- United States

- /

- Communications

- /

- NYSE:CIEN

AI-Driven Revenue Surge Could Be a Game Changer for Ciena (CIEN)

Reviewed by Sasha Jovanovic

- Ciena reported third-quarter 2025 revenue of US$1.22 billion, surpassing its guidance and marking strong sequential and year-over-year growth as AI-driven infrastructure demand surged.

- Management signaled accelerated operating margin targets and highlighted record orders, reflecting Ciena’s strengthened position as AI adoption drives bandwidth and network expansion needs.

- We’ll explore how robust AI infrastructure demand shapes Ciena’s investment narrative following its standout revenue outperformance and optimistic management commentary.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ciena Investment Narrative Recap

To be a Ciena shareholder, you need to believe that robust and persistent demand for AI and cloud-driven network infrastructure will offset any concentration risk from its largest customers and defend against rapid technological shifts that could challenge Ciena’s competitive position. The recent revenue beat and optimistic guidance amplify near-term excitement, but they don’t materially reduce the biggest risk: a slowdown in hyperscaler spending could quickly impact results given Ciena’s customer reliance.

Among Ciena's client wins, the partnership with Colt Technology Services to increase transatlantic and terrestrial capacity by 20% directly reinforces the company's strength as a supplier to large-scale, data-driven networks. This positions Ciena to benefit from surging bandwidth and optical transport needs, right in step with the accelerating AI infrastructure cycle that management cited as its biggest near-term catalyst.

However, despite these positive drivers, investors should pay close attention to the risk that comes with Ciena’s heavy revenue concentration among just a few large customers, if one of these...

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028. This requires 12.5% yearly revenue growth and a $449.6 million earnings increase from $140.9 million currently.

Uncover how Ciena's forecasts yield a $152.62 fair value, a 22% downside to its current price.

Exploring Other Perspectives

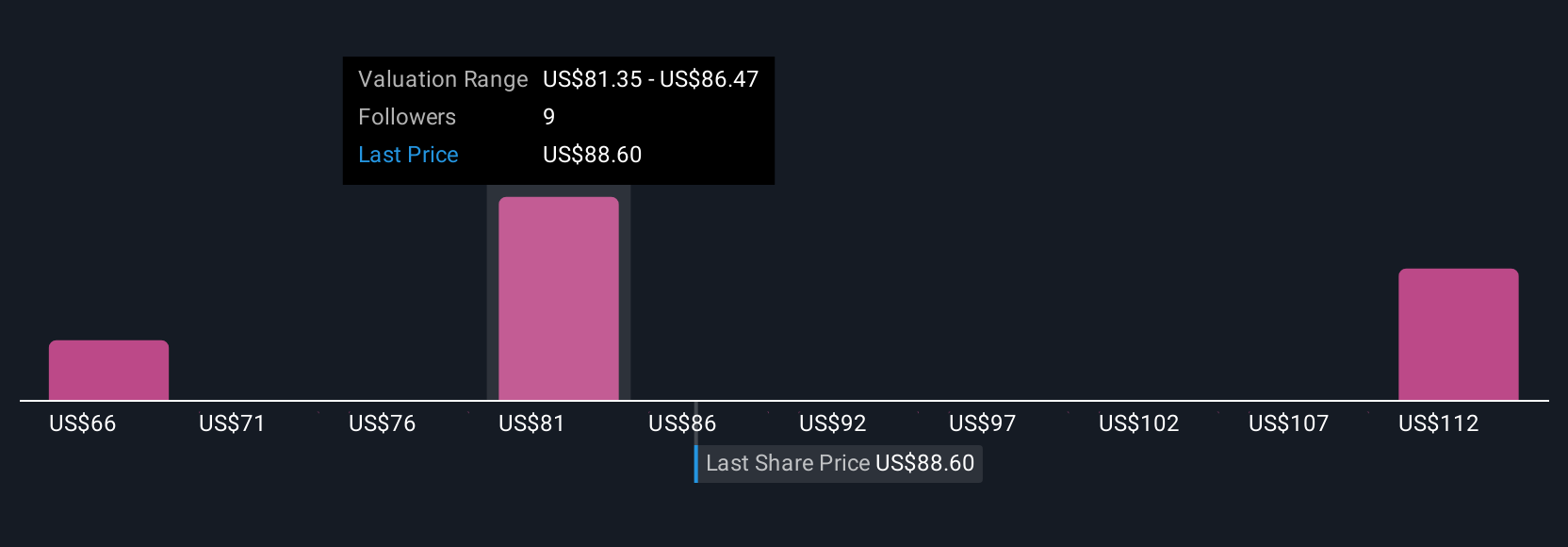

Five fair value estimates from the Simply Wall St Community range from US$67.93 up to US$152.63. With investor opinions spread across this full spectrum, it's important to consider how Ciena’s reliance on a small set of key customers creates both opportunity and earnings vulnerability.

Explore 5 other fair value estimates on Ciena - why the stock might be worth less than half the current price!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success