Fabrinet (FN) Margin Compression Challenges Growth Narrative Despite Strong Earnings Track Record

Reviewed by Simply Wall St

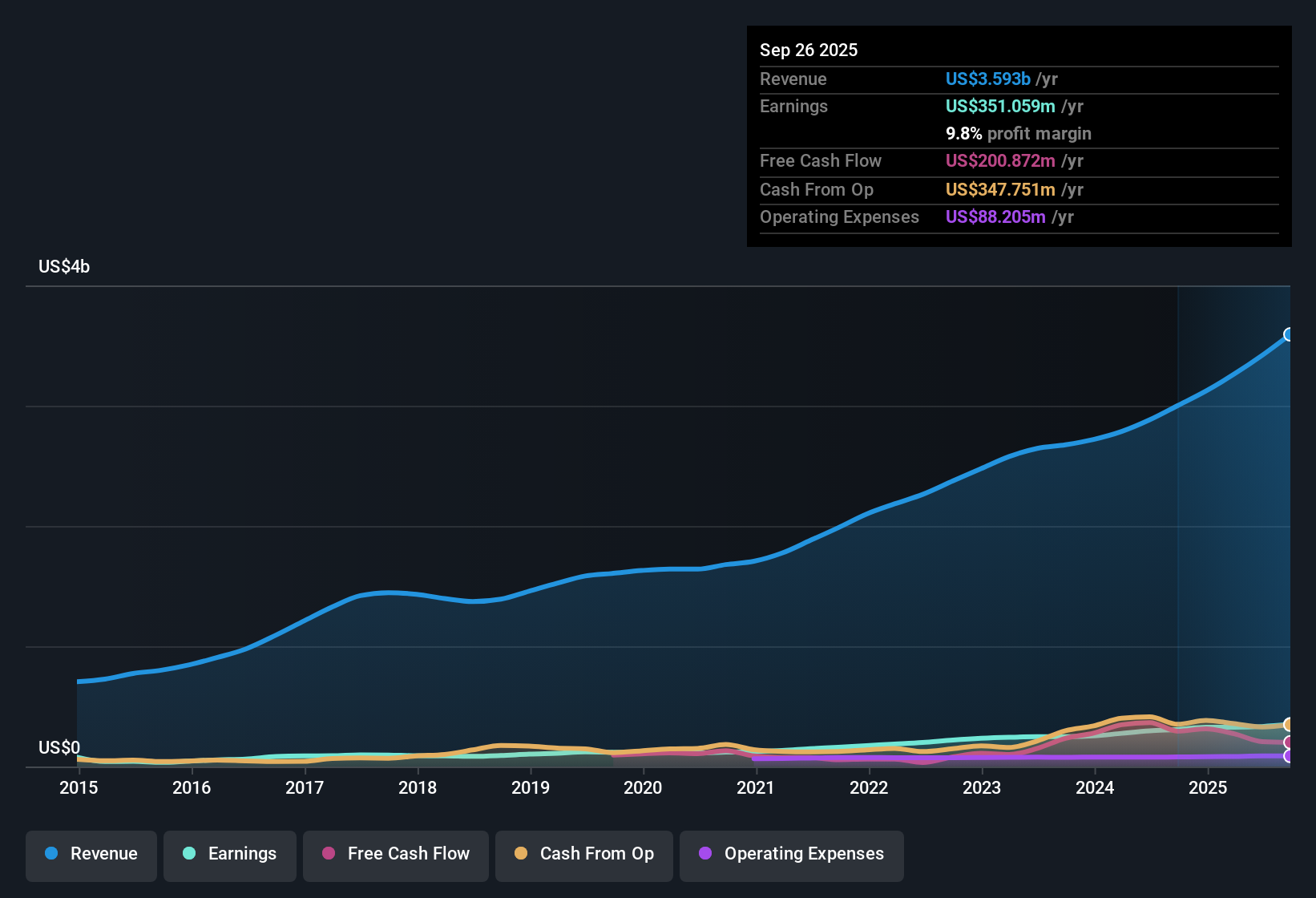

Fabrinet (FN) reported annual earnings growth of 13.9%, contributing to an impressive five-year average earnings growth rate of 20.1%. Earnings are forecast to rise at 18.66% per year, while revenue is projected to increase 17.4% annually. Both figures are expected to outpace the broader US market’s growth expectations. However, net profit margins narrowed to 9.8% from 10.3% last year, signaling some margin compression worth noting for investors.

See our full analysis for Fabrinet.The next section examines how these headline numbers compare when set against the most widely followed narratives, putting consensus views and recent results in direct comparison.

See what the community is saying about Fabrinet

Customer Concentration Drives Revenue Volatility

- NVIDIA and Cisco together contributed 46% of Fabrinet's total revenue in fiscal 2025, highlighting a major concentration risk tied to just two customers.

- Bears argue this heavy reliance could trigger significant top-line swings if one partner insources manufacturing or reduces orders.

- Consensus narrative notes that such exposure amplifies earnings volatility even as Fabrinet expands its customer base.

- Persistent supply chain disruptions in high-demand products already hold back near-term sales, compounding the exposure.

Valuation Gap: Premium to Industry and DCF

- Shares are trading at 46.9x price-to-earnings, a substantial premium to both US electronic industry peers (25x average) and Fabrinet’s DCF fair value of $303.87. This compares to a share price of $459.60.

- Analysts' consensus view highlights that while robust growth drives this premium, the current price now sits 34% above the company’s DCF fair value and 4% higher than the $466.75 analyst target, suggesting investors are paying up for future growth.

- Consensus narrative points out that for this valuation to be justified, Fabrinet would need to achieve $5.4 billion revenue and $537.3 million earnings by 2028 with stable or growing margins.

- The narrow difference between today’s share price and analyst targets signals most see the stock as fairly valued, not a bargain.

What’s next for Fabrinet? See how analysts weigh growth against risk in the full consensus narrative. 📊 Read the full Fabrinet Consensus Narrative.

Margin Pressures Amid Expansion

- Net profit margins have narrowed to 9.8% from 10.3% last year, even as the company accelerates expansions like the Building 10 project to meet strong demand in AI and next-gen telecom.

- Analysts' consensus view underscores that while margin pressures can emerge from major capacity ramps and supply bottlenecks, investments in advanced manufacturing and entry into new sectors like automotive and high-performance compute are expected to support margins in the longer term.

- Operational efficiencies have helped prop up record operating margins, but ongoing price competition and supply shortages remain risks for net margin improvement.

- If supply constraints ease and higher-value products gain traction, consensus expects modest margin upside in the years ahead.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fabrinet on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique read on these results? Share your insights and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Fabrinet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Fabrinet’s premium valuation and recent margin compression raise concerns about whether future growth can support its current stock price.

If you’re seeking better value and want to avoid overpaying, check out these 842 undervalued stocks based on cash flows for companies trading at a discount based on their underlying cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FN

Fabrinet

Provides optical packaging and precision optical, electro-mechanical, and electronic manufacturing services in North America, the Asia-Pacific, and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives