Did Rising Sales and Shrinking Profits Just Shift CTS' (CTS) Investment Narrative?

Reviewed by Sasha Jovanovic

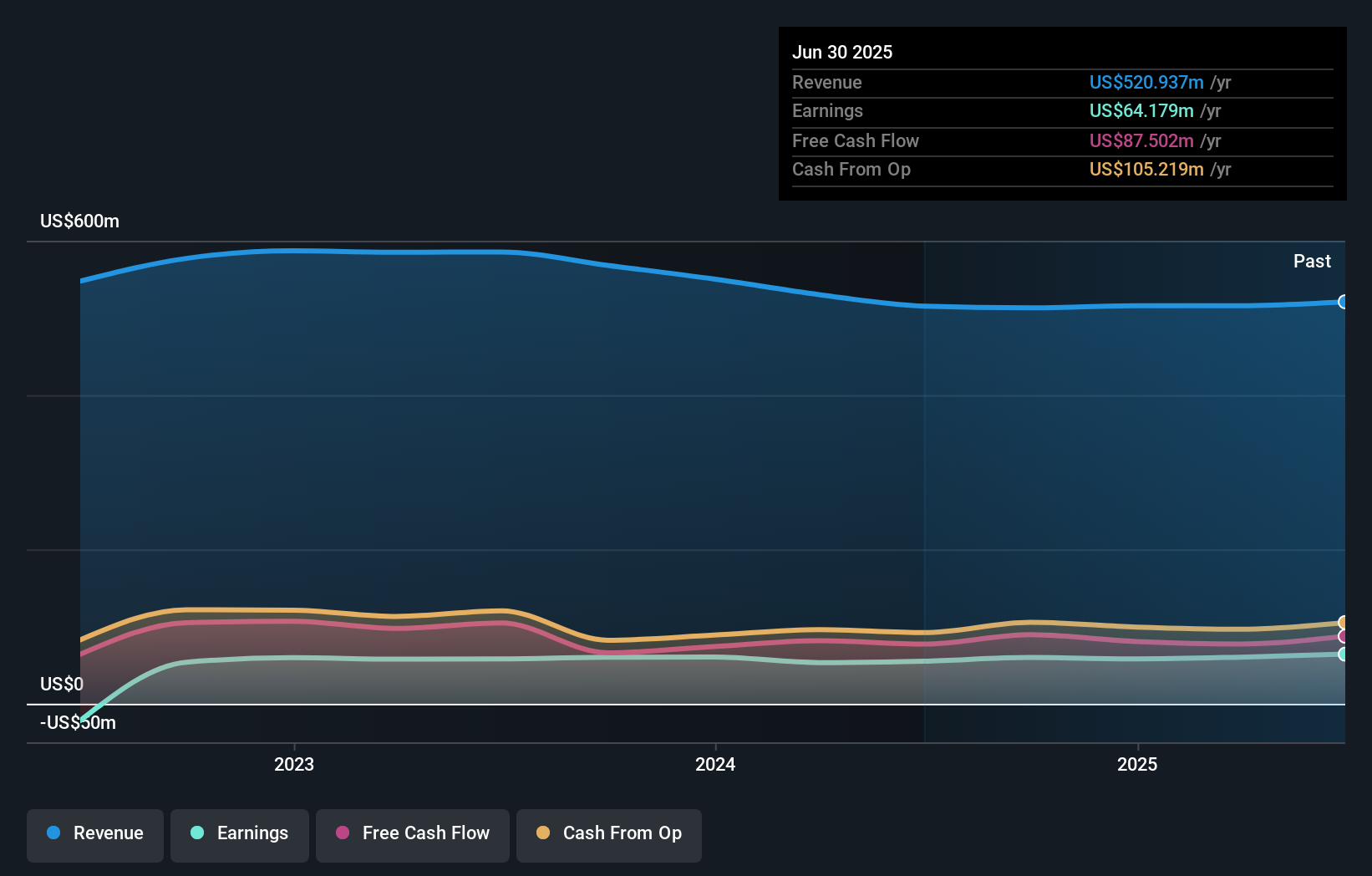

- In late October 2025, CTS Corporation reported third quarter earnings with year-over-year sales growth to US$142.97 million, but a decline in net income compared to the prior year; the company also narrowed its full-year 2025 sales guidance and confirmed ongoing share repurchases amounting to 5.82% of shares outstanding since announcing the buyback in February 2024.

- Amidst these updates, CTS signaled a continued focus on capital allocation by highlighting a strong cash position, returning US$44 million to shareholders in 2025, and expressing intentions to pursue acquisitions supported by a robust balance sheet.

- To assess how these earnings results and updated guidance shape CTS's investment narrative, we'll consider the impact of rising sales but shrinking quarterly profits on its long-term outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CTS Investment Narrative Recap

To own CTS shares, you need to believe in its ability to drive long-term growth by expanding into new markets and sustaining profit margins, despite current transportation sector softness and challenges in certain medical product sales. The recent Q3 results, higher sales but lower net income, with narrowed guidance, do not materially alter the immediate outlook, as the biggest catalyst remains diversification and the largest risk continues to be revenue pressure from weaker transportation demand and evolving global trade risks.

The ongoing share repurchase program, with 5.82% of shares bought back since February 2024, stands out as especially relevant, reinforcing CTS's commitment to returning capital while maintaining ample liquidity for future acquisitions. This supports the near-term catalyst of maximizing shareholder returns while balancing organic and inorganic growth initiatives, even as core end market risks persist.

However, what investors should especially watch for is that, despite strong cash returns, lingering exposure to tariffs and shifts in transportation demand could still...

Read the full narrative on CTS (it's free!)

CTS' narrative projects $610.6 million revenue and $78.8 million earnings by 2028. This requires 5.4% yearly revenue growth and a $14.6 million earnings increase from $64.2 million.

Uncover how CTS' forecasts yield a $43.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for CTS, tightly ranging from US$42.97 to US$43, reflecting closely aligned outlooks. With mixed sentiment on medical and transportation sales trends, your view on diversification ambitions could be essential to your investment thesis.

Explore 2 other fair value estimates on CTS - why the stock might be worth just $42.97!

Build Your Own CTS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CTS research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CTS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CTS' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTS

CTS

Designs, manufactures, and sells sensors, connectivity components, and actuators in North America, Europe, and Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives