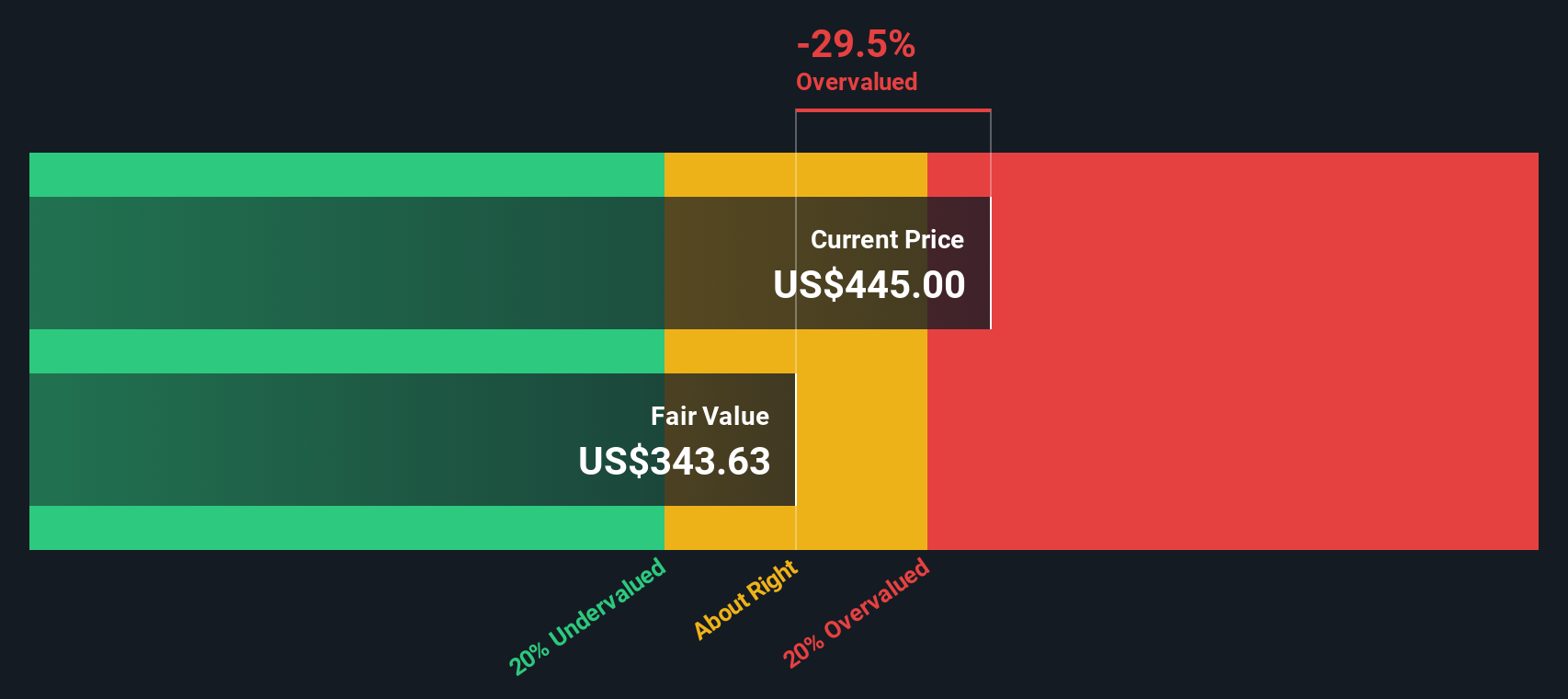

The outcome is that Simply Wall St calculates an intrinsic value of $342.91 per share for Motorola Solutions using the DCF method. Considering the current share price of $438.98, this suggests the stock is trading roughly 28.0% above its estimated fair value. In DCF terms, this means the stock appears notably overvalued today, given current assumptions and forecasts.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Motorola Solutions may be overvalued by 28.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Motorola Solutions Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for evaluating profitable companies like Motorola Solutions because it directly ties the company’s valuation to its earnings power. For investors, PE ratios help gauge whether a stock’s price is justified given its current and expected profitability.

In practice, the "right" PE ratio for a company can differ based on how quickly it is expected to grow and the risks it faces. Higher growth rates and strong profitability can warrant higher PE multiples, whereas elevated risks or weaker growth may justify lower ones.

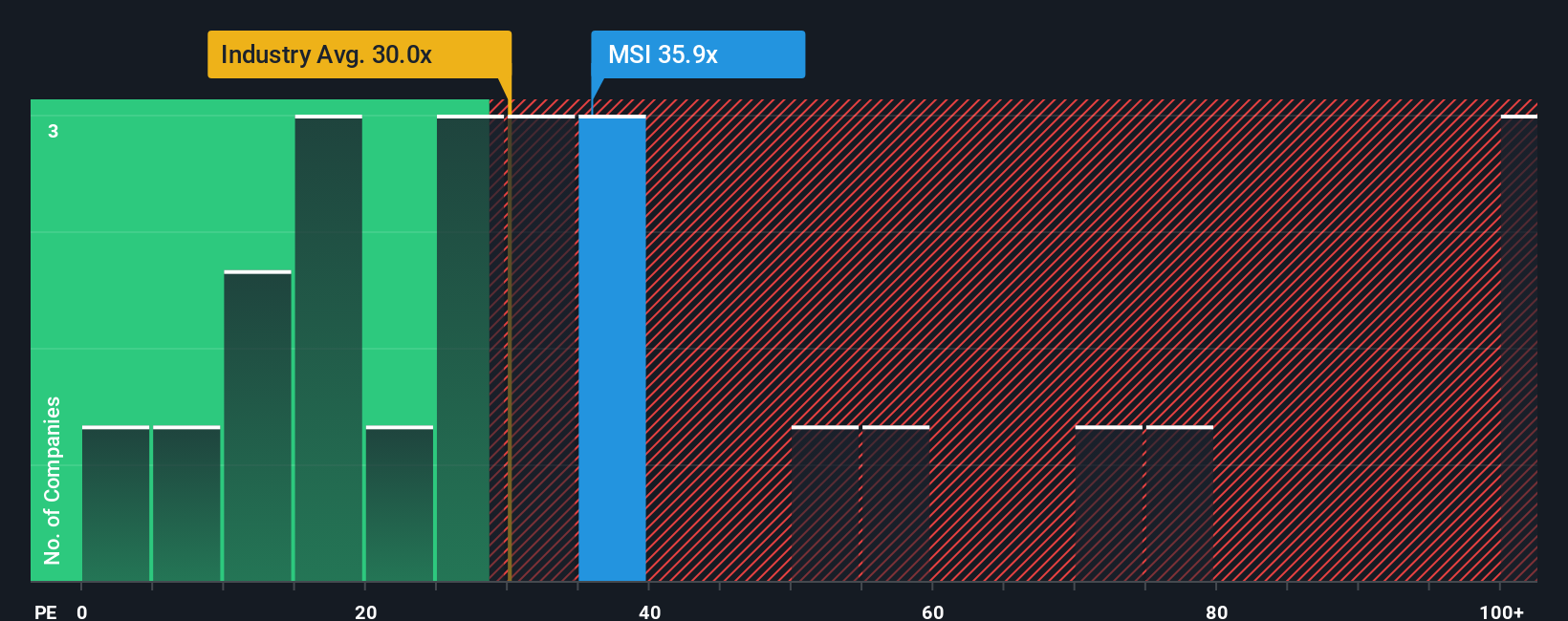

Motorola Solutions is currently trading at a PE ratio of 34.6x. To put this in perspective, the average PE for the Communications industry sits at 30.6x. Peers on average trade at a much higher 82.2x. On the surface, Motorola’s multiple suggests a premium to the sector, but it is much lower than some competitors.

Simply Wall St’s proprietary Fair Ratio offers a more tailored benchmark. It estimates that, given Motorola Solutions’ specific growth profile, risk factors, market cap, and financial health, a fair PE for the stock should be 29.4x. This approach improves upon peer or industry averages because it adjusts for what makes Motorola unique, rather than offering a one-size-fits-all comparison.

With Motorola trading at 34.6x earnings versus a fair ratio of 29.4x, the stock appears somewhat expensive on this measure and is likely pricing in a bit more optimism than its fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Motorola Solutions Narrative

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives: a Narrative is your unique story or perspective about Motorola Solutions, combining your own expectations for its future revenue, earnings, and profit margins into a financial forecast that leads directly to your personalized fair value estimate.

Narratives make investing more intuitive by tying together what you believe the company’s future will look like, how that translates into numbers, and how those numbers compare to the current share price. This approach can help you decide when to buy or sell, instead of relying solely on historic metrics. On Simply Wall St’s Community page, millions of investors are creating and updating Narratives that automatically reflect new events, earnings, and news, ensuring each story remains up to date and actionable.

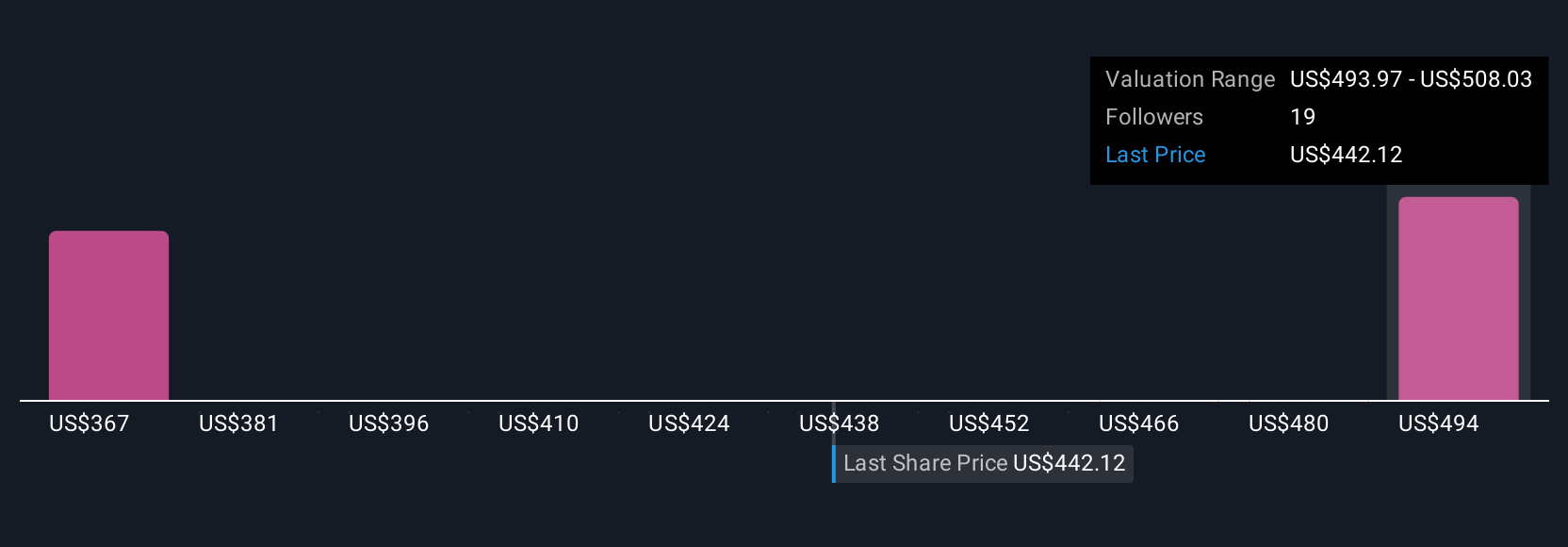

For example, some investors may see Motorola Solutions as an AI and smart city powerhouse, forecasting aggressive growth and a fair value above $500. Others focus on competitive risks and margin pressures, setting their fair value closer to $340. This demonstrates that your Narrative is a flexible and powerful tool to put your own view into action.

Do you think there's more to the story for Motorola Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion