Do Coherent’s (COHR) Latest Innovations Reveal a Shift in Its Competitive Advantage?

Reviewed by Sasha Jovanovic

- Earlier this month, Coherent Corp. reported first-quarter financial results showing US$1.58 billion in sales and US$226.35 million in net income, alongside the introduction of the Axon FP femtosecond laser and EDGE CUT20 industrial cutting solution.

- Coherent’s new product launches feature advanced integration and portability, which could help address evolving needs in research, life sciences, and industrial manufacturing.

- We'll examine how the strong quarterly earnings and innovative product launches may influence Coherent's overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Coherent Investment Narrative Recap

To be a shareholder in Coherent, you need confidence in the company’s ability to stay ahead with leading-edge photonics and laser technologies, navigating industry cycles and competitive threats while capitalizing on AI-driven datacom growth. The recent jump in quarterly earnings and cutting-edge product launches reinforce positive momentum, but do not fully offset the key short-term catalyst: sustained demand for advanced optical components, or the ongoing risk from aggressive pricing competition and margin pressures across core markets.

The launch of the Axon FP femtosecond laser stands out as directly connected to Coherent’s reputation for innovation. By introducing a more accessible, integrated solution for researchers and industrial clients, this new product helps address customer needs and aligns closely with the company’s strategy to broaden its reach in higher-value, fast-evolving applications, an area tightly linked to potential growth catalysts.

Yet, despite these positive signals, investors should keep in mind that, unlike revenue momentum, the risk posed by intensifying low-cost competition in transceivers has not gone away...

Read the full narrative on Coherent (it's free!)

Coherent's outlook suggests revenues will reach $7.7 billion and earnings $732.0 million by 2028. This scenario relies on a 9.8% annual revenue growth rate and a $812.6 million increase in earnings from the current level of -$80.6 million.

Uncover how Coherent's forecasts yield a $161.37 fair value, a 17% upside to its current price.

Exploring Other Perspectives

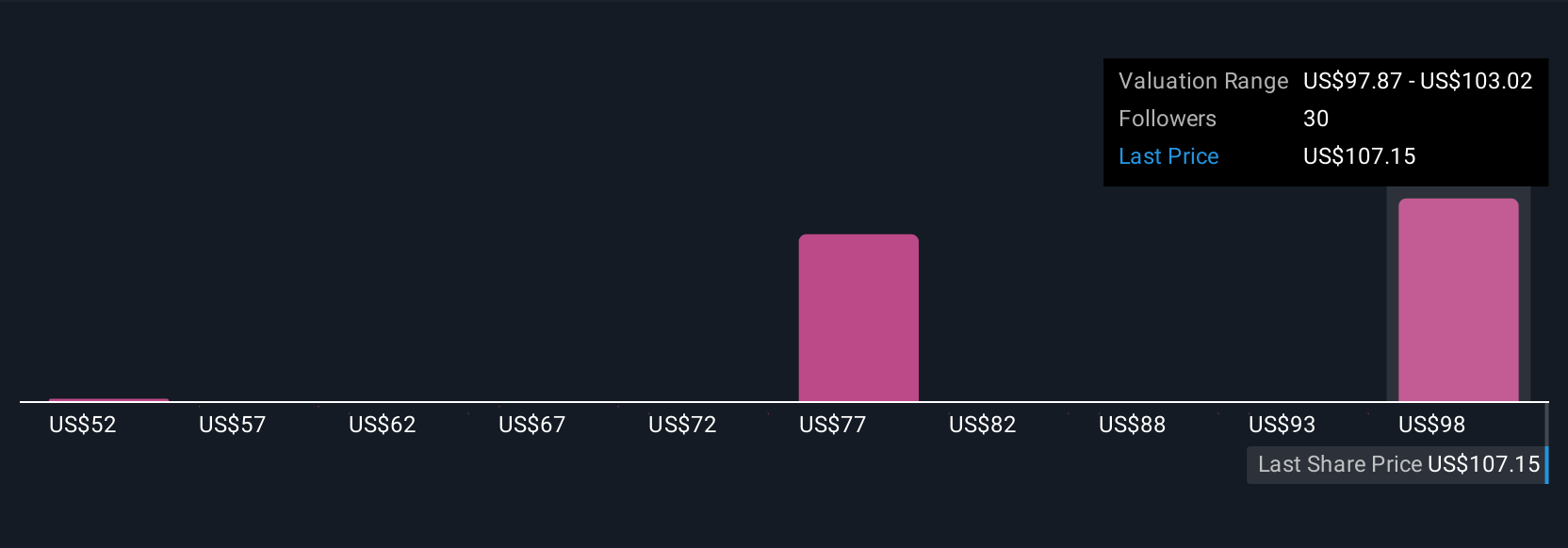

Simply Wall St Community members shared six fair value estimates for Coherent ranging from US$51.56 to US$161.37, showcasing substantial disagreement. While some focus on near-term product innovation, others weigh the risk of margin compression from global competitors, highlighting how your outlook on Coherent’s performance could differ widely.

Explore 6 other fair value estimates on Coherent - why the stock might be worth as much as 17% more than the current price!

Build Your Own Coherent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coherent research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coherent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coherent's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives