How Investors Are Reacting To Benchmark Electronics (BHE) Powering the Aurora Exascale Supercomputer

Reviewed by Simply Wall St

- Benchmark Electronics recently announced the successful commissioning and validation of the Aurora exascale supercomputer at Argonne National Laboratory, a project involving close collaboration with Intel and focused on advanced liquid-cooled, high-performance computing subsystems manufactured and tested in the US.

- This achievement highlights Benchmark's ability to deliver complex, mission-critical technology solutions to major scientific and government clients, showcasing its specialized engineering and manufacturing capabilities.

- We'll explore how Benchmark’s work on the groundbreaking Aurora supercomputer shapes its investment narrative and technology leadership position.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Benchmark Electronics Investment Narrative Recap

To be a shareholder in Benchmark Electronics, you need to believe in its ability to win and deliver complex, high-value projects for leading scientific and government clients, leveraging its advanced US-based manufacturing. While the Aurora supercomputer milestone boosts Benchmark’s credentials in high-performance computing, it does not materially affect the most pressing short-term catalyst: signs of stabilizing demand across key sectors and improved quarterly revenues. The greatest risk remains ongoing softness in customer demand, particularly in core end-markets.

Benchmark’s recent announcement of a new manufacturing facility opening in Guadalajara, Mexico, directly aligns with its efforts to address capacity constraints and support growth in medical and computing segments. For investors, this expansion complements the company’s exposure to high-complexity opportunities like Aurora and may position it to capture additional sector-specific rebounds in the coming quarters. However, despite these encouraging signals...

Read the full narrative on Benchmark Electronics (it's free!)

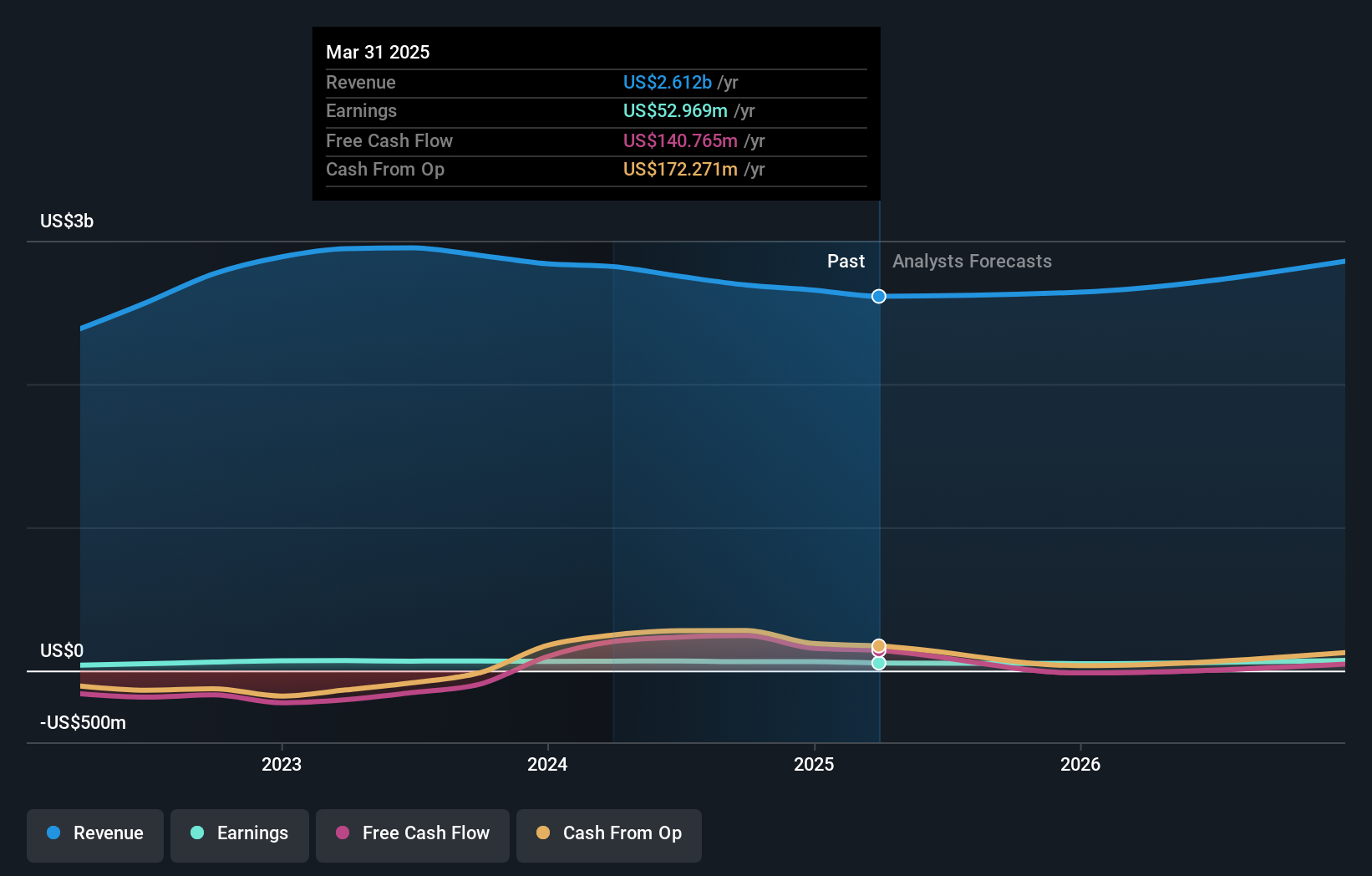

Benchmark Electronics' outlook anticipates $3.0 billion in revenue and $78.4 million in earnings by 2028. This implies 4.6% annual revenue growth and a $25.4 million increase in earnings from the current $53.0 million.

Uncover how Benchmark Electronics' forecasts yield a $45.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted three fair value estimates ranging from US$5.58 to US$45 per share. Despite this broad spread, ongoing sector demand softness may continue to weigh on future revenue and earnings potential, so consider several viewpoints before forming your own outlook.

Explore 3 other fair value estimates on Benchmark Electronics - why the stock might be worth less than half the current price!

Build Your Own Benchmark Electronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Benchmark Electronics research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Benchmark Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Benchmark Electronics' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives