- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Shareholders Received A Total Return Of 38% In The Last Three Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Hewlett Packard Enterprise Company (NYSE:HPE) shareholders, since the share price is down 24% in the last three years, falling well short of the market return of around 47%.

View our latest analysis for Hewlett Packard Enterprise

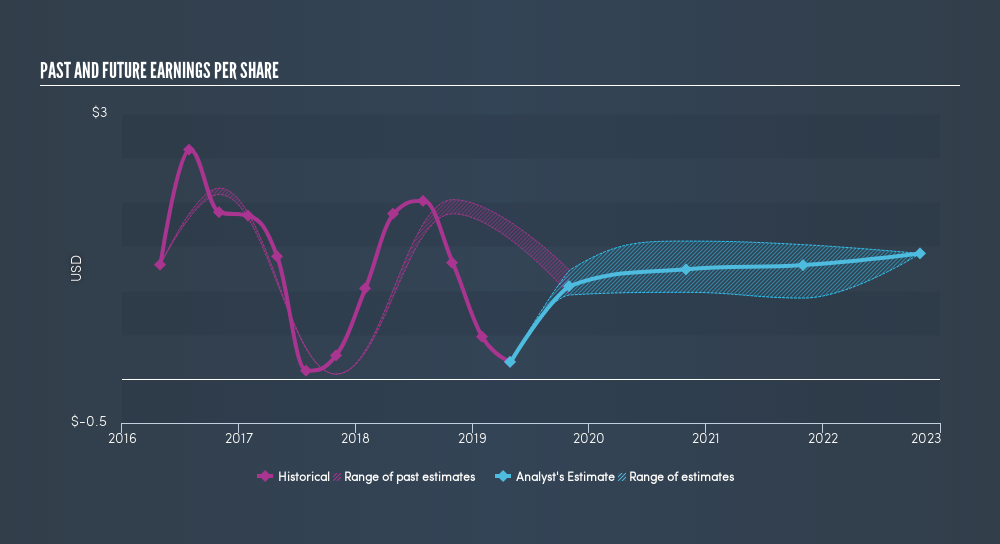

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years that the share price fell, Hewlett Packard Enterprise's earnings per share (EPS) dropped by 47% each year. This fall in the EPS is worse than the 8.9% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in. This positive sentiment is also reflected in the generous P/E ratio of 77.81.

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Hewlett Packard Enterprise, it has a TSR of 38% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

The last twelve months weren't great for Hewlett Packard Enterprise shares, which cost holders 1.6%, including dividends, while the market was up about 7.0%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Fortunately the longer term story is brighter, with total returns averaging about 11% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before forming an opinion on Hewlett Packard Enterprise you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives