- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Collaborates With COMLINE SE To Enhance Cloud Offering With AI Technology

Reviewed by Simply Wall St

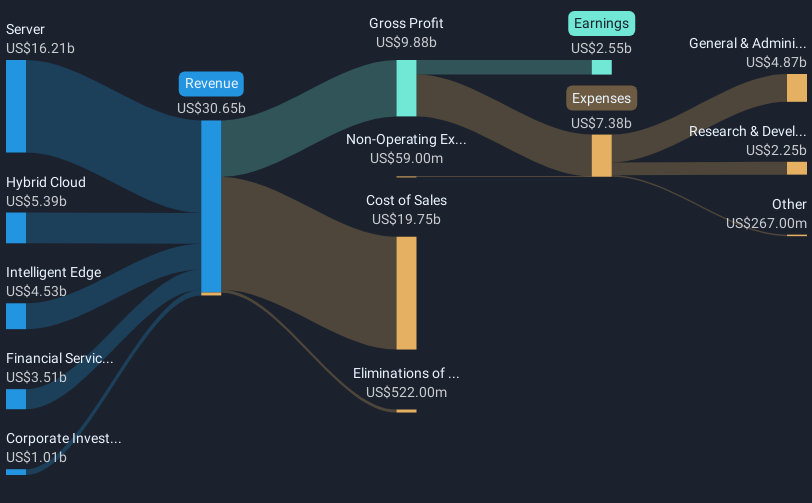

Hewlett Packard Enterprise (NYSE:HPE) recently partnered with COMLINE SE to expand cloud offerings using HPE Private Cloud AI, signaling a commitment to advancing AI technology. Despite a 2% decline in share price over the last quarter, the announcement of this partnership, alongside product innovations like the shipment of the NVIDIA Blackwell family-based solution, highlights HPE's active engagement in technological advancements. During this period, market conditions were challenging, with major indices like the Nasdaq Composite sliding by 0.6% amid mixed investor sentiments. Broader market fluctuations, driven by concerns such as the impact of tariffs and tech sector volatility, may have overshadowed HPE's positive financial results for Q4 2024, which reported a significant increase in sales and net income. The tech sector's recent downturn, coupled with fluctuating broader market performance, created a complex environment for HPE's stock performance.

Click here and access our complete analysis report to understand the dynamics of Hewlett Packard Enterprise.

Hewlett Packard Enterprise (HPE) experienced a significant total return of 95.95% over the past five years, reflecting strong performance in a challenging market. A major contributor was HPE's consistent earnings growth, with earnings increasing by 21.8% per year on average. The company also exceeded the broader US market's return of 16.9% over the past year, showcasing its robust ability to navigate the competitive tech sector.

Key factors influencing this performance include strategic partnerships, such as the collaboration with RWE to enhance weather forecasting models, and innovations in AI, evident in the launch of the HPE ProLiant Compute XD. Additionally, ongoing stock buybacks, including the recent repurchase of 2.47 million shares for US$50.38 million in December 2024, and consistent dividend declarations, further emphasize HPE's commitment to returning value to shareholders.

- Get the full picture of Hewlett Packard Enterprise's valuation metrics and investment prospects—click to explore.

- Assess the downside scenarios for Hewlett Packard Enterprise with our risk evaluation.

- Invested in Hewlett Packard Enterprise? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Develops intelligent solutions in the United States, the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion