CTS (CTS): Assessing Fair Value After Recent 12% Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for CTS.

CTS shares bounced 3.1% higher in the last day and have now logged a 12% share price gain over the past three months. However, the stock’s total return over the past twelve months remains down 26%, which reflects a tougher long-term environment even as near-term momentum picks up.

If you’re curious to see what else investors are getting excited about in tech, consider exploring See the full list for free..

With shares rebounding but long-term returns still lagging, the question now is whether CTS remains undervalued after its recent gains or if the market has already factored in the company’s future growth prospects.

Most Popular Narrative: Fairly Valued

CTS’s last close of $43.26 sits just above the narrative’s fair value estimate. This points to a market price that closely reflects future expectations. This proximity suggests that investors may be seeing eye-to-eye with current analyst assumptions, making the narrative especially relevant right now.

The company's continued diversification into high-growth end markets such as medical (with particular momentum in therapeutic and portable ultrasound applications) and industrial (with new wins in EV charging, automation, and connectivity solutions) positions CTS to benefit from the accelerating adoption of smart, connected, and electrified technologies. This supports sustained future revenue growth and enhanced margin mix.

Curious how the experts landed on a fair value so close to the market price? The narrative includes ambitious growth levers and a higher-margin roadmap, but what are the concrete financial leaps underpinning this target? See what is driving the projections and whether there's a hidden edge in the numbers.

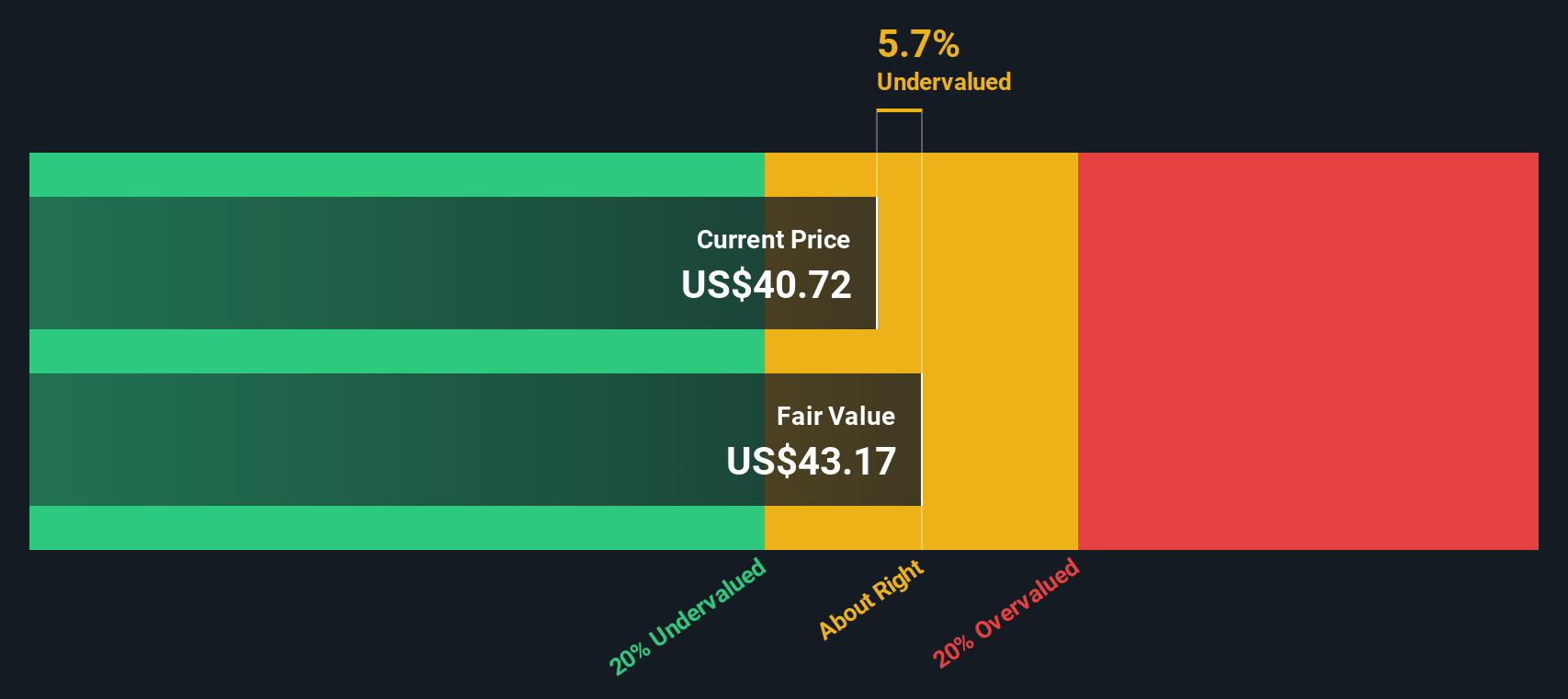

Result: Fair Value of $43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in transportation sales and evolving global trade tensions still raise questions about how reliably CTS can deliver on its growth story.

Find out about the key risks to this CTS narrative.

Another View: What Does the DCF Say?

While current pricing lines up with analyst expectations, our DCF model offers a slightly different perspective. It sees CTS trading about 0.7% below its fair value estimate, which suggests a minor undervaluation by this method. But is this small gap enough to matter, or does it point to greater opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CTS Narrative

If you see things differently or want to dig into the numbers on your own terms, you can shape your own perspective in just minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding CTS.

Looking for more investment ideas?

Let smarter choices work for you. Don’t wait to find stocks with untapped potential, resilient earnings, or market-changing tech that others overlook.

- Start earning more predictable income by checking out these 20 dividend stocks with yields > 3%, which offers attractive yields and dependable payout histories.

- Gain an edge on the hottest trends when you evaluate these 26 AI penny stocks, as these companies are shaping tomorrow’s industries through advanced artificial intelligence breakthroughs.

- Capitalize on hidden gems by targeting these 849 undervalued stocks based on cash flows, where fundamental value meets real upside before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTS

CTS

Designs, manufactures, and sells sensors, connectivity components, and actuators in North America, Europe, and Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives