How Investors Are Reacting To CTS (CTS) As Global Container Shipping Liftings and Freight Rates Recover

Reviewed by Simply Wall St

- In June 2025, the container shipping market finished the first half of the year with global liftings reaching 93.5 million TEUs, a 4.5% year-to-date increase, while most regions saw export growth, except for North America which faced a 3% decline.

- The Global Price Index rose to 86 points in June, reflecting an ongoing modest recovery in freight rates and suggesting improving conditions for container shipping operators despite still being below last year's levels.

- We'll explore how the recovery in global freight rates could influence CTS's outlook and its current growth narrative.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

CTS Investment Narrative Recap

Owning CTS shares today is about believing in the potential for ongoing growth from smart technology and industrial diversification, while recognizing the risks posed by persistent transportation market softness and global trade uncertainty. The recent uptick in the Global Price Index supports a modest recovery for the container shipping sector but does not materially alter the near-term risk that China market weakness and tariffs are putting continued pressure on CTS's largest business segment.

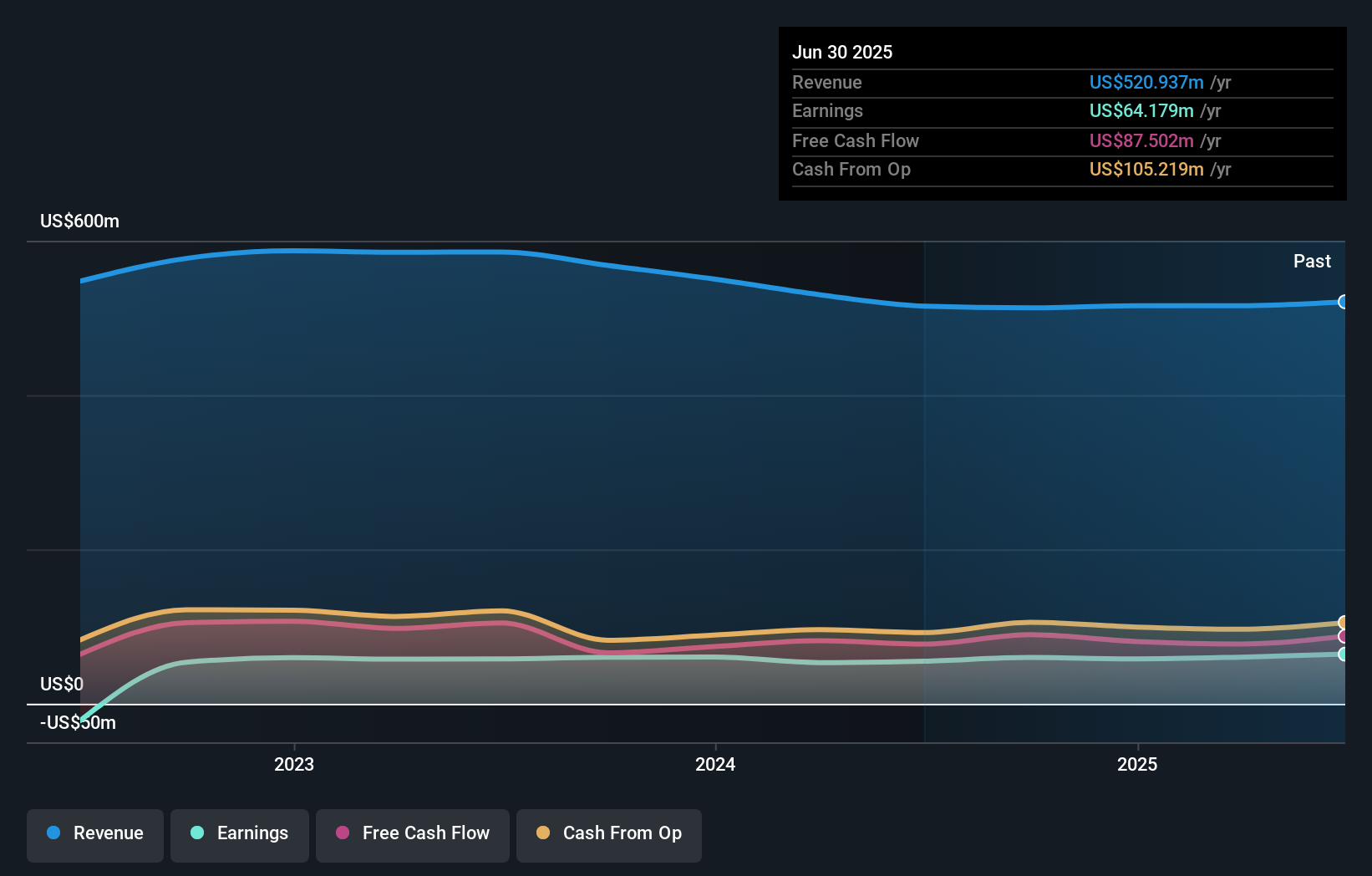

The July 2025 announcement confirming sales guidance of US$520 million to US$550 million this year stands out, as it signals company confidence despite market volatility. This stability in outlook is especially relevant given persistent macro risks and highlights management’s emphasis on execution and resilience as key near-term catalysts.

Yet, in contrast, investors should be aware of how ongoing trade tariffs and geopolitical uncertainty could...

Read the full narrative on CTS (it's free!)

CTS' outlook points to $610.6 million in revenue and $78.8 million in earnings by 2028. This is based on a 5.4% annual revenue growth rate and a $14.6 million increase in earnings from the current $64.2 million.

Uncover how CTS' forecasts yield a $43.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate of US$43 comes from the Simply Wall St Community, signaling limited diversity in retail investor perspectives. Despite this, many are focused on risks from continued weakness in transportation sales, which could have broader implications for CTS’s revenue stability; consider exploring more viewpoints beyond the consensus.

Explore another fair value estimate on CTS - why the stock might be worth just $43.00!

Build Your Own CTS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CTS research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CTS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CTS' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTS

CTS

Designs, manufactures, and sells sensors, connectivity components, and actuators in North America, Europe, and Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives