Coherent (NYSE:COHR) recently made headlines with a strong performance, reporting third-quarter sales of $1,498 million and a net income of $16 million, turning around a net loss from the previous year. This positive financial news coincides with a 43% rise in the company's stock price over the past month. The launch of the Axon FL fiber coupling module, designed for neuroscientific applications, and the promising revenue guidance for the forthcoming quarter could have further enhanced investor sentiment. While the broader market increased by 4% recently, Coherent's notable growth likely added weight to the positive trend.

We've spotted 1 possible red flag for Coherent you should be aware of.

Coherent's recent developments, such as the introduction of the Axon FL fiber coupling module and promising revenue guidance, are poised to bolster its long-term potential. Over the past five years, Coherent has achieved a total shareholder return of 73.56%, reflecting substantial growth. This performance is particularly noteworthy considering that over the past year, Coherent outperformed the US Electronic industry, which saw a return of 13.7%. This outperformance underscores the positive impact of the company's strategic initiatives and R&D investments in advanced AI and optical platforms.

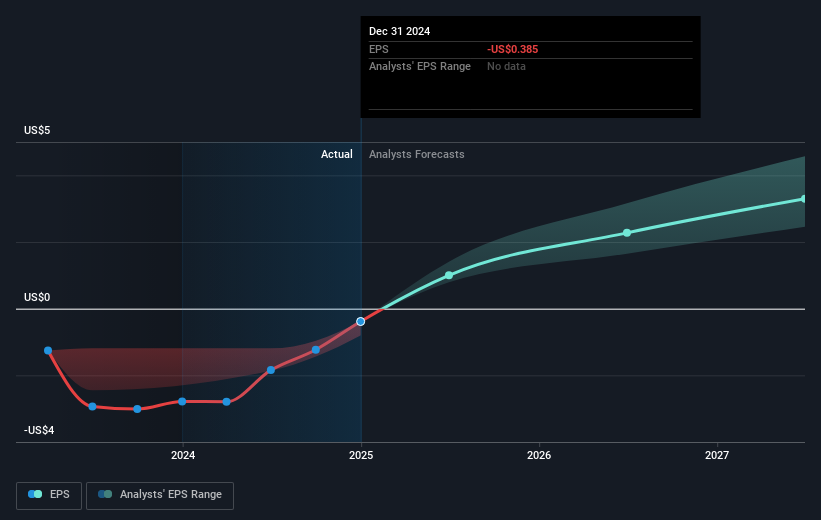

While the short-term share price has surged by 43%, the consensus analyst price target of US$95.57 remains 32.2% above the current share price of US$64.84. The ongoing focus on advanced products, coupled with strategic pricing and cost optimization, is expected to drive revenue growth and improved earnings forecasts. Existing revenue is US$5.60 billion, with future projections indicating a rise to US$7.2 billion by 2028, supported by a forecasted annual revenue growth rate of 8.6%. As the company navigates near-term challenges, such as industrial market softness and global trade dynamics, the solid foundation built through innovation and expansion positions it well for future growth.

Gain insights into Coherent's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and optical and laser systems and subsystems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives