- United States

- /

- Tech Hardware

- /

- NYSE:DBD

Diebold Nixdorf, Incorporated Earnings Missed Analyst Estimates: Here's What Analysts Are Forecasting Now

It's been a pretty great week for Diebold Nixdorf, Incorporated (NYSE:DBD) shareholders, with its shares surging 19% to US$38.00 in the week since its latest quarterly results. Revenues of US$895m beat expectations by 2.3%. Unfortunately statutory earnings per share (EPS) fell well short of the mark, turning in a loss of US$0.39 compared to previous analyst expectations of a profit. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Diebold Nixdorf after the latest results.

See our latest analysis for Diebold Nixdorf

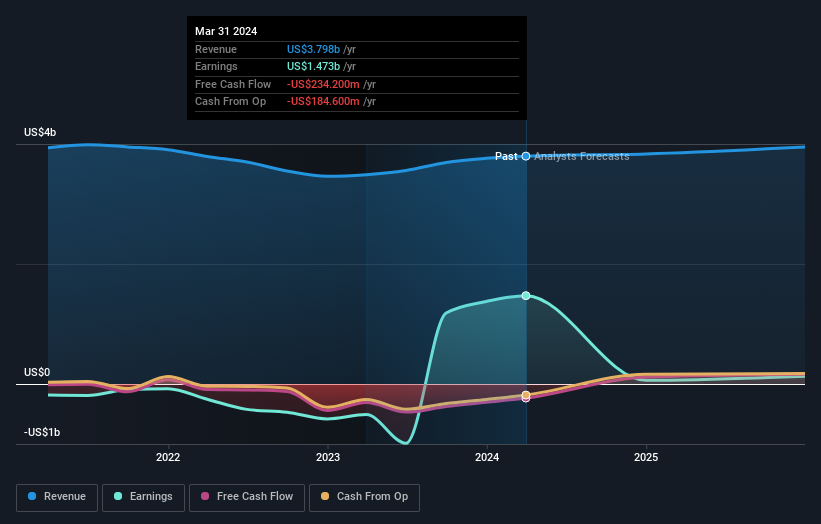

Following last week's earnings report, Diebold Nixdorf's two analysts are forecasting 2024 revenues to be US$3.83b, approximately in line with the last 12 months. Statutory earnings per share are expected to tumble 96% to US$1.64 in the same period. In the lead-up to this report, the analysts had been modelling revenues of US$3.83b and earnings per share (EPS) of US$3.61 in 2024. So there's definitely been a decline in sentiment after the latest results, noting the pretty serious reduction to new EPS forecasts.

Despite cutting their earnings forecasts,the analysts have lifted their price target 72% to US$46.50, suggesting that these impacts are not expected to weigh on the stock's value in the long term.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's also worth noting that the years of declining revenue look to have come to an end, with the forecast stauing flat to the end of 2024. Historically, Diebold Nixdorf's top line has shrunk approximately 5.0% annually over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 5.9% per year. Although Diebold Nixdorf's revenues are expected to improve, it seems that it is still expected to grow slower than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Diebold Nixdorf going out as far as 2025, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 3 warning signs for Diebold Nixdorf you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DBD

Diebold Nixdorf

Engages in the automating, digitizing, and transforming the way people bank and shop worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026