How Keysight’s 1,000-Qubit Quantum Control System and Open RAN Advances Have Changed Its Investment Story (KEYS)

Reviewed by Simply Wall St

- In late July 2025, Keysight Technologies delivered a commercial 1,000-qubit quantum control system to Japan’s National Institute of Advanced Industrial Science and Technology and showcased advanced Open RAN energy efficiency solutions at the O-RAN Alliance PlugFest.

- This establishes Keysight as a pioneer in large-scale quantum computing infrastructure and underscores its leadership in high-performance communications testing and power optimization.

- We’ll examine how Keysight’s milestone 1,000-qubit quantum control system could influence its long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

Keysight Technologies Investment Narrative Recap

To be a shareholder in Keysight Technologies, you need confidence in its leadership in high-performance test solutions for advanced communications, computing, and quantum systems, with sustained R&D-driven demand and innovation as the core long-term drivers. The recent delivery of the first commercial 1,000-qubit quantum control system is a technical milestone but does not materially impact the company’s most immediate catalyst, which remains the pace of AI data center and wireline infrastructure spending; the biggest short-term risk continues to be exposure to cyclical end-market softness and ongoing tariff pressures.

Among recent announcements, the quantum system delivery to Japan’s AIST is the most relevant, reinforcing Keysight’s position at the cutting edge of quantum R&D infrastructure. However, the primary catalyst underpinning near-term performance is still robust investment in AI-driven high-speed data center buildouts and related test equipment, with the quantum project highlighting potential for longer-term opportunity rather than reshaping immediate financial outlooks.

In contrast, investors should also be aware of the company’s vulnerability to persistent softness in its Electronic Industrial Solutions Group, where...

Read the full narrative on Keysight Technologies (it's free!)

Keysight Technologies is projected to achieve $6.2 billion in revenue and $1.3 billion in earnings by 2028. This outlook assumes annual revenue growth of 6.6% and an earnings increase of $558 million from the current earnings of $742 million.

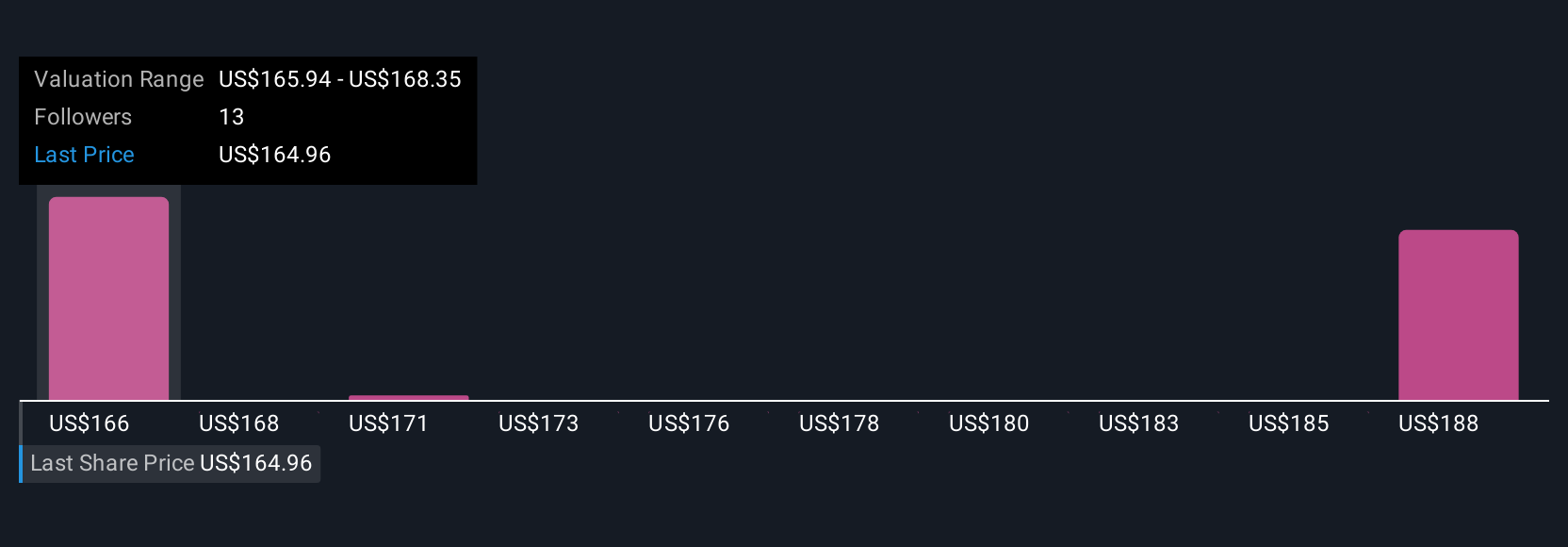

Uncover how Keysight Technologies' forecasts yield a $188.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community set Keysight’s fair value between US$173.01 and US$190.01 per share. Despite strong belief in the company's innovation, persistent weaknesses in certain industrial end markets may weigh on performance, so consider how much individual expectations can diverge.

Explore 4 other fair value estimates on Keysight Technologies - why the stock might be worth as much as 17% more than the current price!

Build Your Own Keysight Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keysight Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Keysight Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keysight Technologies' overall financial health at a glance.

No Opportunity In Keysight Technologies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives