Subdued Growth No Barrier To Badger Meter, Inc. (NYSE:BMI) With Shares Advancing 33%

Badger Meter, Inc. (NYSE:BMI) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

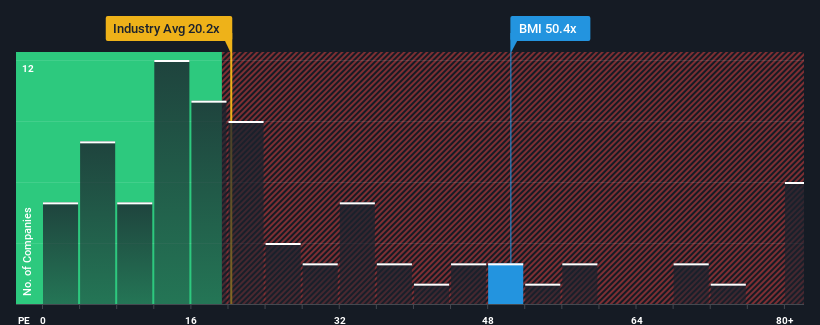

Following the firm bounce in price, Badger Meter's price-to-earnings (or "P/E") ratio of 50.4x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 1 warning sign investors should be aware of before investing in Badger Meter. Read for free now.Recent times have been advantageous for Badger Meter as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Badger Meter

Is There Enough Growth For Badger Meter?

In order to justify its P/E ratio, Badger Meter would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. The strong recent performance means it was also able to grow EPS by 116% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 12% per annum during the coming three years according to the eight analysts following the company. That's shaping up to be similar to the 10% per year growth forecast for the broader market.

In light of this, it's curious that Badger Meter's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

The strong share price surge has got Badger Meter's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Badger Meter currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Badger Meter is showing 1 warning sign in our investment analysis, you should know about.

You might be able to find a better investment than Badger Meter. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Badger Meter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BMI

Badger Meter

Manufactures and markets flow measurement, quality, control, and communication solutions worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion