Corning (GLW) Profit Surge Reinforces Bullish Narratives Despite Premium Valuation

Reviewed by Simply Wall St

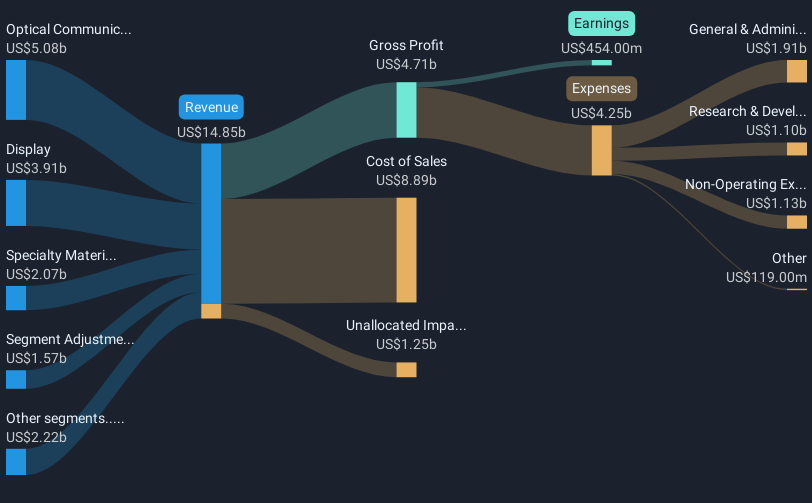

Corning (GLW) posted a massive 775.6% earnings growth over the past year, with net profit margins climbing to 9.2% from 1.2% a year earlier. While the company’s five-year earnings trend shows an average decline of 5.4% per year, the outlook is now brighter. Earnings are forecast to grow 23.1% annually, outpacing the US market average of 15.9%. Margins have improved significantly and profit growth is expected to stay strong, though the company’s higher price-to-earnings ratio may give value-conscious investors pause.

See our full analysis for Corning.Next up, we’ll look at how these headline results compare to the prevailing market narratives for Corning, examining where the numbers reinforce expectations and where they might challenge consensus views.

See what the community is saying about Corning

Optical and Solar Demand Fueling Growth Targets

- Corning's Springboard plan aims to add more than $4 billion in yearly sales by 2026, specifically leveraging booming demand in Optical Communications and Solar. Management sees this as a path to margin expansion and sustained growth well above sector averages.

- Analysts' consensus view highlights two drivers they expect to keep propelling the business:

- Strong U.S. manufacturing presence is helping Corning win commercial deals, contributing to robust sales gains even with macro headwinds in play.

- Strategy to commercialize new U.S.-made solar products with guaranteed customer capacity through 2025 is aligned with policy shifts toward energy independence, which has started to deliver higher revenue and earnings and is projected to continue doing so.

- The bullish themes around these industrial growth drivers may surprise some given the five-year annualized earnings decline of 5.4%. It is notable that the current direction relies on durable secular trends and contract wins rather than temporary market surges.

To see how analysts are weighing both opportunity and risk, dive deeper into the full range of perspectives.

📊 Read the full Corning Consensus Narrative.Profit Margin Ambitions Stoked by Gen AI

- Margin improvement ambitions are key, with analysts assuming profit margins rising from 5.8% to 12.6% over three years, driven by new innovations for Gen AI data centers and ongoing cost discipline in core manufacturing.

- According to the consensus narrative, the focus on next-gen data center tech and incremental operating margin improvements could push Corning's margins beyond historic averages:

- Targets to reach 20% operating margin by end-2026 rely mainly on Gen AI-driven business, with associated revenue growth boosting bottom-line operating leverage.

- Higher margin guidance challenges skeptics, given margins had fallen as low as 1.2% in the past twelve months. Consensus expects secular demand for data connectivity and solar to keep this margin expansion on track.

Valuation Stays Stretched Above Peers

- Corning trades on a price-to-earnings ratio of 55.9x, which is substantially higher than both its direct peer average and the broader US electronic industry average of 23.9x. It also exceeds its own DCF fair value of $65.98 by a wide margin at the current share price of $89.08.

- What stands out in the consensus narrative is the tension between growth optimism and valuation reality:

- The current share price sits well above both analyst target price of $92.75 and DCF fair value, suggesting the market is already pricing in aggressive growth and profitability assumptions that could be vulnerable if the pace of revenue expansion or margin improvement stalls.

- Consensus also points out that while the rewards of growth are clear, limited flagged risks and a premium valuation present a stiff hurdle. Any shortfall in delivery may impact future returns for value-focused investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Corning on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the data? Take just a few minutes to bring your interpretation to life and share your unique insights. Do it your way

A great starting point for your Corning research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Corning’s premium valuation, which sits far above both peer and DCF benchmarks, means investors face higher risk if growth or profitability disappoints.

If you'd rather seek out potential bargains, discover these 836 undervalued stocks based on cash flows that could offer stronger value and lower downside if market expectations shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives