- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Should HPE’s Quantum Scaling Alliance Accelerate Investor Focus on Quantum-Classical Integration?

Reviewed by Sasha Jovanovic

- Hewlett Packard Enterprise has announced the formation of the Quantum Scaling Alliance alongside seven leading technology organizations, aiming to accelerate the development of scalable and practical quantum computing solutions that integrate with classical high-performance computing and advanced networking.

- This collaborative alliance, co-led by prominent scientists and industry experts, addresses a critical challenge in bringing quantum computing to industry scale, signaling a significant leap in HPE's innovation agenda and technological relevance.

- We'll explore how HPE's leadership in quantum-classical integration could reshape its investment narrative and future market positioning.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Hewlett Packard Enterprise Investment Narrative Recap

To be a shareholder in Hewlett Packard Enterprise, you need to believe in its ongoing transformation from traditional hardware to higher-margin AI infrastructure and networking, underpinned by strategic alliances and innovation. The Quantum Scaling Alliance announcement signals HPE’s intent to maintain technological relevance, but by itself, it does not materially shift the most pressing short-term catalyst: delivering cost synergies and smooth integration following the Juniper acquisition. The largest immediate risk remains the successful execution of this integration, which could impact expected margin expansion.

A recent confirmation of this transformation is HPE’s partnership with the U.S. Department of Energy and Los Alamos National Laboratory to deliver two new AI-driven supercomputers. This move aligns with HPE’s push deeper into high-performance computing and underscores how alliances and client wins in advanced infrastructure may support its efforts to capture enterprise cloud and AI growth drivers in the short to medium term.

By contrast, investors should also be mindful of the risks tied to integration execution and potential revenue disruption, particularly if...

Read the full narrative on Hewlett Packard Enterprise (it's free!)

Hewlett Packard Enterprise's outlook anticipates $44.4 billion in revenue and $2.7 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 10.3% and an earnings increase of $1.6 billion from the current level of $1.1 billion.

Uncover how Hewlett Packard Enterprise's forecasts yield a $26.51 fair value, a 13% upside to its current price.

Exploring Other Perspectives

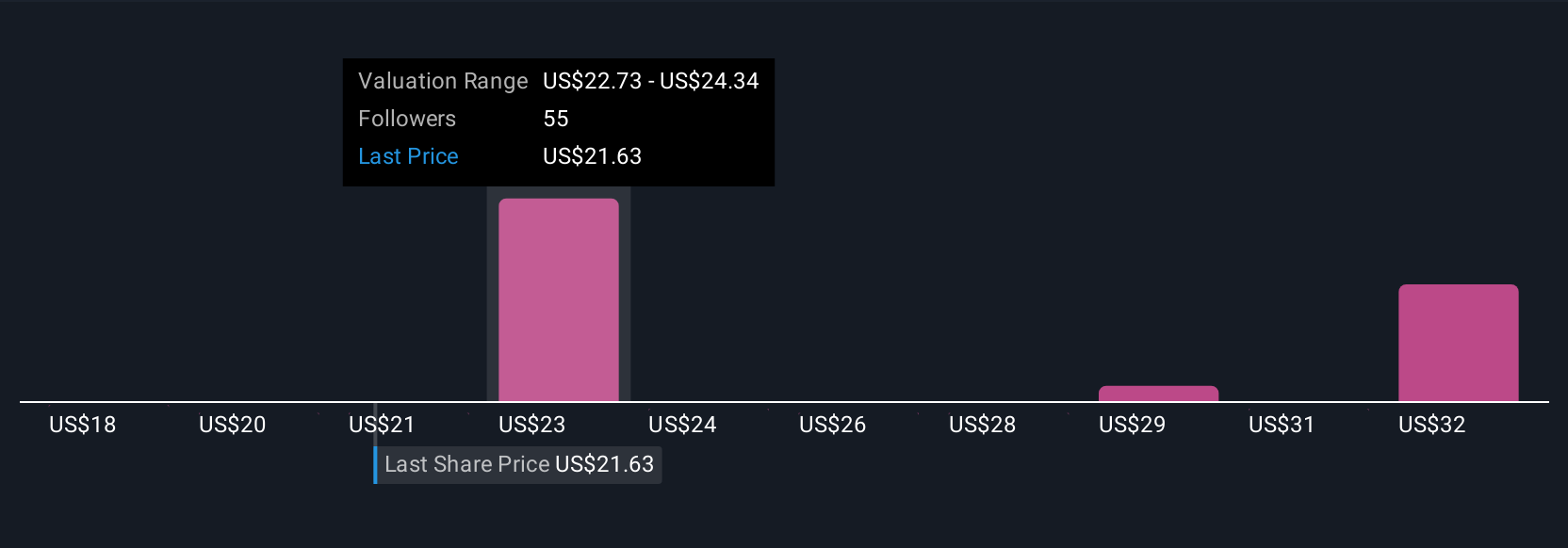

Five recent fair value estimates from the Simply Wall St Community range from US$17.90 to US$34.38, highlighting the wide spread in shareholder expectations. While some see significant room for upside, delivering on cost savings from the Juniper integration remains an important challenge that may shape future performance; explore different viewpoints to see where you stand.

Explore 5 other fair value estimates on Hewlett Packard Enterprise - why the stock might be worth as much as 46% more than the current price!

Build Your Own Hewlett Packard Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Hewlett Packard Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hewlett Packard Enterprise's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives