- United States

- /

- Tech Hardware

- /

- NYSE:DBD

Diebold Nixdorf (DBD) Jumps 9.0% After Strong Q3, New Buyback and Bank AlJazira Deal – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Diebold Nixdorf recently reported strong third-quarter results, confirmed an upbeat full-year outlook, announced the completion of a major share buyback, and unveiled a new US$200 million share repurchase program while highlighting new global software deployments with Bank AlJazira.

- The combination of improved profitability, continued revenue growth, and new product adoption in key international banking markets underscores the company’s efforts to strengthen both its financial and competitive positions.

- We'll explore how the new buyback program and sustained profit growth influence Diebold Nixdorf's investment case moving forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Diebold Nixdorf Investment Narrative Recap

To own Diebold Nixdorf shares, you need to believe in the company’s ability to accelerate its transition to higher-margin software and services while navigating stiff competition and structural shifts in global banking and retail automation. The recent share buyback and continued profit momentum are positive, but these do not fundamentally reduce the biggest near-term risk: the unpredictable timing and scale of large institutional contracts, which still impact revenue and earnings volatility.

Among recent developments, the announcement that Bank AlJazira will deploy Diebold Nixdorf’s latest VCP-Lite 7 self-service software on over 400 ATMs directly supports the company’s strategy to increase its global footprint and grow its base of recurring, higher-margin service revenues. These types of wins highlight the potential for new product adoption to support topline and margin expansion, but the timing and conversion of similar international banking projects remains a swing factor for near-term financials.

However, investors should also keep in mind the ongoing risk that delays or cancellations in large banking or retail contracts can quickly disrupt revenue streams and profitability, especially when...

Read the full narrative on Diebold Nixdorf (it's free!)

Diebold Nixdorf's outlook anticipates $4.2 billion in revenue and $312.7 million in earnings by 2028. This scenario is based on a 4.3% annual revenue growth rate and represents a $325.6 million increase in earnings from the current -$12.9 million.

Uncover how Diebold Nixdorf's forecasts yield a $75.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

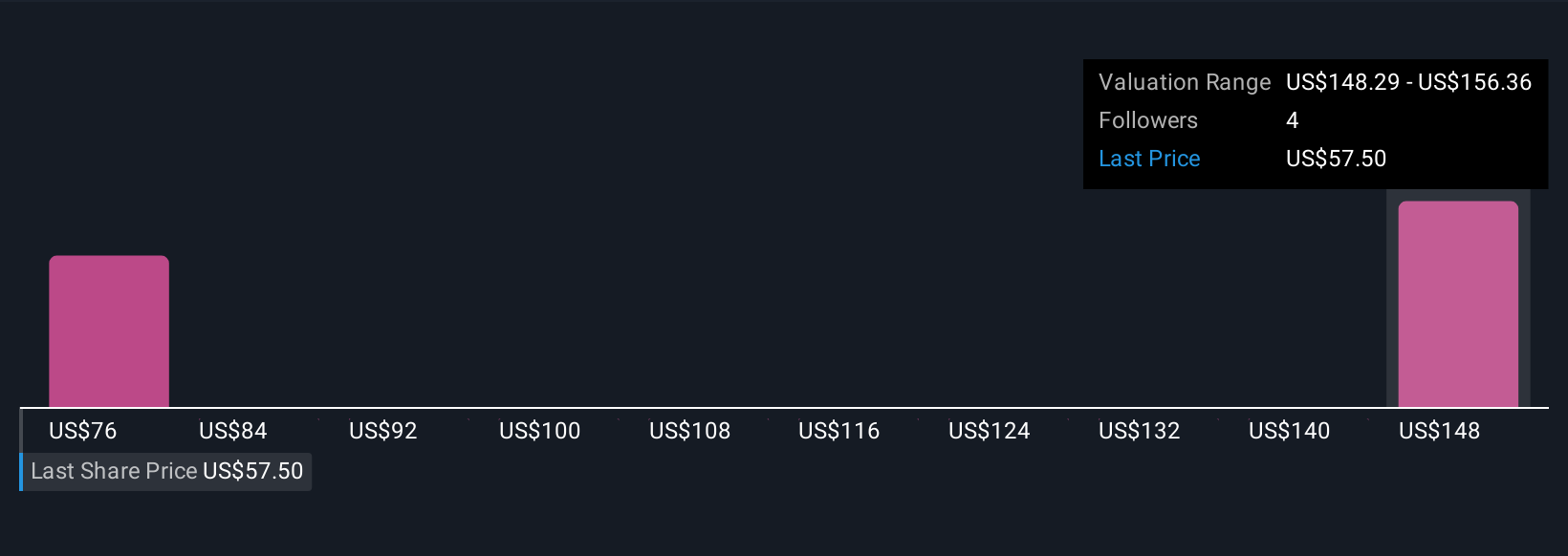

The Simply Wall St Community submitted two fair value estimates for Diebold Nixdorf, ranging from US$75.67 to US$115.34 per share. While many see growth in recurring service contracts as a strong catalyst, the diversity of opinion offers you several alternative viewpoints to consider.

Explore 2 other fair value estimates on Diebold Nixdorf - why the stock might be worth as much as 79% more than the current price!

Build Your Own Diebold Nixdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diebold Nixdorf research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Diebold Nixdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diebold Nixdorf's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBD

Diebold Nixdorf

Engages in the automating, digitizing, and transforming the way people bank and shop worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives