A Look at Keysight Technologies (KEYS) Valuation After New Quantum Alliance and AI Design Assistant Launch

Reviewed by Simply Wall St

Keysight Technologies (KEYS) just put two big flags in the ground: a five year quantum computing research pact in Singapore and new AI assistants for its design software, and the stock is responding.

See our latest analysis for Keysight Technologies.

Those quantum and AI moves come after a steady run higher, with the latest share price at $203.71 and a robust year to date share price return of 26.65 percent. The five year total shareholder return of 54.54 percent suggests longer term momentum is still very much intact.

If Keysight’s mix of quantum, AI, and testing solutions has your attention, it could be a good moment to explore other high growth tech and AI stocks that are shaping the next wave of innovation.

With steady earnings growth, a rising share price, and fresh quantum and AI catalysts, is Keysight still trading below its long term potential, or are investors already paying up for all that future growth?

Most Popular Narrative: 5.5% Undervalued

With Keysight closing at $203.71 against a narrative fair value near $216, the story points to measured upside built on structural growth drivers.

Expansion of software and recurring service offerings, now comprising 36% and 28% of total revenue respectively, increases gross and net margins by enhancing revenue stability, improving product mix, and reducing cyclicality from traditional hardware segments.

Curious how margin rich software, rising services, and a premium earnings multiple all knit together into that valuation call? The full narrative unpacks the precise growth rates, profitability assumptions, and future multiple that need to hold for this upside case to work. Want to see the exact financial runway behind that fair value label? Dive in to see what the consensus is really betting on.

Result: Fair Value of $216 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on smooth execution, with tariff pressures and any cooling in AI infrastructure spending both capable of quickly compressing margins and growth.

Find out about the key risks to this Keysight Technologies narrative.

Another Angle on Value

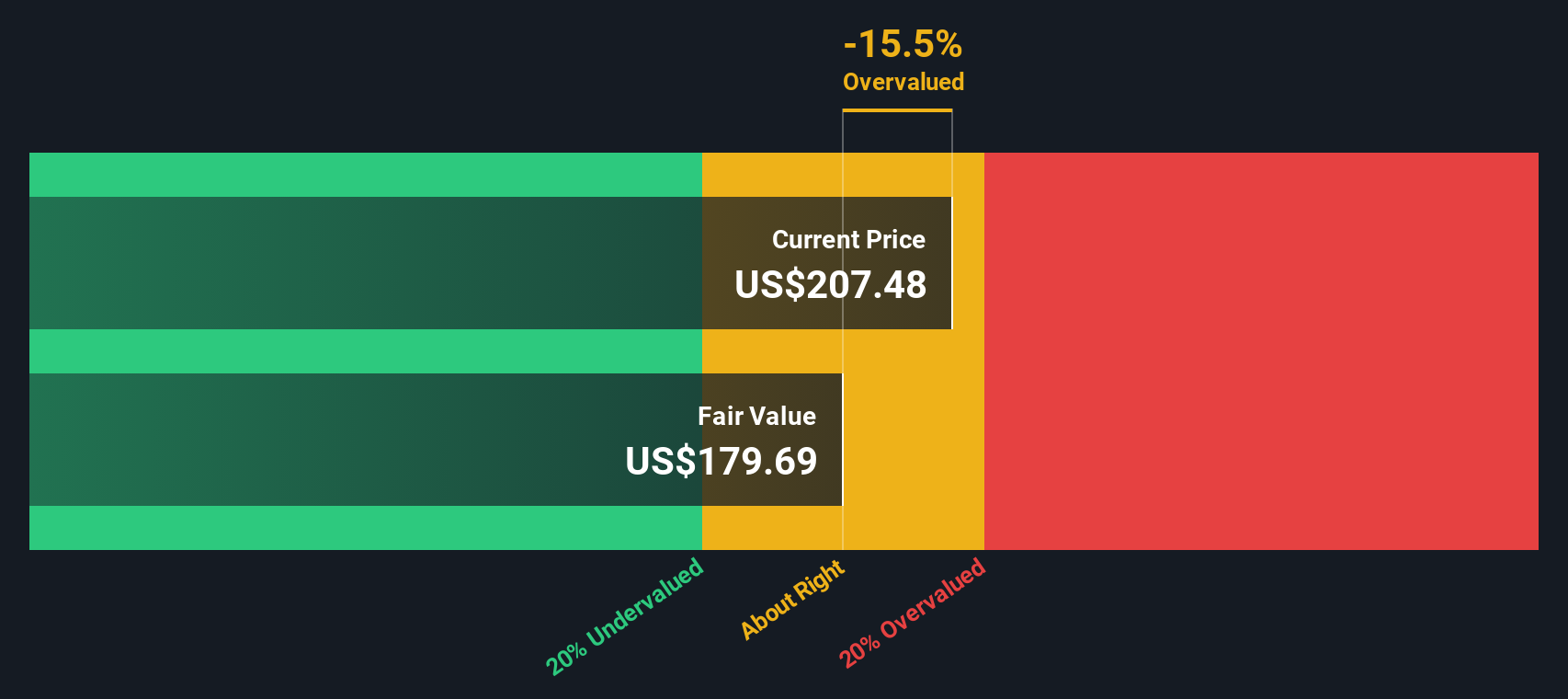

While the narrative fair value suggests Keysight is 5.5 percent undervalued, our DCF model is more cautious and puts fair value nearer $179, below today’s $203.71. If future growth or margins disappoint even slightly, could that premium quickly unwind?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Keysight Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Keysight Technologies Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a custom view in just minutes using Do it your way.

A great starting point for your Keysight Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful screener to work and line up your next opportunities so you are not reacting after the market moves.

- Capture early stage potential with these 3629 penny stocks with strong financials that already show the financial strength many micro caps never achieve.

- Lock in more resilient portfolio income by targeting these 10 dividend stocks with yields > 3% that can keep paying you even when markets get choppy.

- Position ahead of the next breakthrough cycle by focusing on these 28 quantum computing stocks building real businesses around frontier computing technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion