- United States

- /

- Communications

- /

- NYSE:CALX

Calix (NYSE:CALX): Assessing Valuation After Major CoastConnect Deal and New COO Appointment

Reviewed by Simply Wall St

Calix (NYSE:CALX) is in the spotlight after CoastConnect accelerated its rollout of Calix’s AI-powered broadband services and workforce training programs. The announcement coincided with the appointment of a new Chief Operating Officer, which signals expansion and operational focus.

See our latest analysis for Calix.

Calix’s recent client wins and executive moves have played out against a backdrop of strong share price momentum this year. The stock's 58.8% share price return year to date stands out, especially as broader markets have faced volatility, and the one-year total shareholder return of 59.5% confirms that investors have reaped impressive gains over the past twelve months. While the last quarter saw some cooling in share price, recent developments suggest interest and confidence remain high for the long-term growth story.

If Calix’s surge and renewed focus on next-generation broadband have you thinking bigger, it could be the perfect time to broaden your investing horizons and discover See the full list for free.

But with a nearly 60% rally over the past year and analysts seeing meaningful upside ahead, investors now face a key question: Is Calix still undervalued, or has the market already priced in its next wave of growth?

Most Popular Narrative: 32.3% Undervalued

Calix's most widely followed valuation narrative puts fair value well above the recent close, suggesting market pricing has yet to catch up with projected growth and profitability inflection. This sets the stage for a potentially powerful run if the company hits its key milestones.

"The upcoming rollout of Calix's third-generation platform, which integrates agentic AI capabilities, is expected to dramatically accelerate broadband providers' ability to monetize new services and experiences across residential, business, and municipal segments; this can drive higher ARPU, increased subscriber growth, reduced churn, and ultimately stronger revenue expansion beginning in the second half of 2025 and accelerating into 2026."

Curious how this price target is built? The most compelling variable driving the narrative is a leap in future earnings power, fueled by margin expansion and recurring revenue growth. But which bold assumptions power these forecasts and how aggressive are they? The full narrative unpacks the reasoning and the debate behind this bullish outlook.

Result: Fair Value of $79.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Slower adoption of AI features or tougher international compliance could challenge Calix's ability to sustain its projected growth and margins.

Find out about the key risks to this Calix narrative.

Another View: What Do Market Ratios Say?

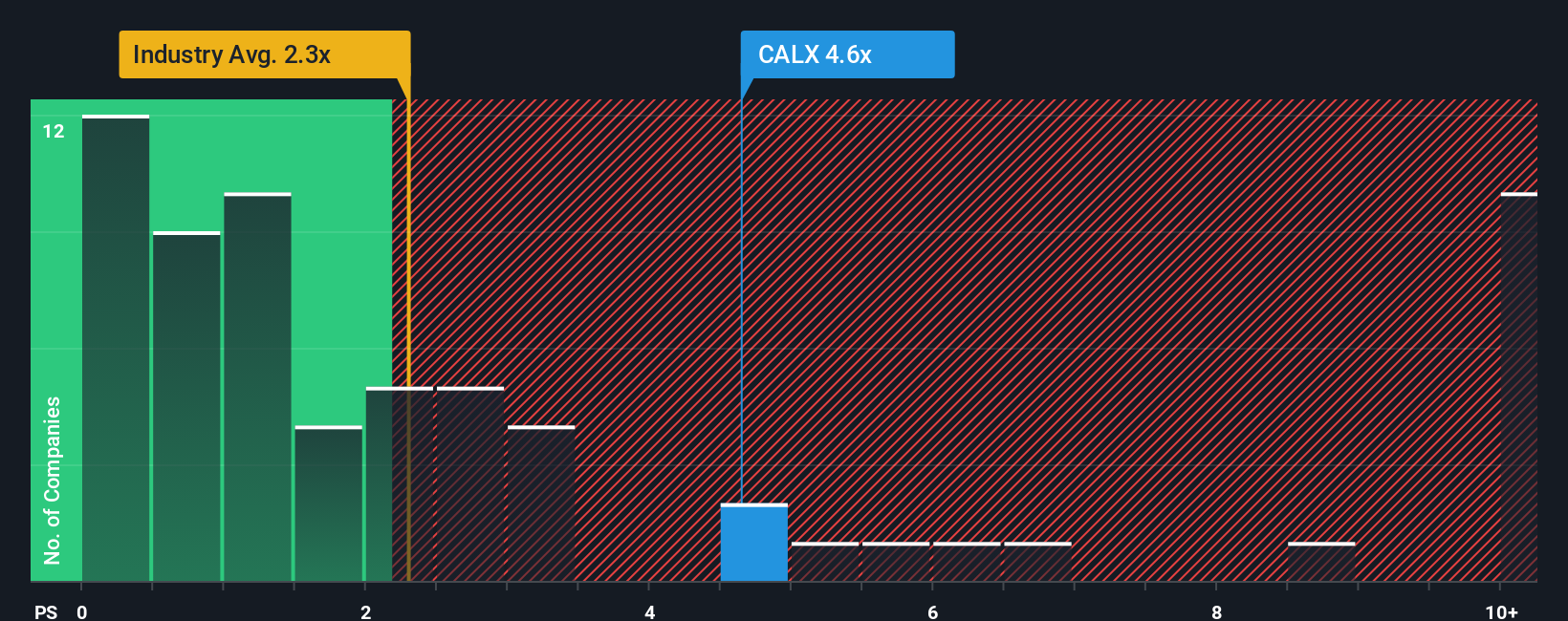

While the growth narrative points to upside, looking at market ratios reveals a more cautious picture. Calix’s price-to-sales ratio of 3.8x is double the US Communications industry average of 1.9x and well above peers at 2x. Even compared to its fair ratio of 4.7x, this premium suggests investors are banking on strong future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Calix Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own Calix storyline in under three minutes. Do it your way.

A great starting point for your Calix research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize the momentum and go beyond Calix. There are more untapped opportunities waiting for your portfolio. Don’t let your next winning stock slip away.

- Maximize your income potential by checking out these 15 dividend stocks with yields > 3%, where you’ll spot companies consistently delivering robust payouts above 3%.

- Uncover the smartest bets in next-generation automation and machine learning through these 26 AI penny stocks fueling the market’s next surge.

- Tap into overlooked gems with these 923 undervalued stocks based on cash flows primed for growth and priced attractively based on solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CALX

Calix

Provides cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives