Keysight Technologies (KEYS): Evaluating Valuation After New EV Test and Wireless Simulation Platform Launches

Reviewed by Kshitija Bhandaru

Keysight Technologies (KEYS) recently launched new end-of-line test platforms supporting electric vehicle manufacturing, directly tackling challenges in standardization and system integration. Combined with new wireless simulation offerings, these moves highlight Keysight’s broad innovation across high-growth technology sectors.

See our latest analysis for Keysight Technologies.

Keysight has been busy this year, pushing out new solutions for both EV production and next-generation wireless. The company’s 1-year total shareholder return stands at 13.3%, signaling momentum is building as investors increasingly recognize its leadership in fast-growing tech and automotive markets.

If transformative moves in EV and wireless caught your attention, it’s worth checking out the latest innovations among automakers. See who’s driving the industry forward with our See the full list for free.

That leads to the pressing question for investors: with Keysight’s stock trending higher on robust innovation and strong financials, is there real upside left, or has the market already priced in those future growth prospects?

Most Popular Narrative: 6.6% Undervalued

The current narrative sees Keysight Technologies' fair value at $187.60, a premium compared to the last close at $175.16. This difference is grounded in a thesis of accelerating growth and expanding margins, inviting a closer look into what’s powering this optimism.

“Early engagement and leadership in next-generation wireless technologies, such as ongoing 5G-Advanced deployments, direct-to-cell, non-terrestrial networks, and active participation in 6G research, position Keysight to capture significant share as new wireless standards roll out globally, supporting future revenue growth and a stable order outlook.”

Curious which financial levers are set to catapult Keysight’s worth above today’s price? The answer hinges on ambitious assumptions for revenue expansion, profit margins, and a bold future earnings multiple. Discover how these shape one of the market’s more bullish narratives.

Result: Fair Value of $187.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising tariffs and shifts in AI infrastructure investment patterns could challenge the bullish outlook and slow Keysight's anticipated margin and revenue growth.

Find out about the key risks to this Keysight Technologies narrative.

Another Perspective: Premium Valuation Signals Caution

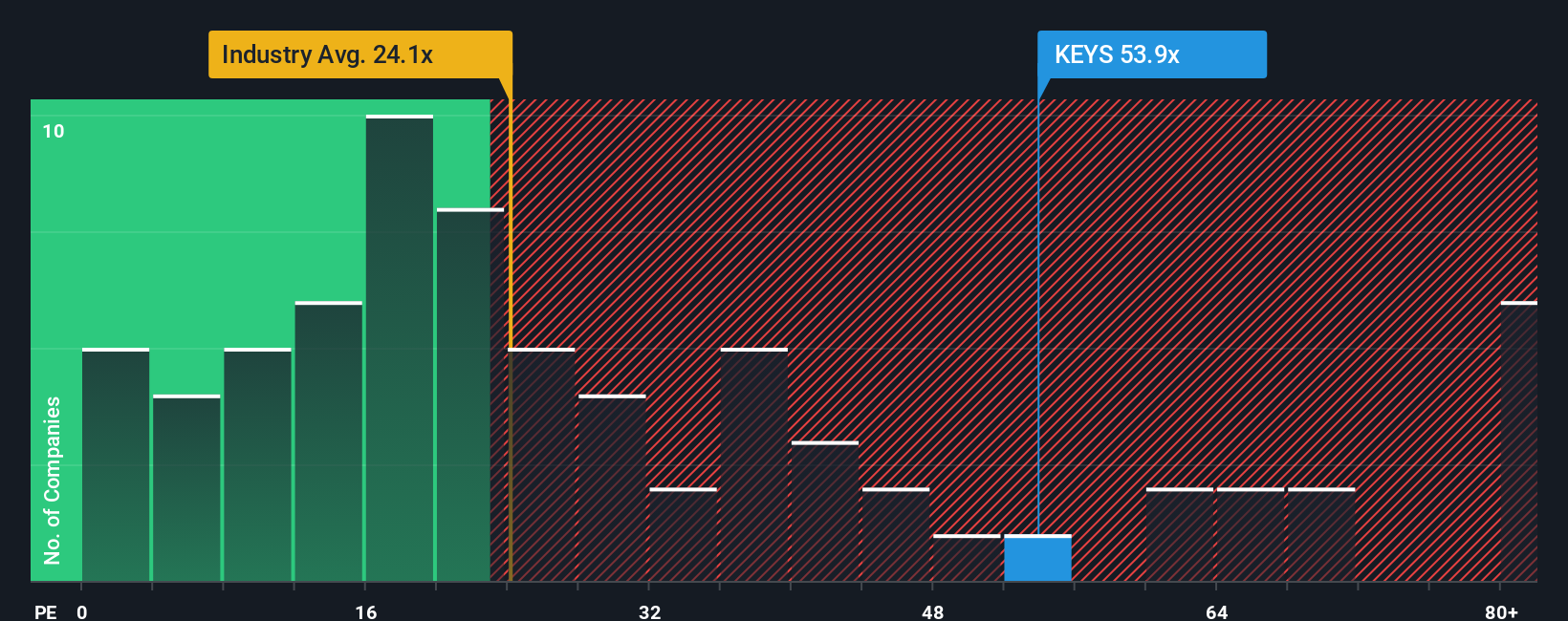

Looking at Keysight through the lens of price-to-earnings, there is a stark contrast to the bullish narrative. The company's P/E ratio stands at 55.3x, which is notably higher than both the industry average of 24.3x and the peer average of 47.1x. Even compared to its estimated fair ratio of 32.4x, Keysight's valuation appears stretched. This premium suggests investors are pricing in a lot of future growth, but it also raises questions about how much room is left for upside and whether risks are fully accounted for.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keysight Technologies Narrative

If you want to dive deeper or take a different approach, you can build your own Keysight narrative in just a few minutes. Do it your way

A great starting point for your Keysight Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors get ahead by tapping into new trends, targeting value opportunities, and capturing emerging growth stories before the crowd. Don’t miss your chance to level up your strategy. See what’s out there today.

- Jump on rare opportunities as you hunt for value with these 904 undervalued stocks based on cash flows and spot stocks trading below their true potential.

- Unleash your portfolio’s potential by tapping into the future with these 24 AI penny stocks fueling innovation across high-growth industries.

- Cash in on steady income streams by checking out these 19 dividend stocks with yields > 3% offering attractive yields for long-term growth and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion