- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Benign Growth For Hewlett Packard Enterprise Company (NYSE:HPE) Underpins Stock's 27% Plummet

The Hewlett Packard Enterprise Company (NYSE:HPE) share price has fared very poorly over the last month, falling by a substantial 27%. Longer-term shareholders would now have taken a real hit with the stock declining 7.6% in the last year.

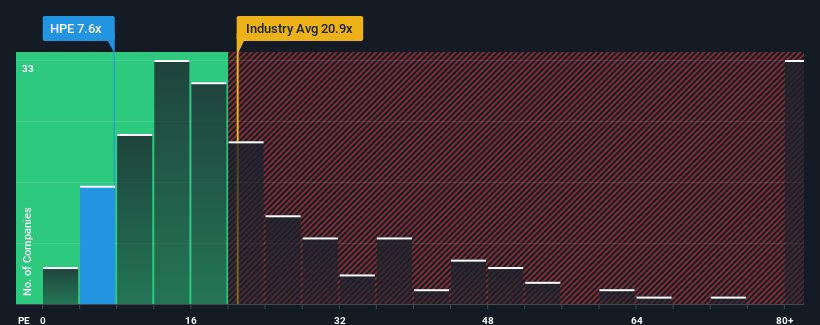

In spite of the heavy fall in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may still consider Hewlett Packard Enterprise as a highly attractive investment with its 7.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been advantageous for Hewlett Packard Enterprise as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Hewlett Packard Enterprise

Is There Any Growth For Hewlett Packard Enterprise?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Hewlett Packard Enterprise's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 43% last year. Still, incredibly EPS has fallen 26% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 1.9% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 11% per annum, which paints a poor picture.

In light of this, it's understandable that Hewlett Packard Enterprise's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Hewlett Packard Enterprise's P/E

Having almost fallen off a cliff, Hewlett Packard Enterprise's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hewlett Packard Enterprise maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Hewlett Packard Enterprise that you need to take into consideration.

Of course, you might also be able to find a better stock than Hewlett Packard Enterprise. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Undervalued with moderate risk and pays a dividend.

Similar Companies

Market Insights

Community Narratives