Crane NXT (CXT) Margin Decline Reinforces Market Skepticism Despite High Forecasted Earnings Growth

Reviewed by Simply Wall St

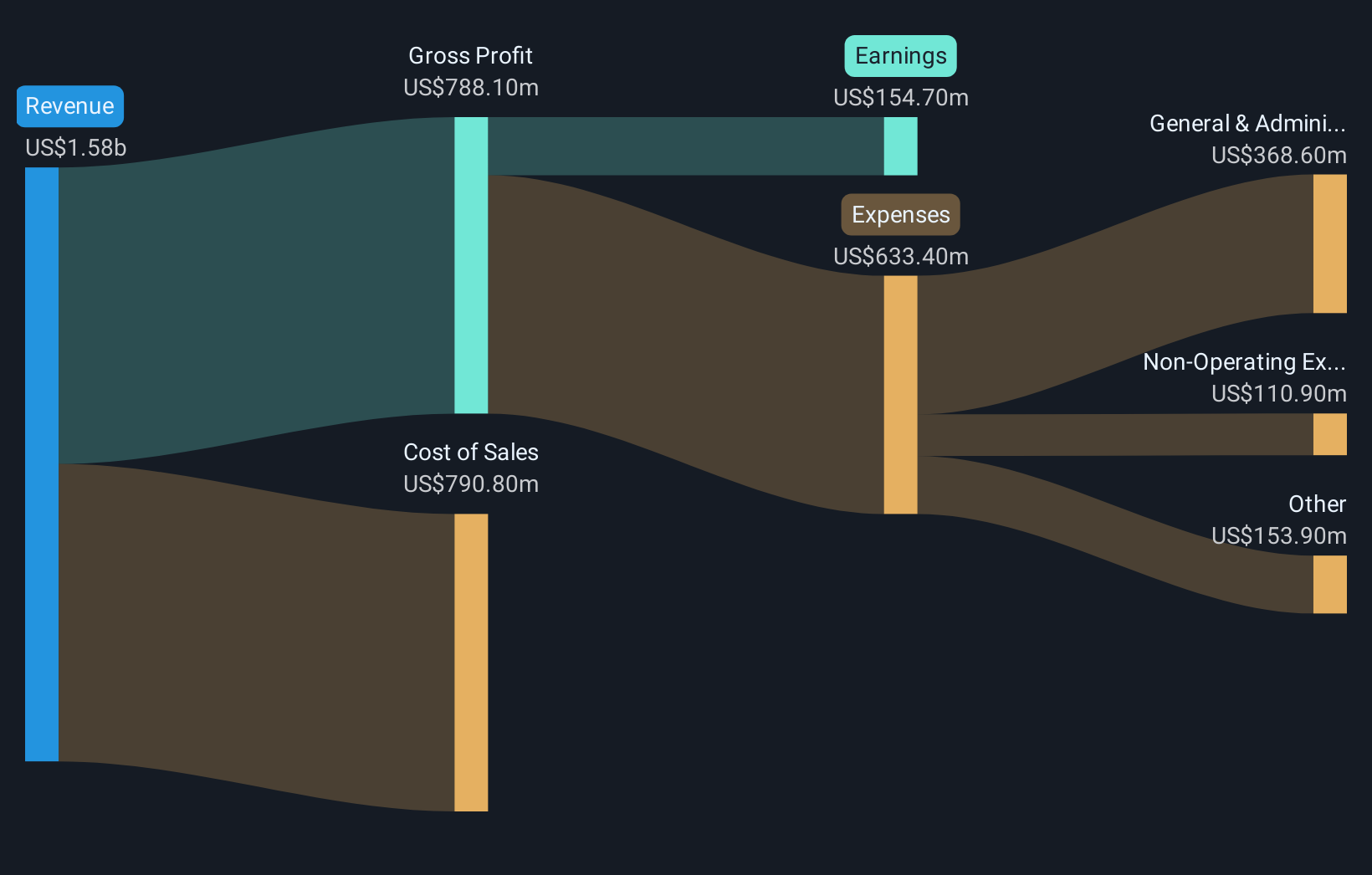

Crane NXT (CXT) reported net profit margins of 9.8%, down from 12.2% previously, as the company navigates pressure on profitability. Despite this margin compression, earnings are forecast to grow 30.25% annually for the next three years, comfortably outpacing the broader US market’s expected 15.8% growth per year. With a price-to-earnings ratio of 22.8x sitting below both peer and industry averages, investors may be encouraged by the combination of high forecasted profit growth, favorable valuation metrics, and shares trading beneath the analyst fair value target.

See our full analysis for Crane NXT.Next up, we’ll see how the latest numbers compare to the most popular narratives shaping sentiment around Crane NXT. This will highlight where consensus holds and where surprises might emerge.

See what the community is saying about Crane NXT

Authentication Margins Could Double by 2026

- Operating synergies and product rationalization are expected to lift Authentication segment margins from the current company-wide 9.8% up to nearly 20% by the end of 2026, according to management’s integration plans.

- Analysts' consensus view points to upside if Crane NXT can successfully integrate its recent acquisitions, as stronger recurring revenue streams and digital security demand are anticipated to boost both topline stability and profitability.

- Expansion of high-margin products like Fortress anti-counterfeiting solutions and JetScan Ultra supports this margin rebound.

- Analysts also highlight that effective synergy execution is critical, since previous margin erosion stemmed from delays in realizing acquisition benefits and unfavorable product mix.

- Consensus narrative notes that recurring revenue growth and digital expansion are central to unlocking those higher margins. See how analysts develop their case in the full narrative. 📊 Read the full Crane NXT Consensus Narrative.

Global Currency Backlog Supports Revenue Visibility

- A high and growing backlog of international currency contracts, fueled by persistent demand from central banks for secure authentication, underpins revenue visibility even as annual revenue growth (6.8% projected) lags the broader US market (10.4%).

- Analysts' consensus view contends that this strong backlog offsets some risks tied to digital payments disruption, with segment diversification helping reduce volatility.

- As governments prioritize anti-money laundering efforts, existing clients’ recurring business has provided a stable foundation for long-term contracts.

- That said, consensus notes continued customer concentration, mostly in central bank deals, could still create vulnerability if digital transitions accelerate more rapidly than anticipated.

Valuation: Discount to Industry, Big Gap to DCF Fair Value

- Crane NXT trades at a price-to-earnings ratio of 22.8x, below the US Electronic industry average of 25.2x, and a current share price of $61.35 which is meaningfully below its DCF fair value estimate of $126.17.

- According to the analysts' consensus view, this valuation gap gives investors a cushion if forecasted profit growth and margin recovery materialize by 2026, but also reflects market caution over the company’s slower revenue growth and reliance on acquisition-led turnaround.

- Even with an analyst price target of $77.33, about 26% higher than the latest share price, the market appears to be discounting Crane NXT’s growth story compared to sector peers.

- This context spotlights why some see strong upside if guidance and operational improvements translate into actual earnings expansion.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Crane NXT on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different angle on the data? Craft your take in just minutes and share your unique perspective: Do it your way

A great starting point for your Crane NXT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Crane NXT’s revenue growth is lagging behind the market average, and its dependence on acquisition-led margin recovery leaves future stability uncertain.

If you want to focus on companies with consistent revenue and earnings expansion regardless of market shifts, search for top candidates using stable growth stocks screener (2078 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXT

Crane NXT

Operates as an industrial technology company that provides technology solutions to secure, detect, and authenticate customers’ important assets.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives