A Look at Corning’s Valuation as It Expands into Solid-State Microbatteries with Ensurge Partnership

Corning (NYSE:GLW) is teaming up with Ensurge Micropower ASA to jointly develop advanced solid-state microbatteries, combining Corning’s ceramic materials and process expertise with Ensurge’s proven battery platform. This partnership highlights Corning’s entry into fast-growing markets and reflects long-term confidence in advancing next-generation battery technologies.

See our latest analysis for Corning.

Corning’s recent string of high-profile moves, such as the microbattery partnership with Ensurge, continued product launches, and a robust share buyback, has grabbed investor attention. The momentum is clear in its numbers: the stock’s 86.47% year-to-date share price return and 84.46% total return over 12 months highlight renewed optimism in Corning’s growth outlook. Its three-year total return above 190% underscores strong long-term performance.

If you’re curious what other innovative companies are catching the market’s eye this year, it could be the perfect chance to discover fast growing stocks with high insider ownership.

With shares rallying so sharply and new innovation deals piling up, investors are left wondering whether Corning’s remarkable run still leaves room for further upside. Is this a genuine buying opportunity, or has the market already priced in future growth?

Most Popular Narrative: 6.1% Undervalued

Corning’s most closely watched narrative places its fair value 6.1% above the last close price, highlighting optimism about future profit acceleration and margin gains. The focus is on core business segments expected to drive advanced growth, creating the foundation for an important market story.

The company sees substantial growth in Optical Communications, particularly in innovations for Gen AI data centers, which are expected to drive incremental revenue and accelerate operating margin improvements toward 20% by the end of 2026. Corning's significant U.S. manufacturing footprint provides a competitive edge and is expected to attract commercial agreements, enhancing sales and net margins despite tariff implications.

Want to know what’s powering this bullish outlook? The main narrative focuses on bold expansion plans, future profit margins nearly double today’s, and growth drivers that exceed the industry norm. Curious how analysts justify the premium price and whether Corning can keep up this pace? Find out which specific financial bets and ambitious milestones shape the full optimistic case.

Result: Fair Value of $92.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Corning’s reliance on non-GAAP measures and ongoing exposure to global tariffs could present unforeseen risks that might temper its bullish outlook.

Find out about the key risks to this Corning narrative.

Another View: Is Corning Overpriced?

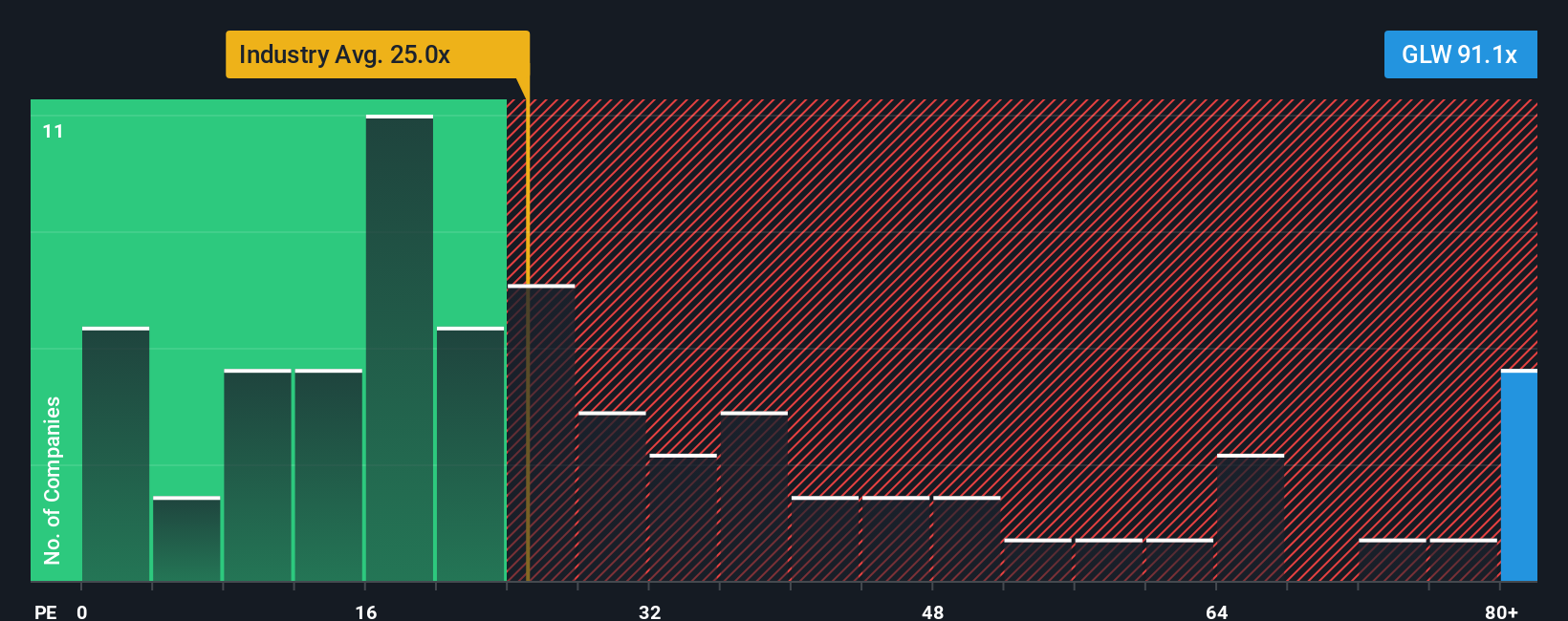

Looking at Corning’s current price compared to earnings, the numbers tell a different story. The company trades at 54.7 times earnings, much higher than both the US electronic industry average of 25.2 and the peer average of 39.1. Notably, even our fair ratio estimate (what the market could move toward) is 37.6, still below Corning’s current level.

While these lofty multiples can sometimes signal market optimism, they can also mean investors are taking on extra valuation risk if growth doesn’t materialize. With this in mind, does the premium truly reflect future potential, or could there be more downside than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corning Narrative

If you’d rather dig in and reach your own conclusion than follow the consensus, building a personal perspective takes just a few minutes. Do it your way.

A great starting point for your Corning research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Use the Simply Wall Street Screener to find outstanding stocks tailored to your goals. Here’s where smart investors are looking next:

- Uncover potential in overlooked corners of the market by checking out these 3606 penny stocks with strong financials offering surprising financial strength.

- Capitalize on the AI wave and stay ahead by focusing on these 26 AI penny stocks making a mark in artificial intelligence innovation.

- Boost your portfolio’s income with these 20 dividend stocks with yields > 3% that deliver solid yields over 3% for steady long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Spotify - A Fundamental and Historical Valuation

Very Bullish

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.