Keysight Technologies (NYSE:KEYS) Reports Strong Q2 Earnings with US$1.31 Billion Revenue

Reviewed by Simply Wall St

Keysight Technologies (NYSE:KEYS) recently announced its second quarter results for 2025, reporting a robust improvement in financial performance, with sales increasing to $1,306 million and net income doubling year-over-year. These strong figures likely supported the company's impressive 20% share price increase over the past month. Additionally, Keysight's collaboration with major industry players such as Fujitsu and Intel, along with new product launches and a positive outlook for the next quarter, might have further buoyed investor sentiment. These developments provided a counterbalance to broader market moves, where fluctuations persisted amid varied economic news.

Keysight Technologies has 1 warning sign we think you should know about.

The recent developments at Keysight Technologies, including strong quarterly results and strategic collaborations, have bolstered investor sentiment and contributed to a sharp 20% increase in share price in the short term. These factors, alongside advancements in AI data centers and technology standards, are anticipated to drive demand for Keysight's high-margin solutions. The company's focus on software and services is expected to enhance margins, as nearly 40% of revenue stems from these higher-margin recurring streams. However, while short-term performance is promising, there's a possibility of revenue constraints due to broader economic uncertainties.

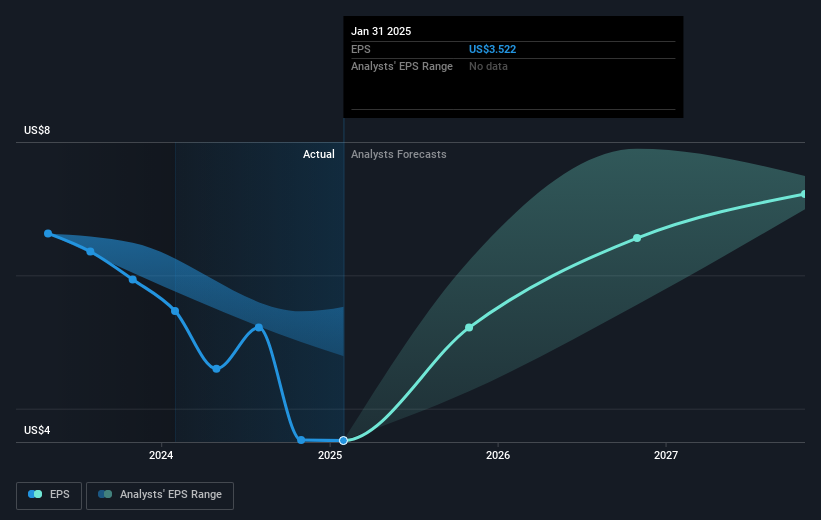

Over a longer-term period of five years, Keysight's total shareholder return, including dividends, reached 57.45%. This performance included share price gains and provides context to where the company stands today. Over the past year, Keysight's returns aligned with the US market, which saw an 11.7% increase. This suggests that despite the competitive pressures and fluctuations, the company's performance remains resilient. However, its 5.7% annual earnings growth over the past five years contrasts with a recent earnings decline of 36.9%, underscoring mixed results.

The company's revenue and earnings forecasts are poised to benefit from the aforementioned developments, with analysts projecting revenue growth and improved profit margins over the coming years. Nonetheless, any adverse economic shifts or sector-specific challenges could impact these forecasts. At a share price of US$164.46, Keysight is trading at a slight discount to the consensus price target of US$179.01, signaling potential upside as per analyst consensus. However, its current high P/E ratio of 46x compared to the industry average raises valuation considerations, given that future expectations rely on continued outperformance in earnings and revenue.

Jump into the full analysis health report here for a deeper understanding of Keysight Technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion