- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CNXN

Discovering Undiscovered Gems in the United States for August 2024

Reviewed by Simply Wall St

In the last week, the market has stayed flat, but it is up 19% over the past year with earnings expected to grow by 15% annually over the next few years. In this favorable environment, identifying stocks with strong fundamentals and growth potential can lead to promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 131.04% | 17.59% | 20.70% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| QDM International | NA | 123.47% | 83.88% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

PC Connection (NasdaqGS:CNXN)

Simply Wall St Value Rating: ★★★★★★

Overview: PC Connection, Inc., along with its subsidiaries, offers a range of IT solutions globally and has a market cap of $1.89 billion.

Operations: PC Connection generates revenue primarily from IT solutions, with a total revenue of $3.12 billion. The company has a net profit margin of 2.56%.

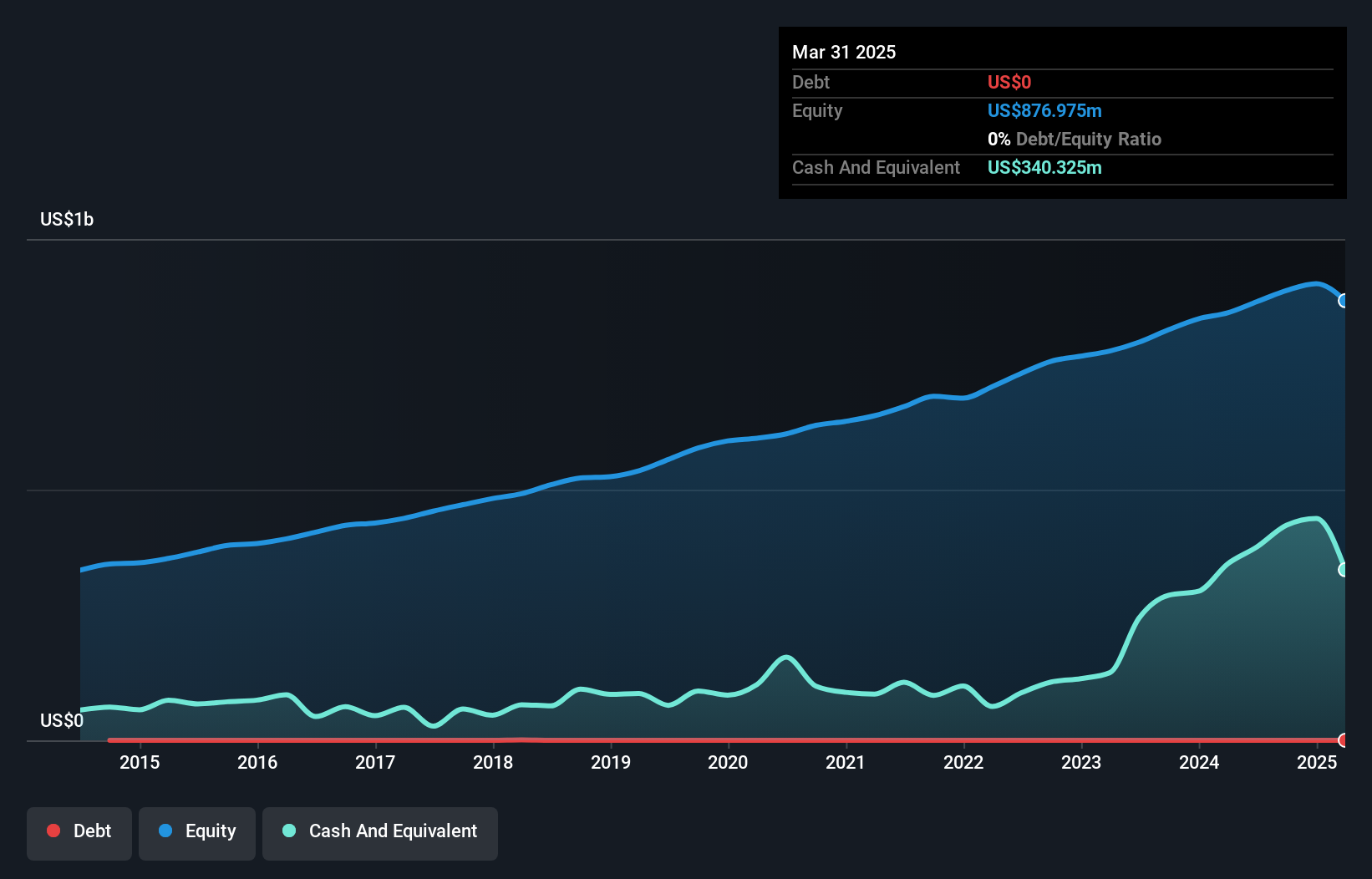

PC Connection, Inc., a notable player in the tech distribution space, reported Q2 2024 sales of US$736.48 million with net income rising to US$26.16 million from US$19.7 million a year ago. The company declared a quarterly dividend of $0.10 per share, payable on August 30, 2024. Recently partnering with Microsoft and Qualcomm for AI-driven Copilot+ PCs launch, PC Connection's earnings grew by 16.8% last year and it remains debt-free for over five years now.

- Unlock comprehensive insights into our analysis of PC Connection stock in this health report.

Examine PC Connection's past performance report to understand how it has performed in the past.

Universal Stainless & Alloy Products (NasdaqGS:USAP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Universal Stainless & Alloy Products, Inc. manufactures and markets semi-finished and finished specialty steel products in the United States and internationally, with a market cap of $346.61 million.

Operations: Universal Stainless & Alloy Products generates revenue primarily from its Metal Processors and Fabrication segment, which reported $311.46 million. The company's market cap stands at $346.61 million.

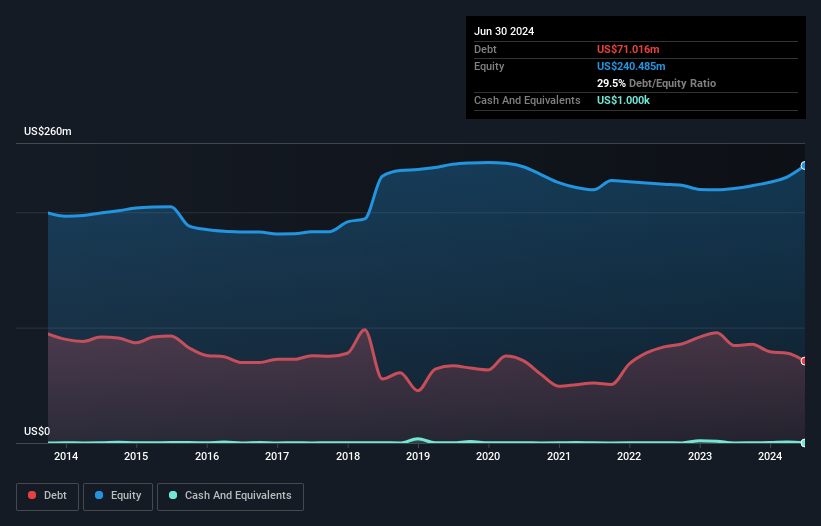

Universal Stainless & Alloy Products has turned profitable this year, with net income jumping to US$8.87 million in Q2 2024 from US$0.90 million a year ago. Its interest payments are well covered by EBIT at 3.5x, and it boasts high-quality earnings while trading at 76% below estimated fair value. The company's net debt to equity ratio stands at a satisfactory 33.7%, although it has slightly increased over the past five years from 27.7%.

Benchmark Electronics (NYSE:BHE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Benchmark Electronics, Inc., together with its subsidiaries, provides product design, engineering services, technology solutions, and manufacturing services across the Americas, Asia, and Europe with a market cap of $1.73 billion.

Operations: Benchmark Electronics generates revenue primarily through product design, engineering services, technology solutions, and manufacturing services. The company operates across the Americas, Asia, and Europe with a market cap of $1.73 billion.

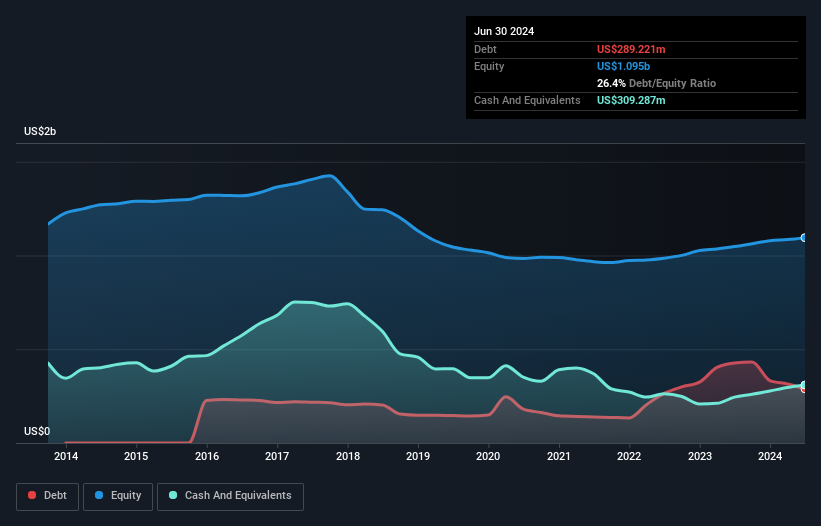

Benchmark Electronics has seen its debt to equity ratio rise from 14% to 26.4% over the past five years, but interest payments are well covered by EBIT at a multiple of 5.3x. Recent earnings grew by 1.6%, outpacing the electronic industry’s -9.9%. The company repurchased shares in the latest year and announced an increased dividend of $0.17 per share, reflecting confidence in future growth prospects with forecasted annual earnings growth of 3.75%.

- Get an in-depth perspective on Benchmark Electronics' performance by reading our health report here.

Summing It All Up

- Discover the full array of 217 US Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNXN

PC Connection

Provides various information technology (IT) solutions worldwide.

Flawless balance sheet with solid track record.